USD/JPY Signal Update

Yesterday’s signals were not triggered as the price did not reach either 119.50 or 121.00.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am London time and 5pm New York time only, or after 8am Tokyo time later.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next retest of the bullish trend line currently sitting at around 119.30.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 119.03.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

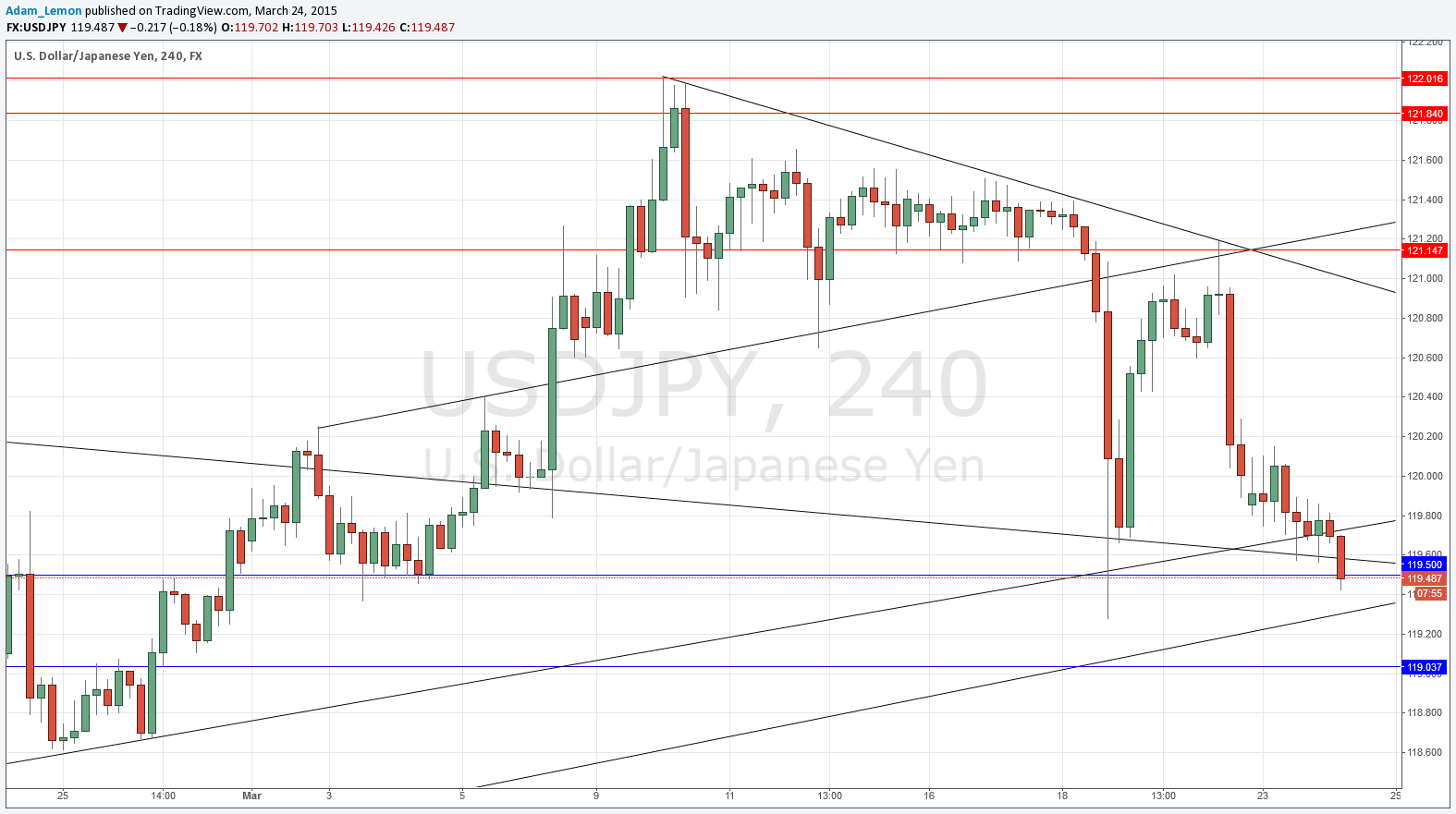

USD/JPY Analysis

We have just reached the anticipated supportive level at 119.50. The action over the past 24 hours has continued to look very bearish as the USD retreats across the board, and two trend lines that might have been supportive look like they are in the process of becoming invalid. At the time of writing, 119.50 does seem to be providing some support, but it feels a little dangerous here. It should be better to wait until there is a strong bullish bounce, either off the lower trend line at around 119.30, or the next horizontal support confluent with a whole number at around 119.03. There might even be a bounce off both which could be a really nice place for a reversal to take place.

However, things do feel very bearish, and unfortunately we are a long way away from any obvious shorting levels.

There are high-impact events scheduled today concerning the USD but nothing regarding the JPY. At 12:30pm London time there will be a release of U.S. CPI data followed at 2pm by New Homes Sales data.