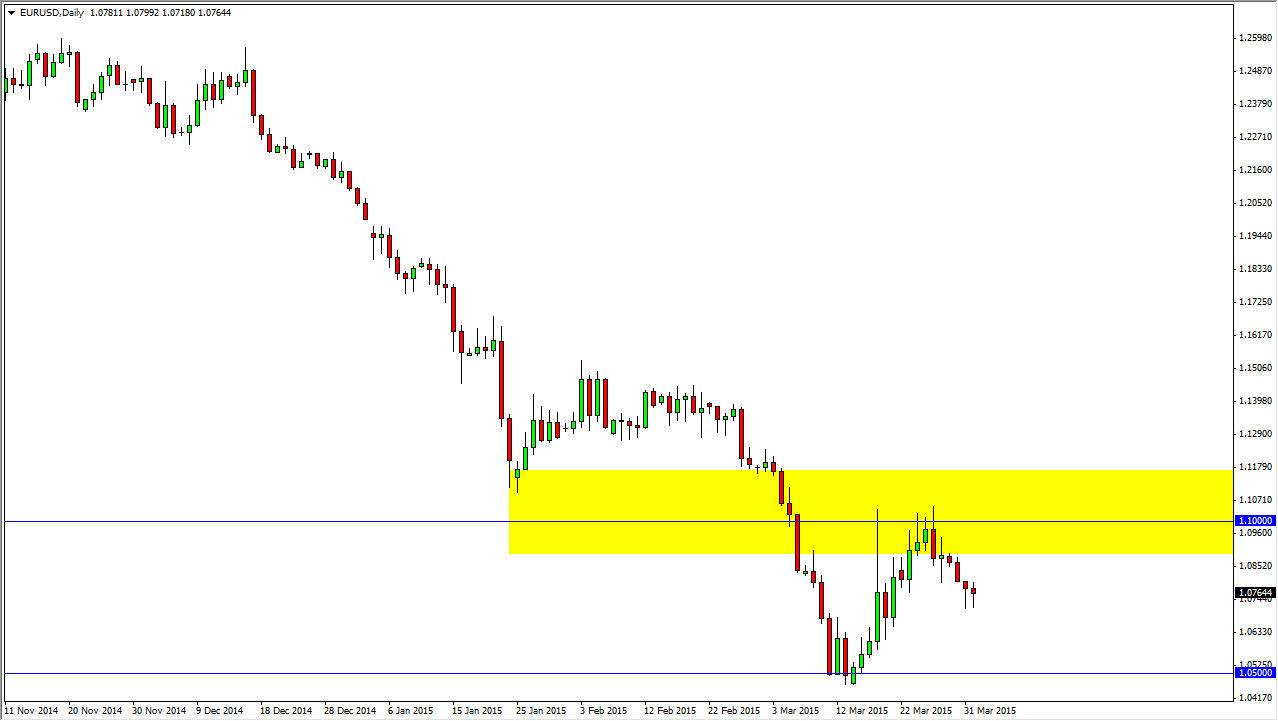

The EUR/USD pair fell during the Wednesday session, but did find enough support to turn things back around and form a little bit of a hammer. Because of this, we now have two hammers in a row on the daily chart and I believe this shows a significant amount of support. However, they do not have any interest in buying the Euro, as there are far too many problems associated with that particular currency. On this chart, you can see that I have a yellow rectangle that is based around the 1.10 handle, and that there has been resistance there previously. I think that any move higher will have to contend with that area, and that the sellers will more than likely step back in and push the pair down at that point.

Selling rallies

I think that the only way to trade this pair is to simply sell rallies as they appear. I have no interest in buying it, at least not until we get above the 1.15 level, something that we are not going to see happen anytime soon. With this, the markets look as if they are going to continue to attract sellers every time they rally, and more than likely people will look at those particular were those as potential value in the US dollar.

With this, I believe that eventually this market heads down to the 1.05 handle, and as a result I have no interest in going long as I just don’t see the scenario where it would be possible. I do recognize that the Nonfarm Payroll numbers come out on Friday, so that could keep this market fairly quiet and perhaps even introduce a significant amount of volatility in this market in the short-term, but ultimately the fundamentals remain the same. I think that a break below the two hammers would also be a nice selling opportunity, as it could be the market giving you a “heads up” as to where it is going next as the bearish pressure increases.