Gold dropped for the fifth time in six sessions as concerns of an interest rate hike by the U.S. Federal Reserve some time this year continued to weigh on the market. Although the weakness in the economic data lately cast doubt on the timing of the first rate increase, some investors aren’t that convinced these numbers (which were probably influenced by the severe winter) will give the Fed cause to delay its decision to normalize policy.

In the meantime, the U.S. stock markets will be on my radar. The possibility of higher interest rates and worries about corporate earnings (due the strong dollar and sluggish consumer spending) also pressure equities. A retreat in equity markets could fuel demand for gold.

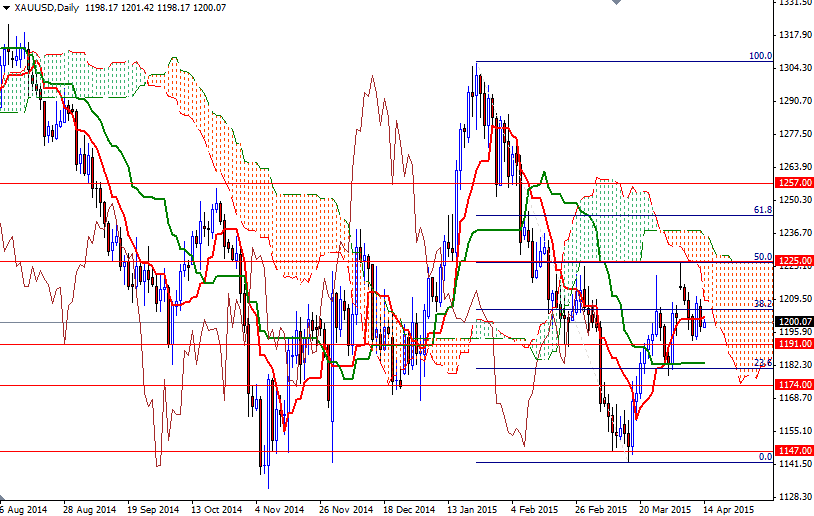

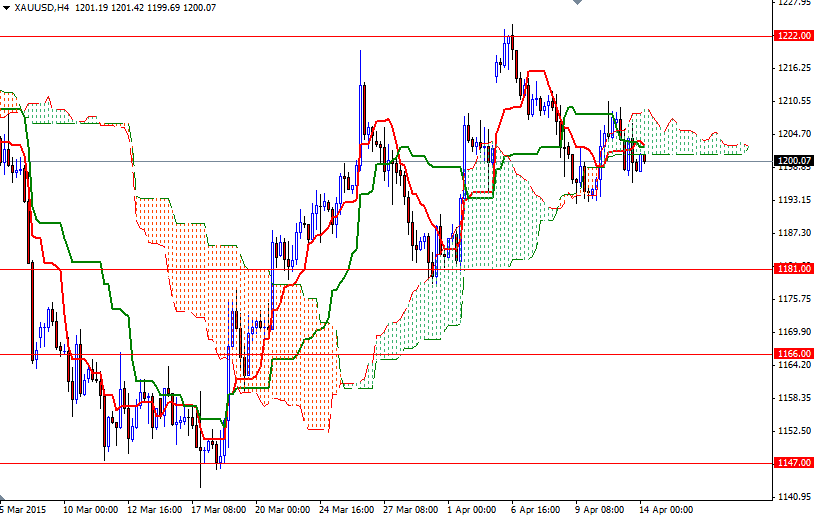

The XAU/USD pair remains within the trading range of the previous 4 sessions and yesterday was an inside day which is usually an indication that the market is going to break out one way or the other. Gold prices are trying to hold above the 1200 - 1198 area at the moment but lack of momentum and the fact that the market is trading below the Ichimoku coulds on the daily and 4-hour time frames make me a bit skeptical. We currently have bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses but as you can see both lines are flat. If the price climbs above the 1214.50 - 1211 region, the market will probably have enough momentum to march towards 1225/0 which is the first significant resistance. To the downside, initial support is located around 1198. That means the bears have to drag prices below yesterday's low so that they can test the 1193/1 zone. Breaking below this support on a daily basis would suggest that the XAU/USD pair will deepen its losses. If that is the case, I think the bears will be aiming for 1183.27 - 1181.