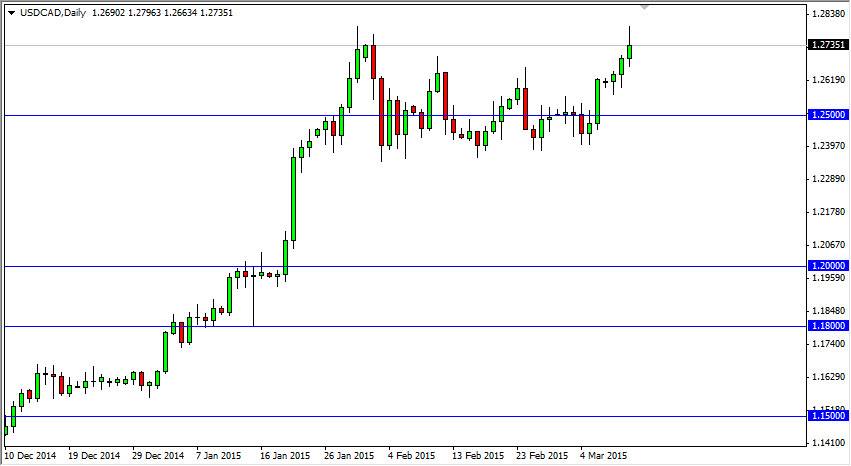

The USD/CAD pair broke out during the session on Wednesday, but pulled back enough to form a shooting star. The shooting star of course suggests that we are going to fall, but ultimately I think there’s far too much in the way of support below to even consider selling. In fact, we have recently broken above the top of a descending triangle, meaning that we had a failed bearish signal. With fact, I think it’s only a matter of time before we continue to go higher, but I also recognize that there is a significant amount of resistance above, especially once you get close to the 1.30 handle. After all, that was where the market stopped during the financial crisis, and not only that, but stopped several times.

With that, it’s probably going to take something rather special to break out above the 1.30 level, so I anticipate seeing quite a bit of pullbacks between here and there in order to build up the momentum necessary to make that move. Once we do though, this pair will continue to be a buy-and-hold type of situation, as the US dollar continues to be the strongest currency in the world.

Buying dips.

I will continue to buy dips, as I believe that they represent value in the US dollar. On top of that, the oil markets or falling apart, and that of course is very negative for the Canadian dollar. I believe that the oil markets will continue to be soft for some time, especially considering that the United States is simply running out of places to store oil right now. In other words, demand isn’t anywhere near high enough to drive the Canadian dollar higher, and quite frankly I don’t know that the Canadians have a problem with that.

Remember, the Canadians recently did a surprise interest-rate cut, and that of course is very bearish for a currency as well. Any pullback at this point in time will more than likely be jumped on right away, so therefore I don’t think that any sustained bearish pressure will be seen.