USD/CHF Signal Update

Yesterday’s signals were not triggered as the bullish price action at 0.9700 did not occur until after the London close.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today only.

Long Trade 1

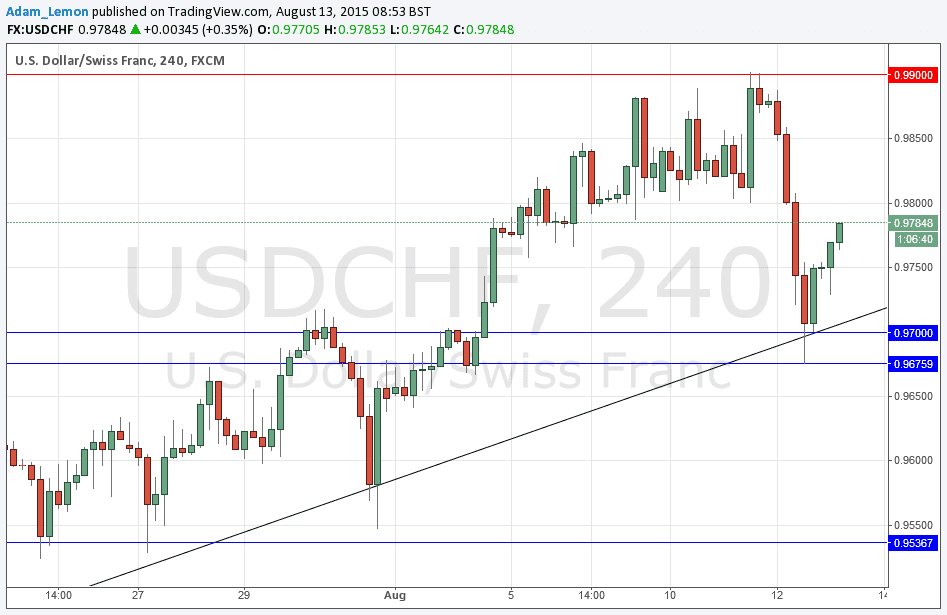

Go long after bullish price action on the H1 time frame following the next entry into the zone between 0.9700 and 0.9676.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short after bearish price action on the H1 time frame following the next touch of 0.9900.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

My forecast yesterday was again totally right: look for a bullish reversal at the old bullish trend line confluent with 0.9700. Unfortunately this did not happen until after London closed, but the price had fallen very sharply and was nicely overextended down there, bouncing back during the late New York session.

It has to be said that this bullish bounce was looking reactive rather than impulsive, but it is looking stronger during London trading and if it can reach the round number at 0.9800 that would be a healthily bullish development.

I expect local resistance at 0.9800 which might be scalped successfully.

There is nothing due today regarding the CHF. Concerning the USD, there will be releases of Retail Sales and Unemployment Claims data at 1:30pm London time.