USD/CHF Signal Update

Yesterday’s signals were not triggered as there was no bullish action when the price first hit the supportive trend line at 0.9523.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered between 8am and 5pm London time today only.

Long Trade 1

Long entry after bullish price action on the H1 time frame following a touch of 0.9385.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.9648 and/or the bearish trend line currently sitting at around 0.9635.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

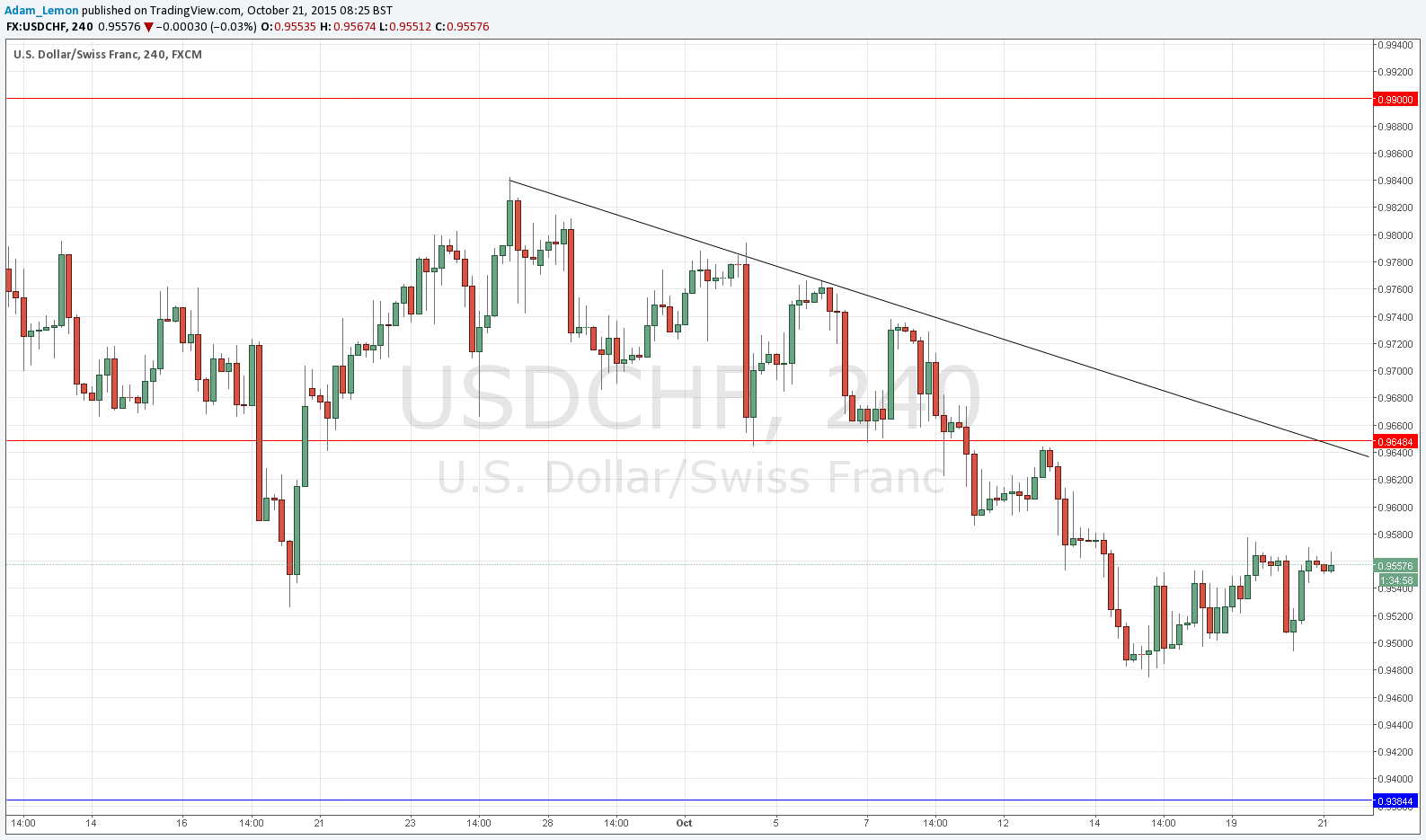

USD/CHF Analysis

I wrote yesterday that I was wary of trading a break below the supportive trend line shown in yesterday’s chart, and this was just as well as the price broke just below before turning around and then breaking the other trend line before flattening out! So first of all we can remove this triangle and the chart below now looks clearer.

It seems there is minor resistance now at around 0.9560 that has been holding, and perhaps a level above that at 0.9585 or so. This suggests that in the absence of a major trend in sentiment it is going to be difficult to get long of this pair and make any significant pips.

We are quite a way from either the strong-looking resistant confluence above at around 0.9635, or the next major support below at 0.9385. In this quiet, flat Forex market, this pair does not look a very attractive trade in the meantime.

There are no high-impact releases due today concerning the CHF or the USD.