Gold opened with a gap up and traded as high as $1218.66 an ounce during the Asian session as last week's downbeat U.S. jobs report raised expectations that the Federal Reserve could be more cautious in tightening monetary policy. The Labor Department reported that the economy added 126K jobs in March well below consensus estimates of 246K, and the unemployment rate held at a more than six and a half-year low of 5.5%. Data also showed that average hourly wages jumped 0.3% but gains for the prior two months were revised down by a total 69K.

Although the payroll report was disappointing, one economic number doesn’t make a trend - especially considering the fact that we had 12 straight months of job gains above 200K. This year will probably be a repeat of last year. Economic growth was negative in the first quarter of 2014 but the economy rebounded quickly in the spring and summer. However, until we see whether March was just a winter blip, people will speculate the timing for the lift-off could be delayed to September at least.

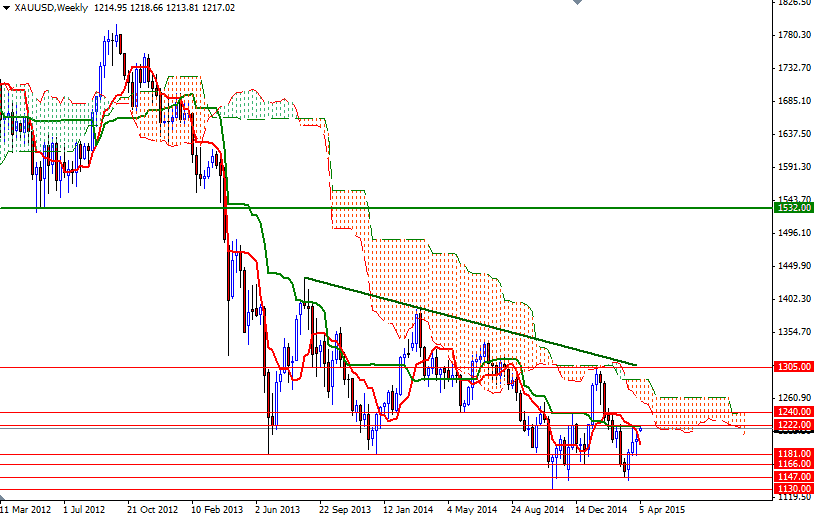

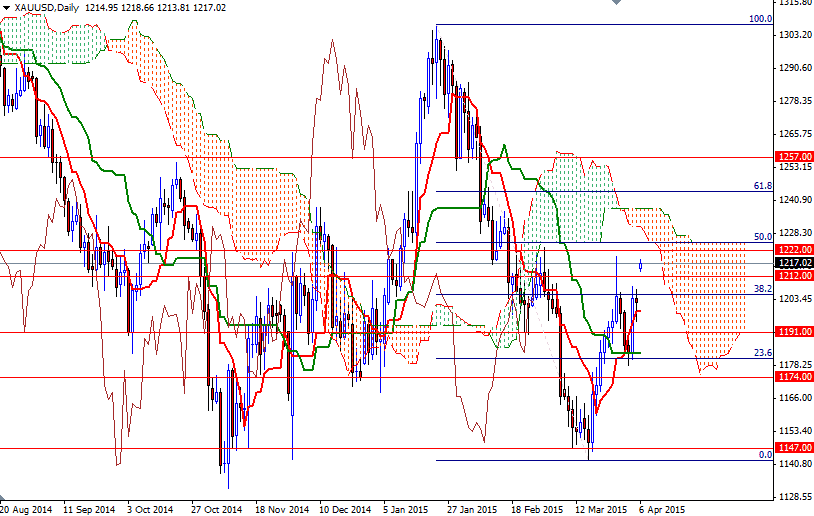

From a technical point of view, the odds are favoring higher prices at the moment. Short term outlook is bullish while the XAU/USD pair is trading above the Ichimoku clouds on the 4-hour time frame, plus the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-day moving average, green line) lines are positively aligned. On the other hand, gold prices are approaching the clouds on the daily chart and that means the market will likely to encounter some sort of strong resistance. There is an interim resistance at 1219.73 but the first important hurdle gold needs to jump is located in the 1225/2 area. I think breaching this barrier is essential for a bullish continuation towards 1235/40. To the downside, I will keep an eye on the 1213/2 region. If this support fails to hold, then the XAU/USD pair may test the 1207/4 area. Closing below this area could increase the possibility of an attempt to visit the 1199/8 support.