EUR/USD Signal Update

Yesterday’s signals expired without being triggered as the price never reached 1.1315.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be made before 5pm London time today.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1315 and/or the supportive trend line currently sitting at around the same price.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1232 and/or the supportive trend line currently sitting at around 1.1235.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

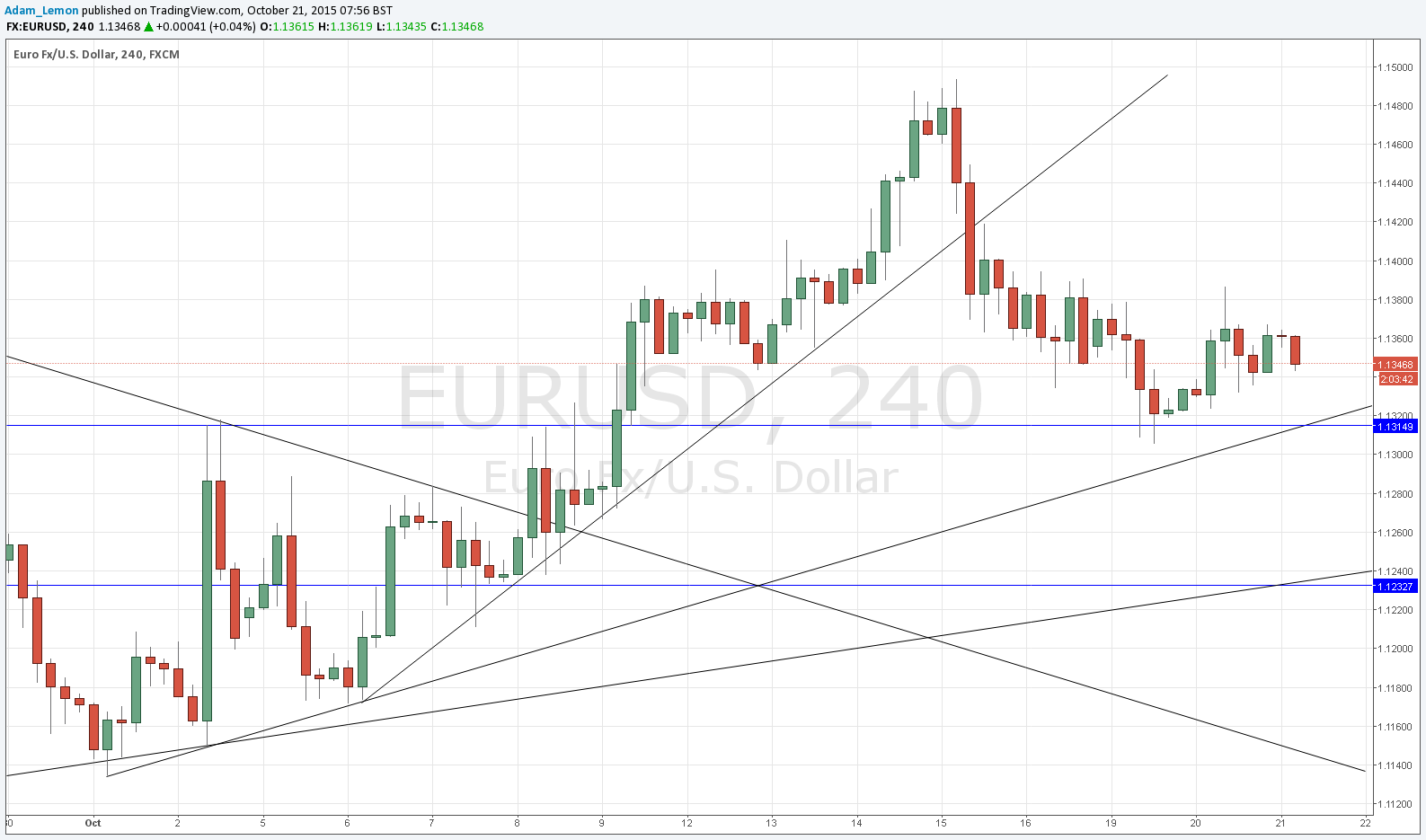

EUR/USD Analysis

I forecast yesterday that an upwards move was the more likely scenario for the day, and this was what happened, before the price hit local resistance at around 1.1380 and fell again. Although the range is not big, the line of least resistance is definitely bullish, and the support I identified at 1.1315 has held. The chart below shows that we now have a clear confluence of a horizontal level and supportive trend line at 1.1315, so a dip back down there is quite likely to produce another intraday upwards move. Whether the price can then clear 1.1380 which is becoming the beginning of a clearly resistant area is another matter. Relatively small profits are probably all that is on offer. Overall the Forex market is quiet and flat at the moment, and trading this pair long from support is probably one of the few intraday trades on offer at the moment.

There is another good level of supportive confluence below at 1.1235.

There are no high-impact releases due today concerning the EUR or the USD.