GBP/USD Signals Update

Yesterday’s signals expired without being triggered as the price never reached either 1.5164 or 1.5402 during yesterday’s London session.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be made before 5pm London time.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.5446.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 1.5360 and leave the remainder of the position to ride.

Short Trade 2

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.5497.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 1.5455 and leave the remainder of the position to ride.

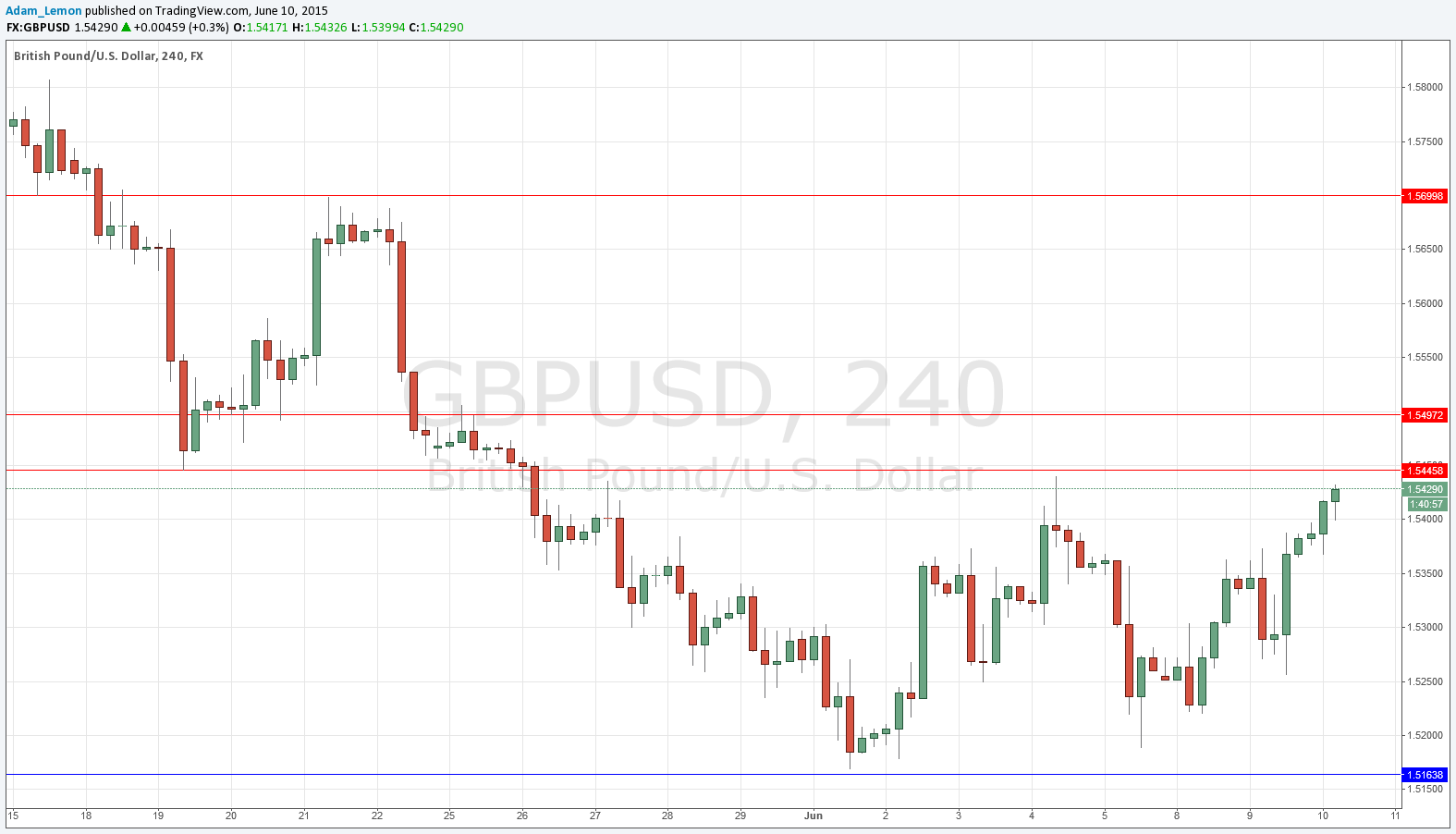

GBP/USD Analysis

I wrote yesterday that we had quite probably already seen the high for that day at about 1.5375, and this proved to be the case. However the price then turned around with some strength at around 1.5250 and the continuing USD weakness has lifted this pair up, breaking weakly through the resistance at 1.5402. There is an inflection point above at 1.5446 that may prove to be resistant if we get there today, and beyond that there is a more key level just under the psychologically important number of 1.5500.

There is probably going to be better bullish action on the EUR/USD. However we have GBP news this morning that if positive could shoot the price up.

There are no high-impact events scheduled today for the USD. Regarding the GBP, there will be a release of U.K. Manufacturing Production data at 9:30am London time, followed later by an appearance from the Governor of the Bank of England at 9pm at the Annual Mansion House Dinner in London.