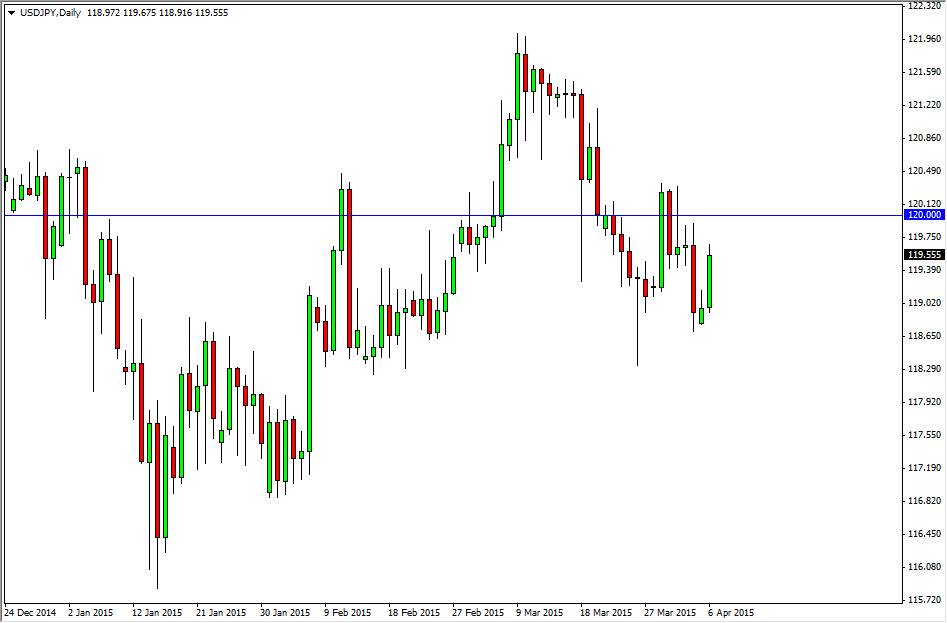

The USD/JPY pair broke higher during the course of the day on Monday, as we head towards the 120 level again. With fact, I feel that it is not until the market breaks above there that I am comfortable buying. With this, I believe that it’s only a matter of time before we head to the 122 level, and then perhaps the 125 level. A short-term pullback at this point time should be considered a buying opportunity as the US dollar continues to be the favored currency in the world, and of course we are still very much in an uptrend.

I recognize of the 119 level is significant support, and that there are even more significant areas below there. I think then to the Bank of Japan will continue to have a very loose monetary policy, and that of course will work against the value of the Japanese yen in general. Ultimately, I believe that the buyers will enter this market every time it pulls back, as a represent value in the greenback.

Buying dips going forward

I believe that the dips that will appear from time to time in this market will represent value, and I think that will be the easiest way to trade this market in general. I believe that we are entering a longer-term buy-and-hold type of mentality in this market, even though the jobs numbers out of the United States on Friday were huge disappointment. It’s a short-term blip on the radar, and quite frankly it would not surprise me at all to see things go back to normal. I think a lot of market participants are starting to feel the same way, as we have just about wiped out all of the losses from the Friday announcement. Given enough time, I believe that this market will finally break out and long-term interest rates will continue to favor the US dollar, meaning that the market will continue to favor the upside in general.