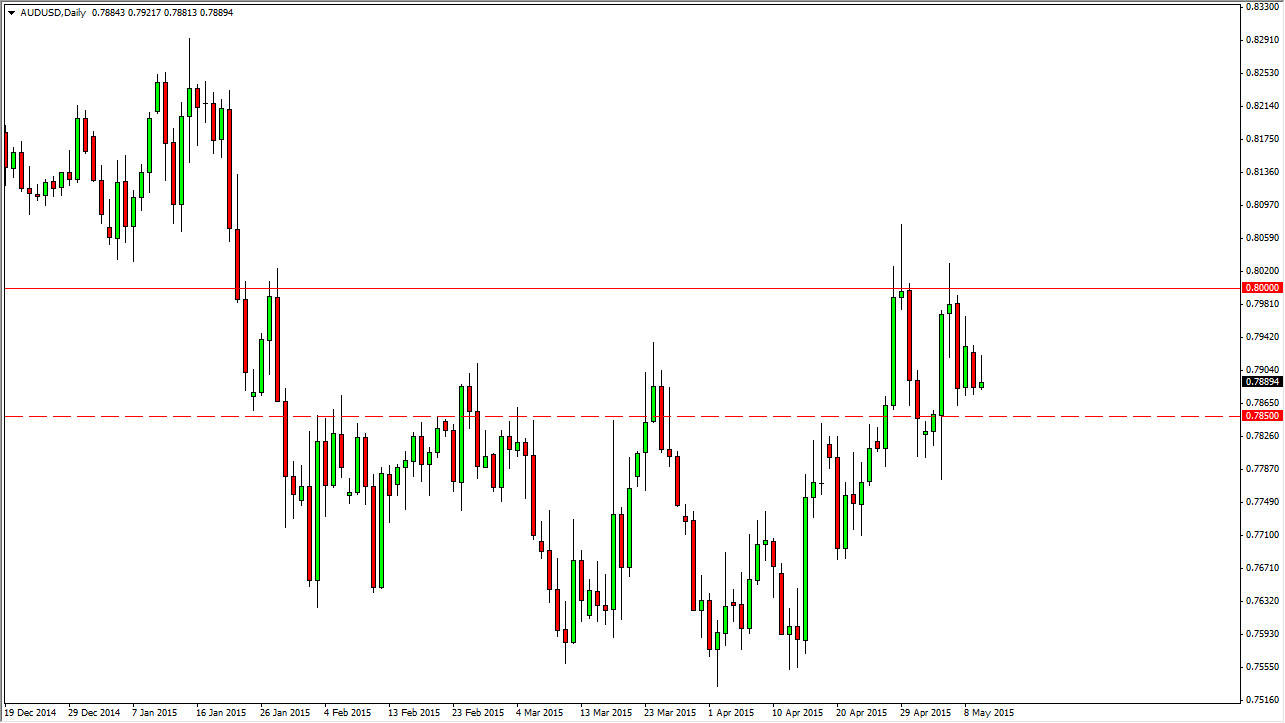

The AUD/USD pair tried to rally during the course of the day on Monday, but fell back down in order to form a shooting star. Because of this, the market looks soft still as far as I can see, as the Australian dollar simply cannot hang onto gains. While the gold markets typically will push this market around, they are essentially doing nothing right now. We have been range bound with a slightly negative bias, and as a result have not been helping the Australian dollar at all. On the other hand, the US dollar looks like it’s a bit exhausted when looking at the US Dollar Index, so I believe that although this market may break down, I do not think that the market is going to necessarily fall apart.

Paying attention to the 0.7850 level

I believe that the 0.7850 level continues to be very important, and have it marked on this chart with a red dashed line. I think if we can break down below this line, the market will continue much lower, probably heading down to the 0.76 handle. Regardless though, even if we get below there I believe that there is a lot of support below in various places, and this will be a very choppy move. I am not looking for any type of meltdown at all. I think that the move back down to 0.76 makes sense, but it is also something that’s going to be very difficult to achieve.

If we break above the 0.80 level, I think that’s a very positive sign, but at the end of the day I see a lot of noise all the way up to about 0.8250. It is because of this that I don’t really have any interest in buying the Australian dollar, and if I wish to go against the US dollar, I will probably do it in other currencies that are a little bit more clear as to their strength, such as the British pound. The Australian dollar is just simply too beholden to risk appetite in the commodity markets for me to be excited about owning it.