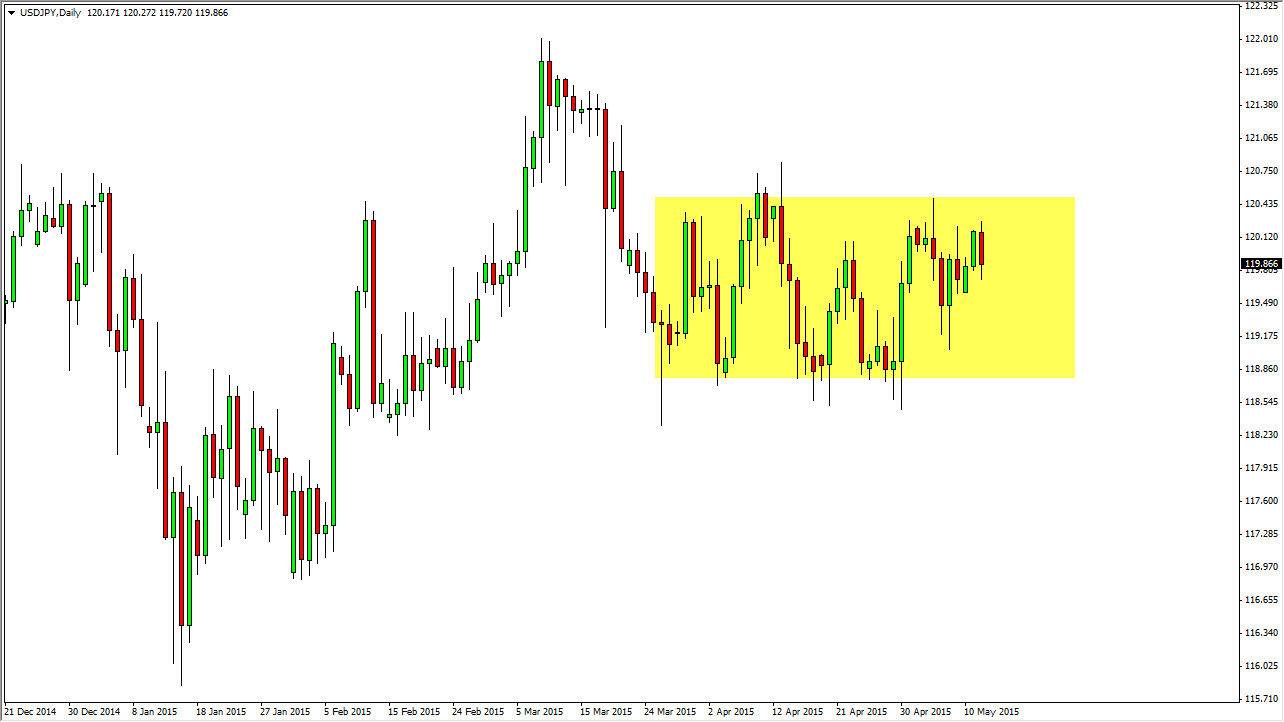

The USD/JPY pair fell during Tuesday trading, testing the 120 handle for support. We actually found support below there, but let’s not forget that we are essentially going sideways over the last couple of months, and that does not look like it’s changing anytime soon. If we can break a little higher, I might be convinced to start buying again, somewhere above the 120.50 handle. Truthfully though, it’s probably just easier to let the market come back to the 118.50 region and start buying there as it appears to be so supportive.

This is going to be an interesting market, because quite frankly the Bank of Japan is ultra-easy with its monetary policy, but there are a lot of concerns as to whether or not the Federal Reserve can tighten interest rates. People got awfully excited about the prospect of higher interest rates in the United States, but recent economic numbers have people wondering whether or not the elation was premature.

I still believe in the longer-term uptrend

I know this is kind of a pain at the moment, but I do believe that long-term this pair goes higher. Quite frankly, Japan is far away from doing anything remotely close to tightening monetary policy, and while the Americans might be a ways away also, they are most certainly closer than the Japanese at this point. With that in mind, I feel that it makes sense that this pair continues to go higher. Don’t get me wrong, I’m not looking for some type of explosive movement, just a longer-term uptrend to continue.

I’ll go ahead and buy pullbacks, trying to build a larger position. There are many people out there that I speak to who are trying to build up a very large position in this pair, as they believe eventually it will offer massive gains. For what it’s worth, the British pound has seen quite a bit of strength lately against most currencies, but the Japanese yen got absolutely slaughtered by that particular currency, and as a result I think it shows how little people want to own the Yen if they can avoid it. I am still bullish.