USD/JPY Signal Update

Yesterday’s signals expired without being triggered as the price never reached 120.40.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am London time and 5pm New York time only, or after 8am Tokyo time later.

Long Trade 1

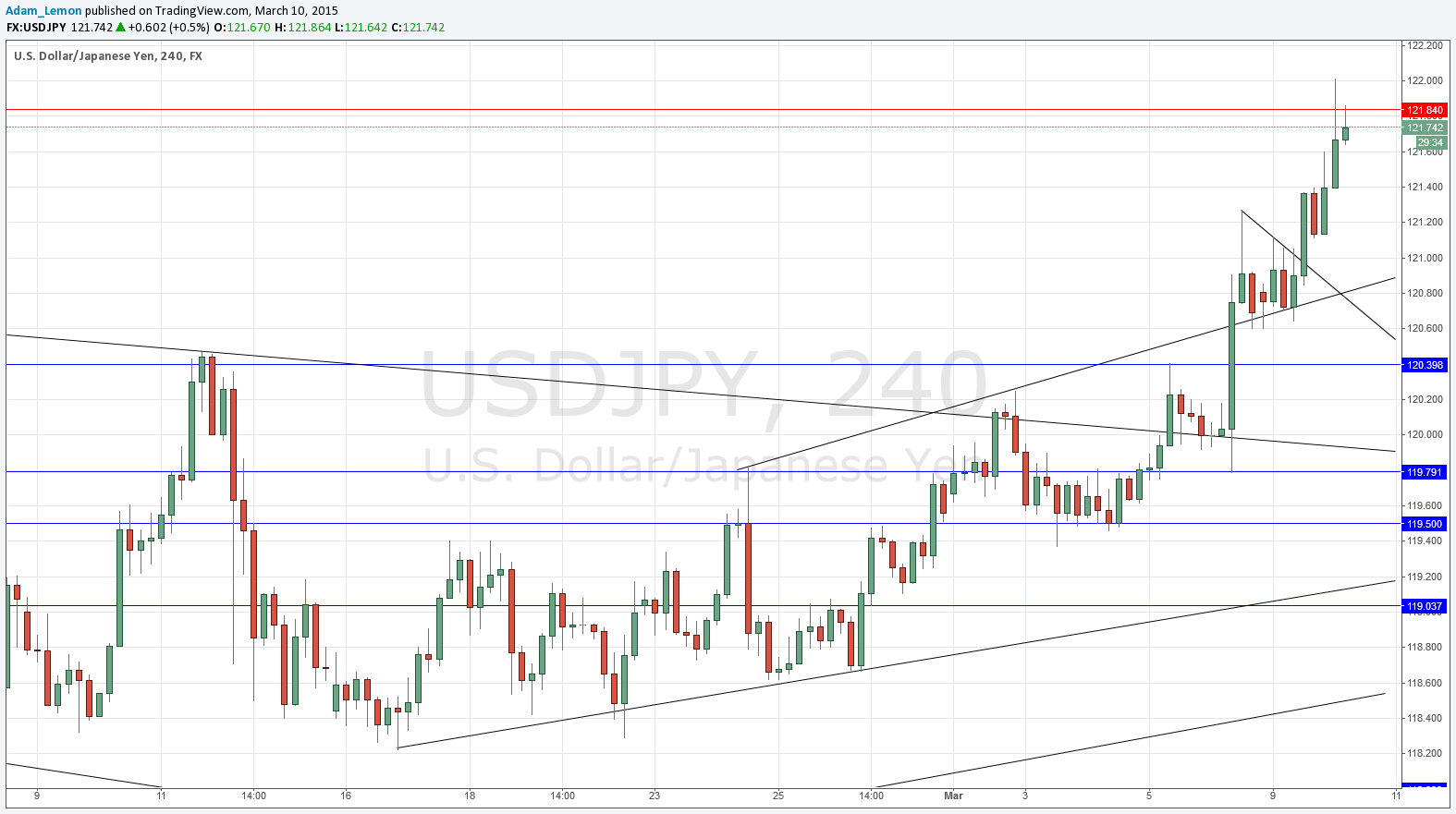

Go long following some bullish price action on the H1 time frame immediately upon the first retest of the nearest bullish trend line, currently sitting at around of 120.85.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Go long following some bullish price action on the H1 time frame immediately upon the first test of 120.40.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

I forecast yesterday that the multi-year high at 121.84 looked likely to hold so it should be a good area at which to seek a short trade. So far that level is being tested rep4eatedly, but it is holding. However I am not confident that a short from this level will go very far at all so it would be wise to get the risk off any short from here as soon as possible.

The pair overall looks strongly bullish and if it breaks out above 121.84 convincingly it will be in blue sky and might rise sharply.

A bearish pull back to the nearest flipped trend line should produce mobile support and a good opportunity to enter long. A more aggressive entry would be at around 121.00.

There are no high-impact events scheduled today for either the JPY or the USD today. Therefore it will probably be a relatively quiet day for this pair.