USD/JPY Signal Update

Yesterday’s signals were not triggered and expired.

Today’s USD/JPY Signals

Risk 0.50%

Trades may only be taken between 8am and 5pm New York time only, and then after 8am Tokyo time later.

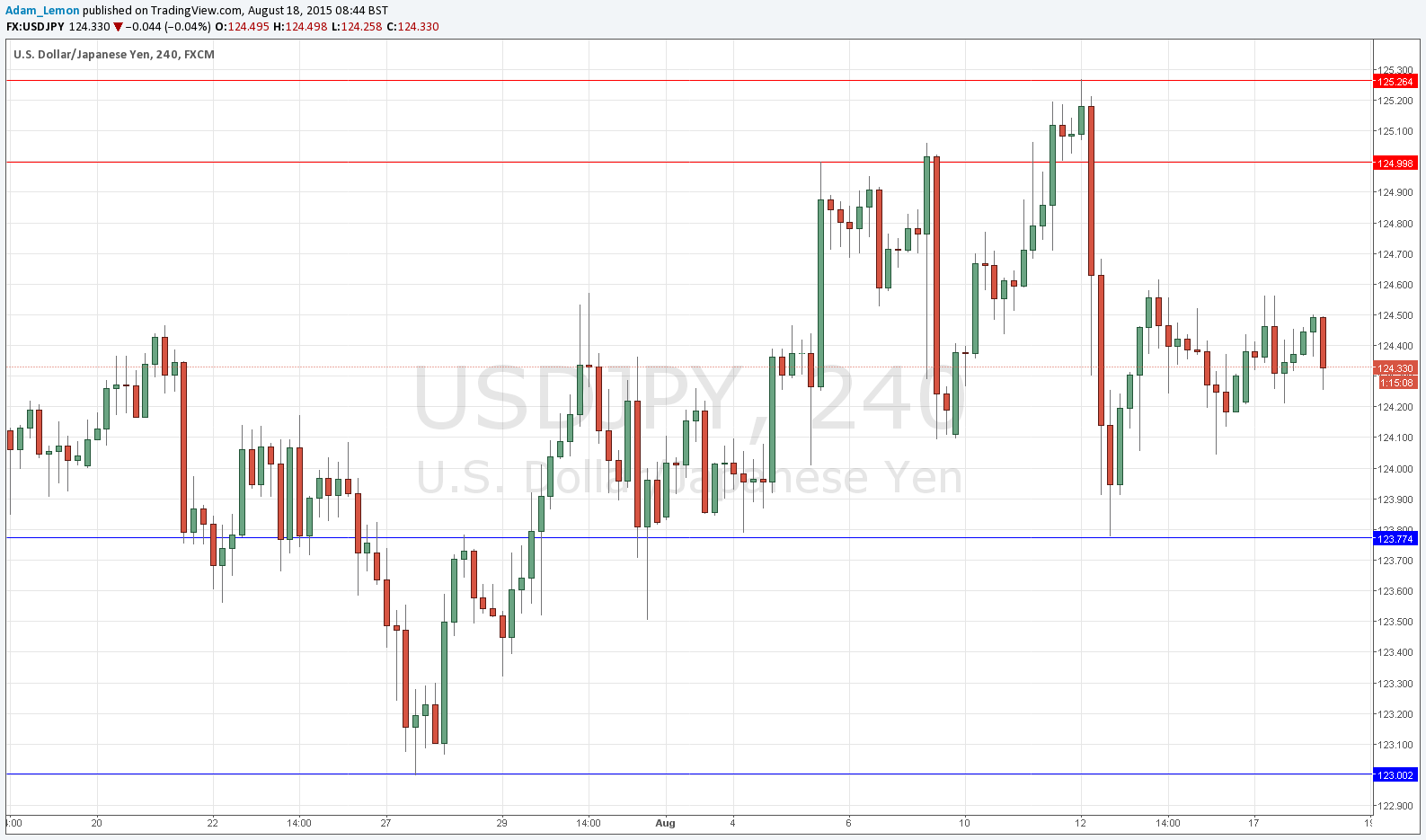

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 123.77.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 123.00.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone from 125.00 to 125.26.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

As expected, yesterday was a very slow day. The New York session saw what looked to be the beginning of a move up, but the price just could not get above 124.50 and barely moved. If the USD news due after the New York open is no surprise, we will probably just chop around more or less unchanged until the FOMC statement is released tomorrow.

There is nothing due concerning the JPY. Regarding the USD, there will be a release of Building Permits data at 1:30pm London time.