USD/CHF Signal Update

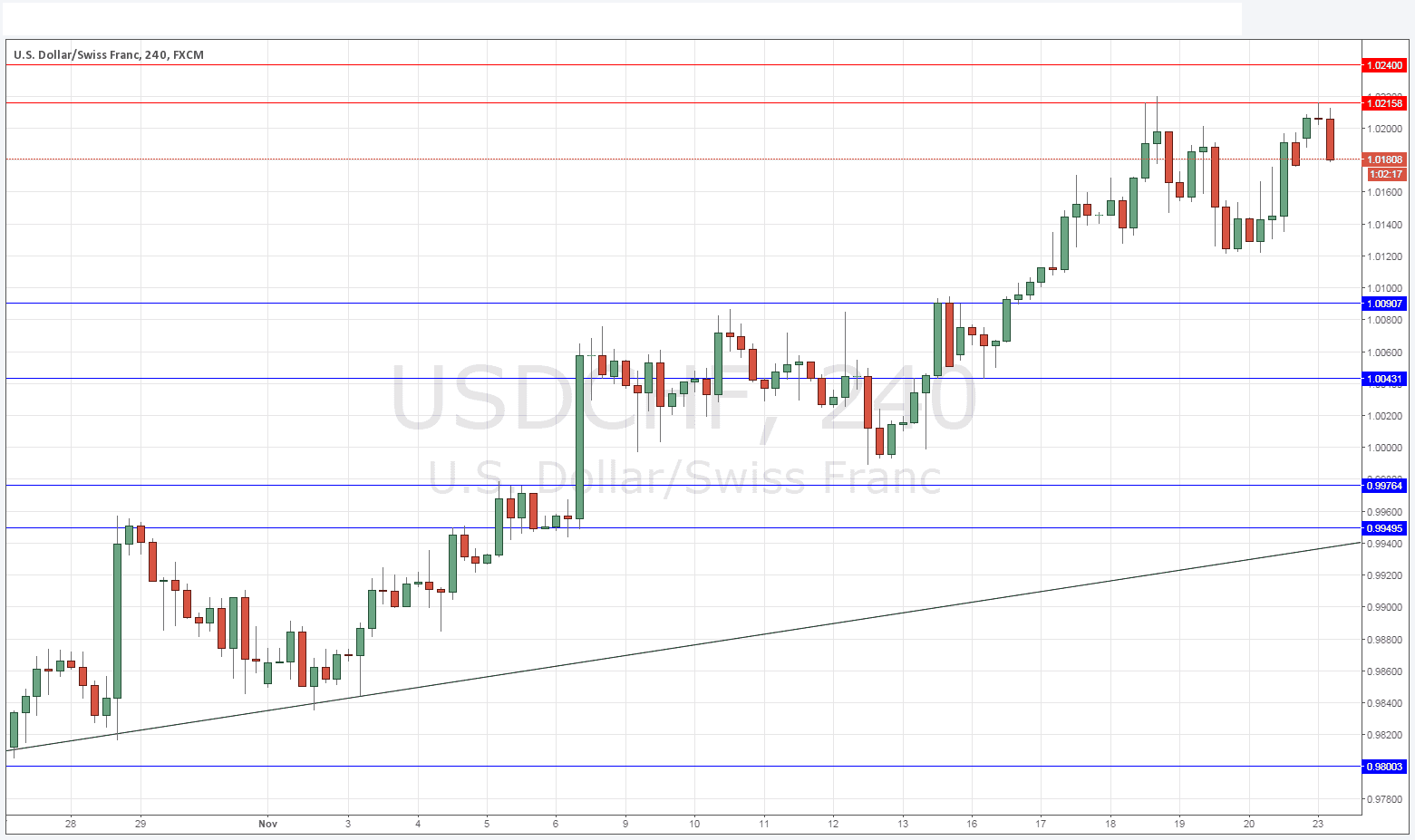

Last Thursday’s signals expired without being triggered as none of the key levels given were hit that day.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be taken before 5pm London time today.

Long Trade 1

* Long entry after bullish price action on the H1 time frame following a touch of 1.0091.

* Place the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

* Long entry after bullish price action on the H1 time frame following a touch of 1.0043.

* Place the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone between 1.0215 and 1.0240.

* Place the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

The zone from 1.0215 to 1.0240 is the last remaining obstacle to a new multi-year high in this strongly trending pair, and it held again during the previous Asian session, with the price currently trading below this week’s initial opening price.

While this pair has been trending strongly lately, it might undergo a relatively sharp correction if the USD pulls back, as traders will see a possible double top having formed and holding at a key resistance level. There are a lot of long positions so a quick fall will probably trigger a lot of stops.

Alternatively, a strong break above 1.0240 could see buying euphoria kick in.

Regarding the CHF, there is nothing due today. Concerning the USD, there will be an announcement from the Federal Reserve on an unknown topic.