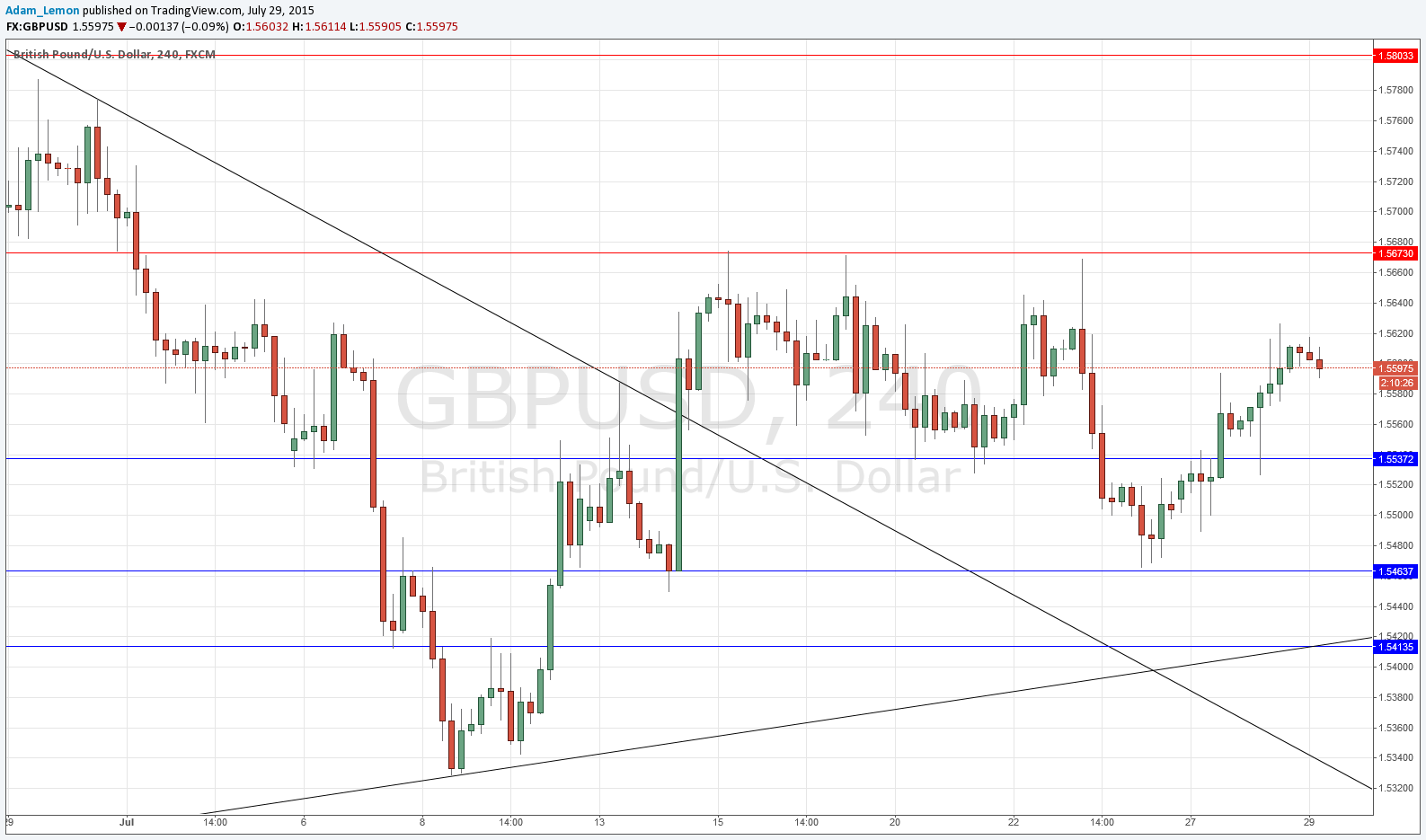

GBP/USD Signals Update

Yesterday’s signals produced a long trade off the bullish bounce from 1.5537, a trade open from here should exited.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be entered between 8am and 5pm London time today only.

Any open trade should be protected before 6:30pm London time.

Short Trade 1

- Go short following a bearish price action reversal on the 1H time frame immediately upon the next touch of 1.5673.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 1.5605 and leave the remainder of the position to run.

Long Trade 1

- Go long following a bullish price action reversal on the 1H time frame immediately upon the next touch of 1.5537.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 1.5670 and leave the remainder of the position to run.

Long Trade 2

- Go long following a bullish price action reversal on the 1H time frame immediately upon the next touch of 1.5464.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 1.5670 and leave the remainder of the position to run.

Long Trade 3

- Go long following a bullish price action reversal on the 1H time frame immediately upon the next touch of 1.5413.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 1.5670 and leave the remainder of the position to run.

GBP/USD Analysis

Yesterday I was seeing some bullish signs plus probably support at 1.5537 and both accurately described yesterday’s London session, although the move up from 1.5537 was relatively limited.

We are still stuck within a well-defined range with no signs of breakout, although the FOMC release tonight could change that situation if there are any surprises.

This is probably not the most interesting pair to trade at the moment, although key levels should hold before the FOMC.

There is nothing due today regarding the GBP. Regarding the USD, there will be a release of the FOMC Meeting Minutes and Federal Funds Rate at 7pm London time.