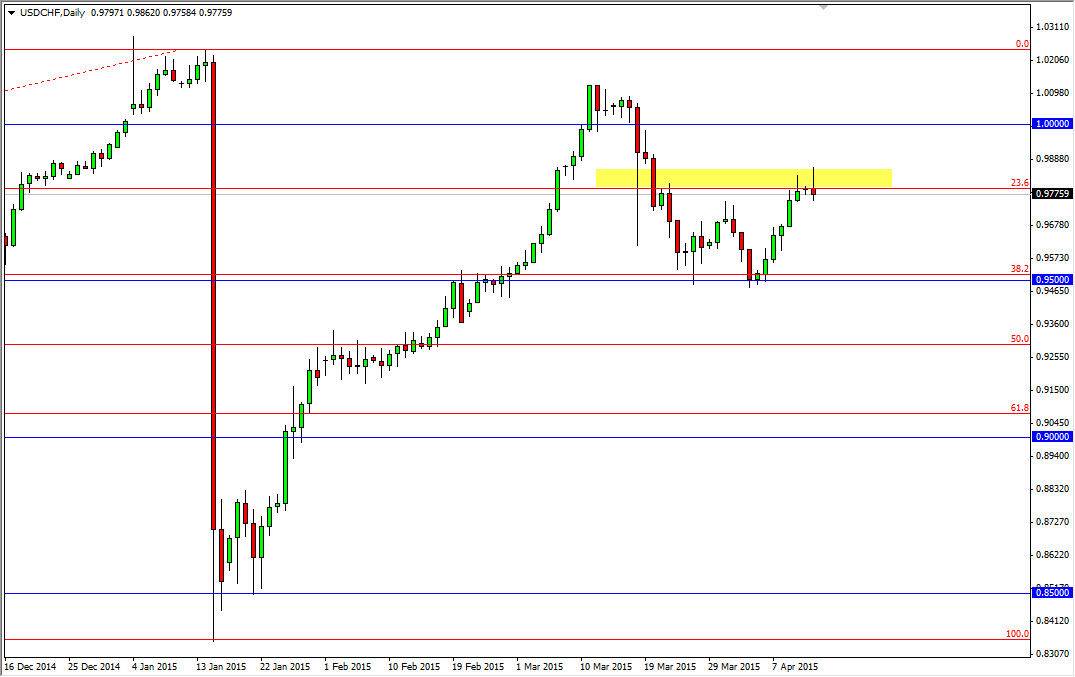

The USD/CHF pair rallied during the session initially on Monday, but as you can see struggled above the 0.98 handle in order to fall back down. By doing so, it ended up forming a significant shooting star, and of course it is where we had seen resistance and support previously, so it makes sense that it would appear here at this large, round, psychologically significant number. With that, I believe that a break down below the bottom of the shooting star probably sends this pair a bit lower. However, I would be a bit cautious about shorting this market with any serious amount of money.

Keep in mind that the US dollar is of course the strongest Forex currency out there right now, and on top of that, we have recently seen a pretty significant rally. With that, it makes sense that we would have to pull back a little bit in order to collect more buyers, and I think that’s essentially what will happen going forward. It’s possible that short-term traders may make some money to the downside, but quite frankly this just gets me interested in buying at lower levels.

Look for supportive candles

If we can form some type of supportive candle between here and the 0.95 handle, I would not hesitate to start buying. I believe that we will eventually go to the parity level next, but it might take a little bit of time getting there. I also think that we will break above there, and perhaps head to the 1.02 level. I have no interest in selling this pair whatsoever, simply because I believe that the US dollar will continue to be favored. It’s not even a question of whether or not you want to invest in Switzerland, it simply the matter of them sending 85% of their exports into the European Union. In fact, the Swiss are extensively tied to the European Union, which is the last place you want to be tied to at the moment.