USD/JPY Signal Update

Yesterday’s signals were not triggered and expired.

Today’s USD/JPY Signals

Risk 0.50%

Trades may only be entered before 5pm Tokyo time later.

Long Trade 1

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 122.00.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 121.42.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

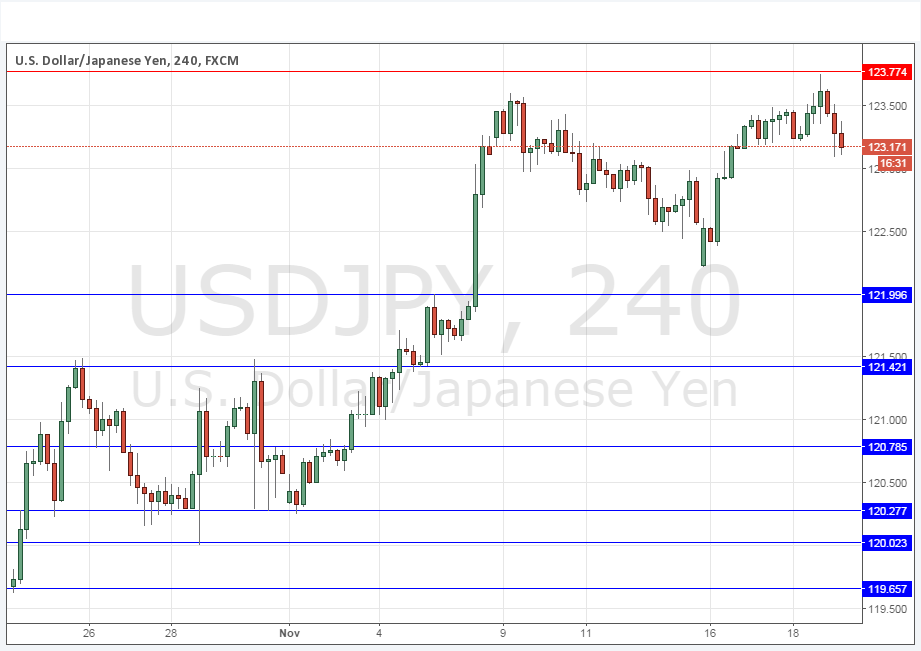

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 123.77.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

The USD rose everywhere as the FOMC release was anticipated, almost reaching the key resistance here of 123.77 before turning around and falling. There was nothing disappointing in the release for USD bulls, but the USD sold off anyway as the market settled half an hour or so after the announcement and into the Asian session.

There may be local support at 123.00 but this pair does not look like a particularly good way to exploit moves in the USD at the moment.

There is nothing due today regarding the JPY. Concerning the USD, there will be a release of Unemployment Claims data at 1:30pm London time, followed by the Philly Fed Manufacturing Index at 5pm.