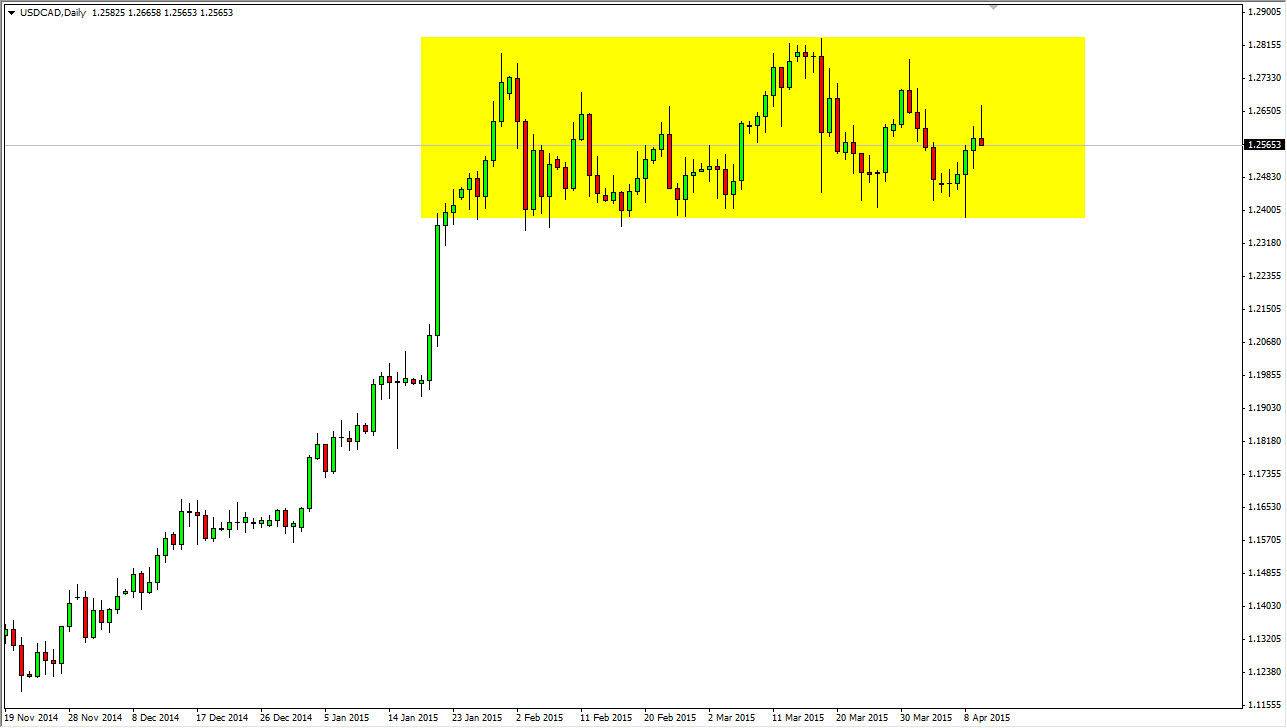

The USD/CAD pair broke higher during the course of the session on Friday, and got as high as the 1.27 region. However, we ended up pulling back in forming a massive shooting star. This of course is a very bearish sign, but ultimately I think that it only represents the impending pullback. I don’t necessarily think that the markets going to fall apart at this point. After all, the Canadian dollar is on its back foot at the moment, mainly because of oil prices being so soft. Remember, there is a direct correlation between the demand for the Canadian dollar and the price of oil, as most Forex traders will use the Canadian dollar as a proxy for global petroleum prices.

I believe that this market continues to consolidate, and that the consolidation is the main driver of where we are going and where we are not. I believe that the 1.24 level below is massively supportive, and that every time we approach that area it’s going to end up being a buying opportunity. I also recognize that a break above the top of the shooting star is a very bullish sign as well, and would more than likely send this market looking for the 1.28 level again, which I see as the resistance barrier.

Short-term trading

I continue to prefer short-term trades, lasting only for a couple of days. I believe is going to take a while for the pair to break out, but we should eventually head to the 1.30 level, which I see as a massive barrier. The 1.30 level has proven itself to be very strong as far as resistance is concerned in the past, even holding back to the massive upsurge after the financial crisis took hold. If we can break above the 1.28 level, I do think that we test the 1.30 level. However, do not expect that level to be broken easily, so it will probably take several different attempts. I have no interest in selling this pair at the moment.