USD/CHF Signal Update

Last Thursday’s signals expired without being triggered as there was no bearish price action at 0.9635.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be made between 8am and 5pm London time today only.

Long Trade 1

Long entry after bullish price action on the H1 time frame following a touch of 0.9739.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Long entry after bullish price action on the H1 time frame following a touch of 0.9648.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.9900.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

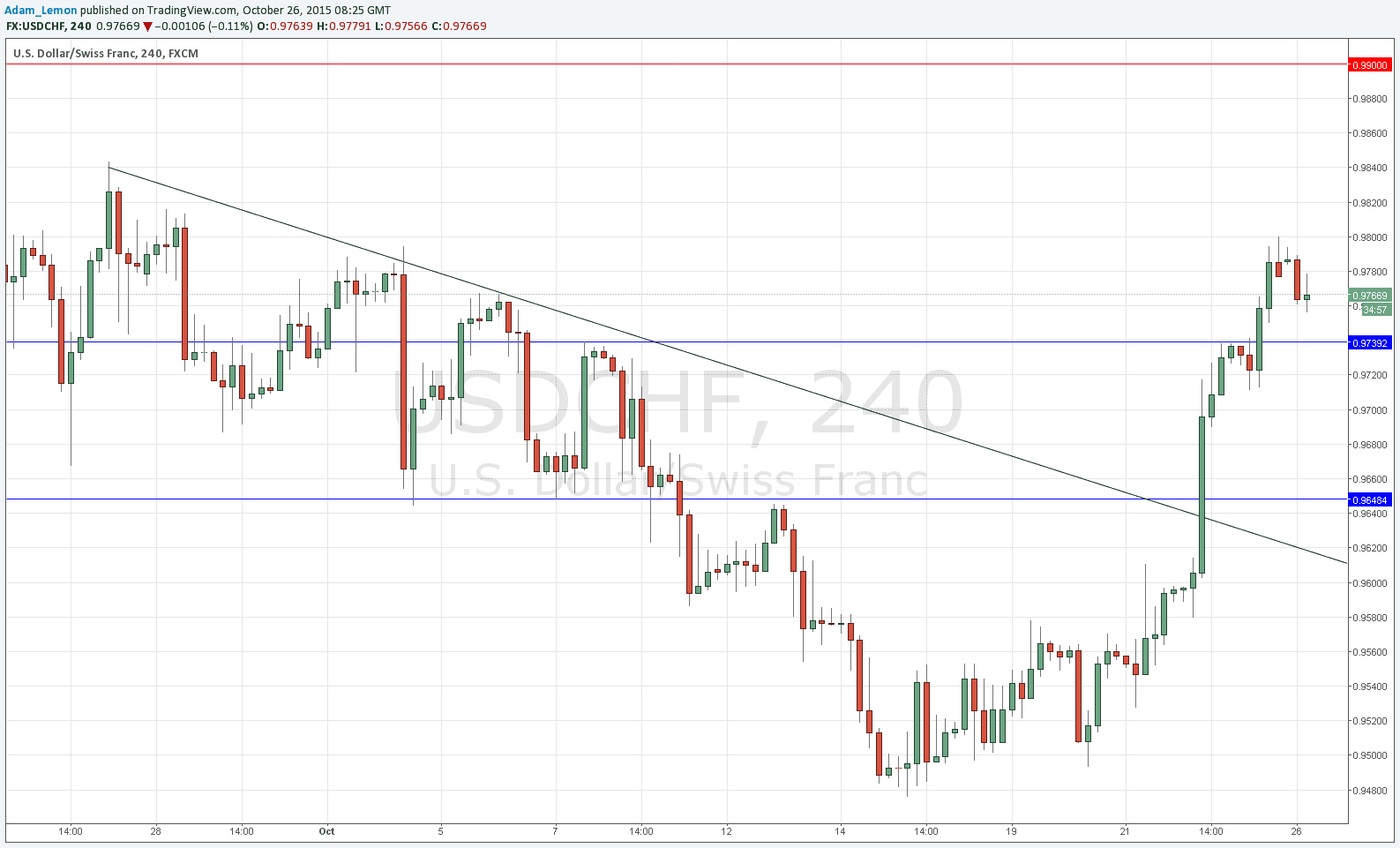

Last Thursday’s strong change in sentiment on the Euro had the effect of dragging the CHF along with it, as the Swiss economy is so closely integrated with the Eurozone. The change in the Euro also gave the USD a boost, so what it meant for this pair was a strong upwards move, cutting through horizontal levels and the bearish trend line very easily.

The round number at 0.9800 checked the advance and the price is now pulling back. It looks like there is logical support at 0.9739 and then further below at 0.9648.

There is old resistance above confluent with the round number at 0.9900.

There is nothing due today regarding either the CHF or the USD.