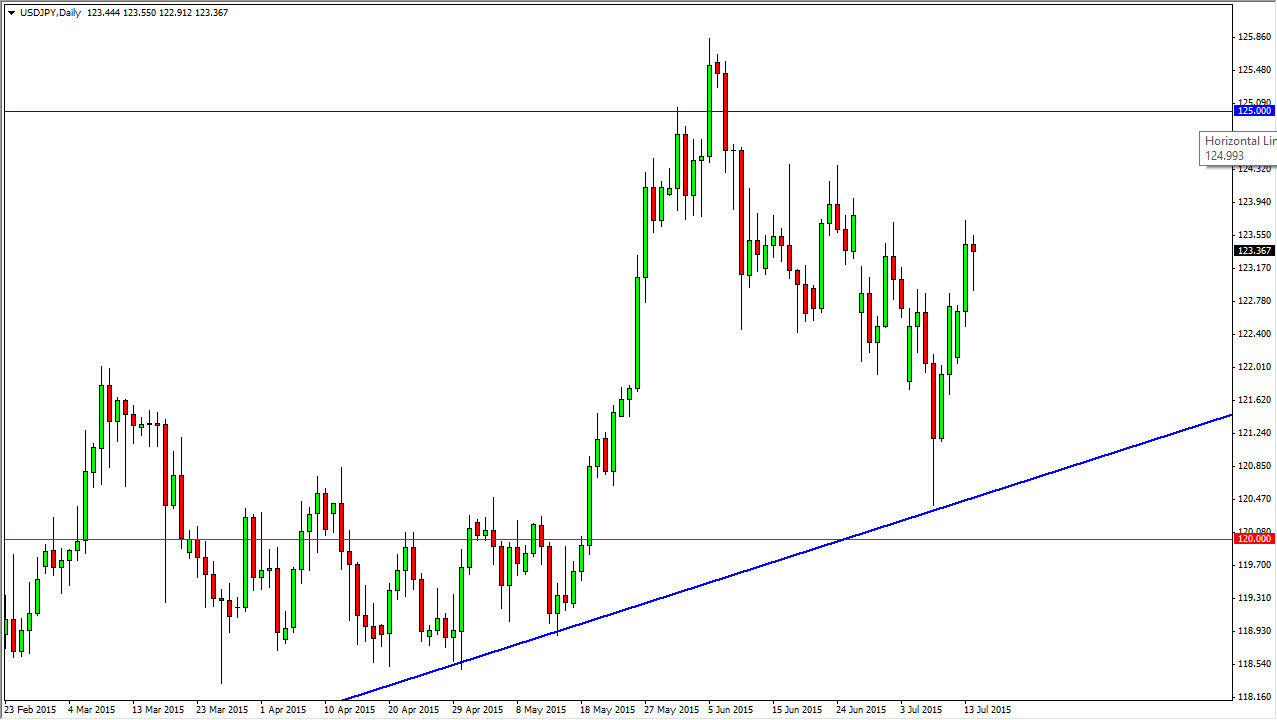

The USD/JPY pair initially fell during the course of the session on Tuesday, falling all the way down to the 123 handle. However, we had buyers reenter the marketplace and push the US dollar higher. I believe that this market continues to go much higher, probably heading to the 125 level before it’s all said and done. The shape of the hammer of course is very bullish, and of course encouraging. That being the case, the market looks as if it is going to continue to favor the US dollar as the interest-rate differential of course will continue to favor the Americans over the Japanese. After all, the Bank of Japan continues to offer nothing but quantitative easing, while the Federal Reserve of course is looking to increase the interest-rate for the United States. With that being the case, and of course makes sense that this pair will continue to go higher.

Risk on, risk off

The “risk on, risk off” attitude in this market shouldn’t be ignored, simply because quite frankly the Japanese yen is considered to be one of the “safest” currencies in the world down, and as a result this pair does tend to go higher when times are good. On top of that, the industry differential should continue to expand in the favor of the United States, and that of course makes the currency much more attractive.

Keep in mind that bond markets move the currency markets more than most other markets. With that being the case, I believe that as long as the Bank of Japan continues to buy Japanese Government Bonds, it’s going to be difficult to believe that the Japanese yen will strengthen over the longer term, as there simply is nothing along the lines of yield coming out of Japan at the moment. On top of that, the Bank of Japan will have to continue to try to bring down the value of the currency, simply because it helps exports which the Japanese economy is absolutely dependent on. I am a buyer on a break of the top of the hammer, and supportive candles below.