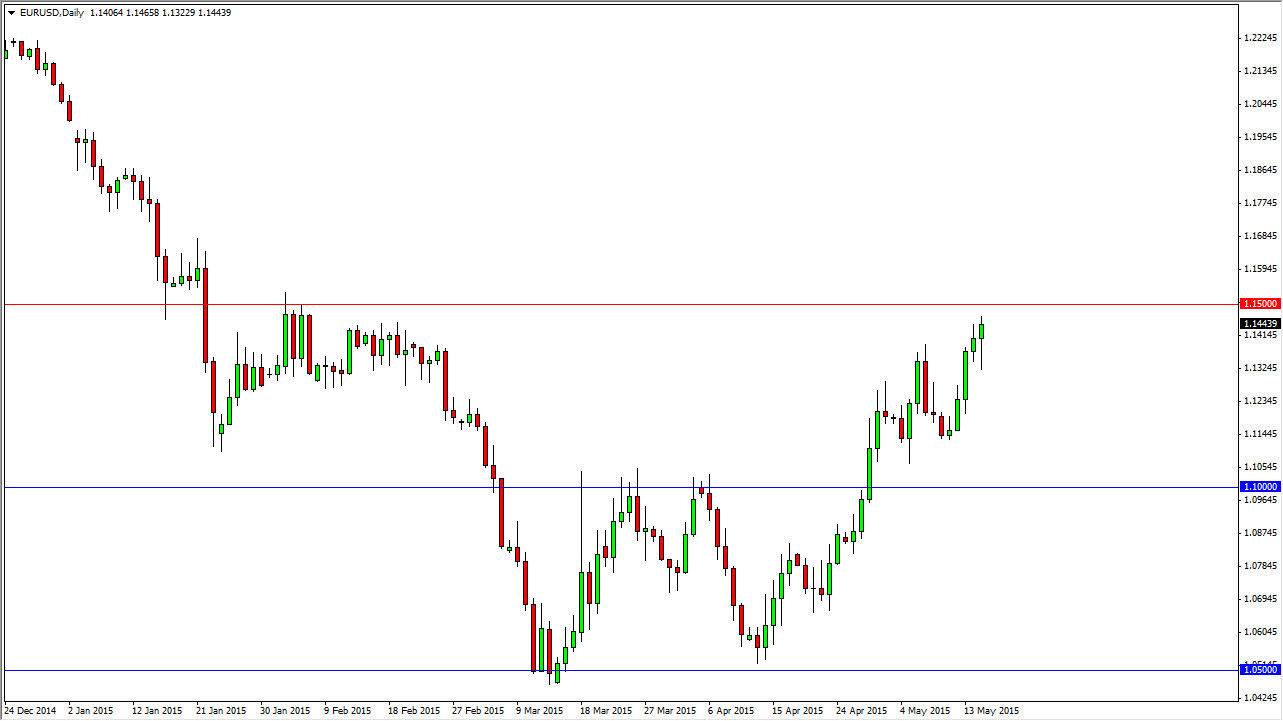

The EUR/USD pair initially fell during the session on Friday, but found enough support near the 1.13 level to turn things back around and form a hammer shaped candle for Friday. This is the top of a massive move higher and I now believe that we are getting ready to complete a “W pattern”, which is one of the most bullish reversal patterns you can see. If we can break above the 1.15 level, this market will have completely changed the overall and long-term trend as far as I can see, and at that point in time I would suddenly become “buy only” in this pair.

In all honestly, I think it’s only a matter of time before this happens, so I’m also buying pullbacks at this point. I really don’t have a scenario in which I want to sell this pair, at least not until we get down below the 1.10 level, something that isn’t going to happen anytime soon. With that being said, it certainly looks as if the US dollar is possibly in a bit of trouble.

Old habits die hard

For the longest time, it was as simple as buying the Euro in selling the US dollar. In fact, it was simply a matter of selling the US dollar in general against most currencies. I think we are starting to see a return to the old habits of simply selling the dollar and looking for yield elsewhere. Granted, Europe isn’t exactly the risk is place on the planet, but it does represent the “anti-dollar” type of sentiment, and that of course will have money flowing into this pair just by that reasoning alone.

On top of that, it appears that money is starting to flow back into the European stock markets, and that of course requires the purchase of Euros. With that, I think that we do go higher over the longer term, and once we get a daily close above 1.15, the trend has completely changed and we will more than likely not look back anytime soon.