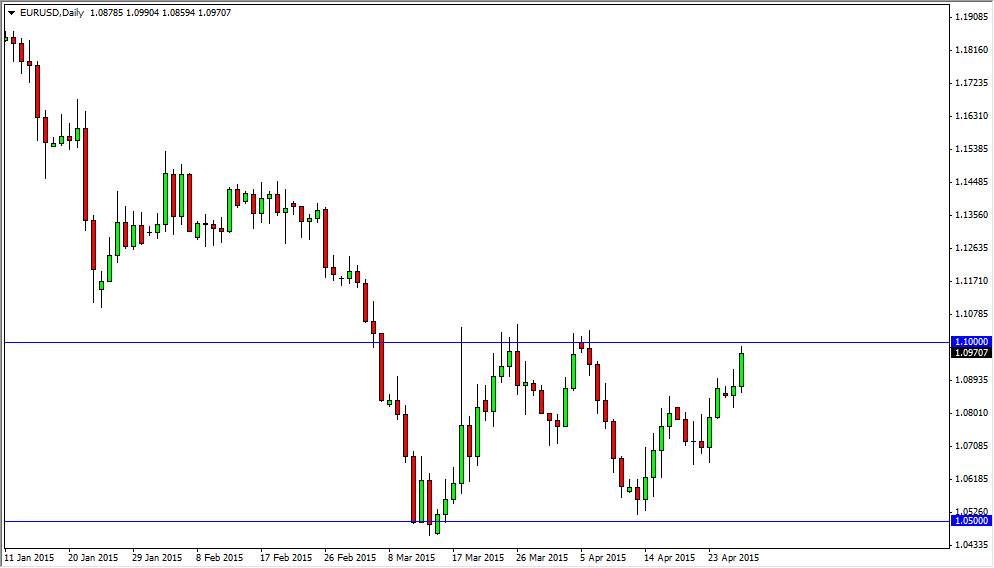

The EUR/USD pair broke much higher during the course of the session on Tuesday, breaking the top of the range for Monday. While I freely admit that this is a very bullish sign, I believe that the 1.10 level above will be important. On top of that, you have to keep in mind that the Federal Reserve is releasing an interest rate decision today, and more importantly an interest rate statement. The statement will be parsed back and forth by traders around the marketplace, and that could dictate where the next couple of hundred pips come from. Because of this, I feel that today is going to be a very important trading session.

I admit that I am much more comfortable shorting this market been buying it, even though we have seen quite a bit of bullishness recently. After all, the 1.10 level looks rather intimidating, and I believe that there is a significant amount of resistance all the way to at least the 1.12 handle. In fact, it’s not until we get above there that I am comfortable buying this pair, and truthfully I believe that it’s not until we get above the 1.15 level before we are able to hang onto a long position for any real length of time.

Waiting for resistive candle

I believe that you can even wait until the daily candle closes unless of course we shoot straight down. This is because I think that a resistive candle at this area signals that the market goes down to the 1.05 level, which is a significant move. Yes, I recognize that there is a significant amount of clustering around the 1.0750 level, so quite frankly it could be volatile but I do think that a pullback from here is a significantly appropriate sell signal. As far as buying is concerned, I am cautious of doing so but recognize that it is a possibility. At this point time though, it’s still looks as if we are in consolidation, even if we are testing the boundaries.