NZD/USD Signal Update

Today’s NZD/USD Signals

Risk 0.75%

Trades may only be entered between 8am New York and 5pm Tokyo times today.

Long Trade 1

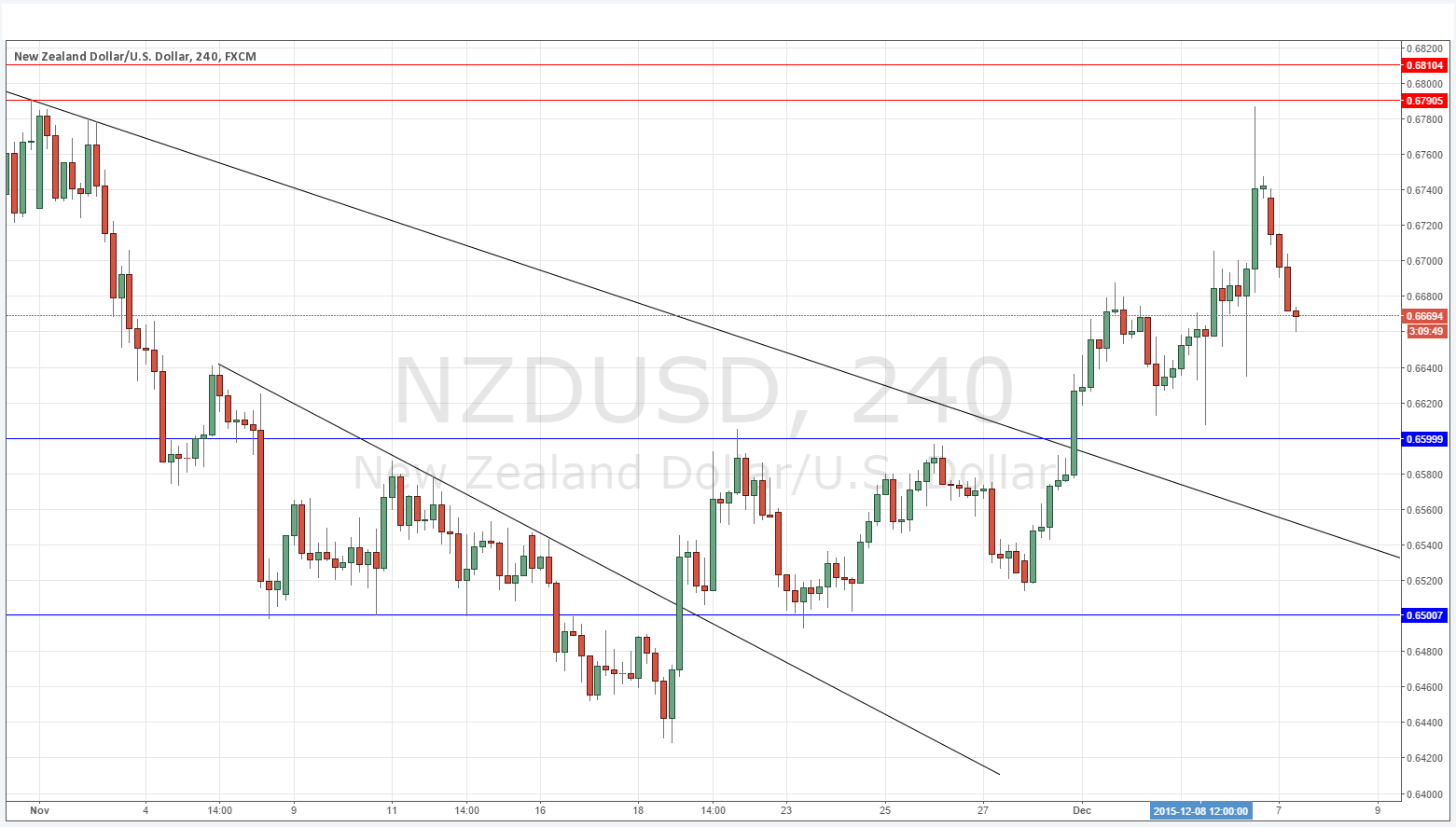

• Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6600.

• Put the stop loss 1 pip below the local swing low.

• Move the stop loss to break even once the trade is 20 pips in profit.

• Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

• Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of the trend line currently sitting at around 0.6550.

• Put the stop loss 1 pip below the local swing low.

• Move the stop loss to break even once the trade is 20 pips in profit.

• Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

• Go short following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone between 0.6790 and 0.6810.

• Put the stop loss 1 pip above the local swing high.

• Move the stop loss to break even once the trade is 20 pips in profit.

• Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

NZD/USD Analysis

Following Friday’s NFP release, this pair spiked up, almost reaching the round number at 0.6800 before falling off solidly. Overall things look somewhat bearish still, but not as much as the AUD/USD pair which has been doing much better. The next round number below at 0.6600 looks as if it is likely to be nicely supportive and it seems probable that the next move will be down to that area.

There is nothing due today regarding either the NZD or the USD.