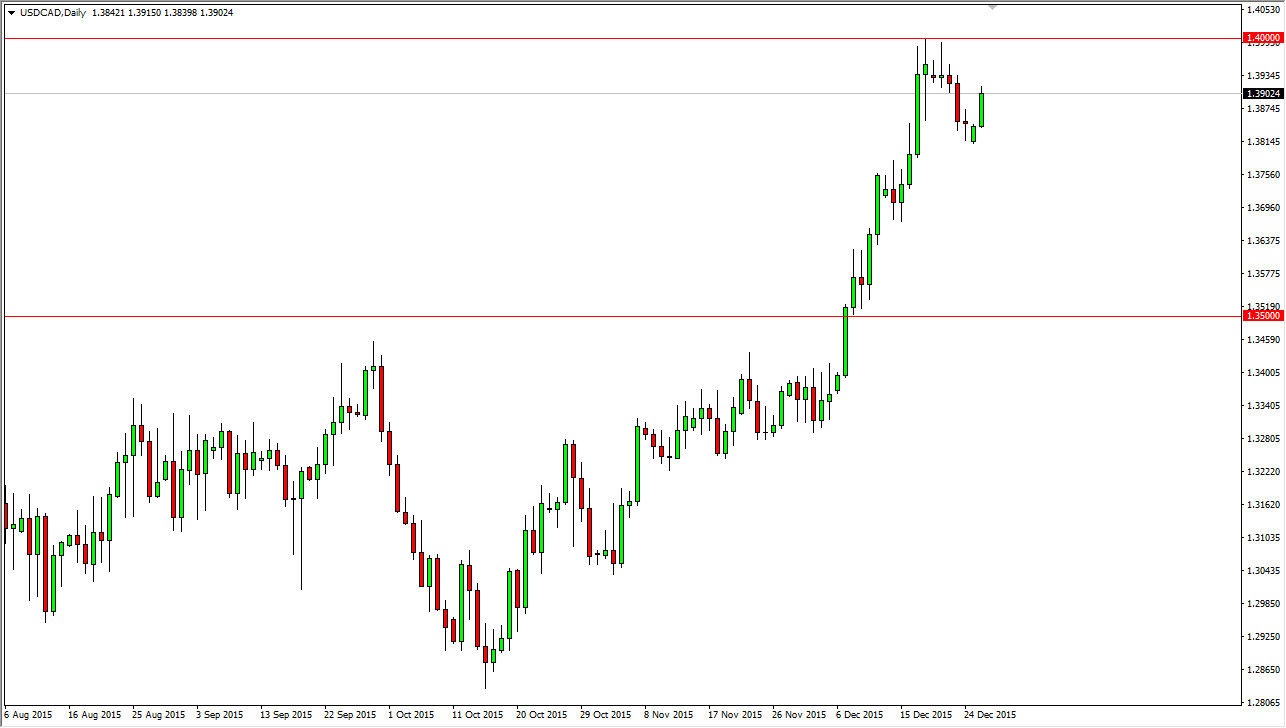

The USD/CAD pair rose during the course of the day on Monday, using the 1.38 level as a bit of a springboard. Needless to say, this of course is a very bullish sign and I believe that the market will continue to go higher. However, I think that we will also have quite a bit of choppiness between now and the eventual break out. With that in mind, I am a buyer of short-term pullbacks as they offer value in the US dollar, and recognize that the Canadian dollar has been struggling for some time.

The oil markets have been absolutely decimated, and that of course won’t do anything good for the Canadian dollar. After all, most currency traders use the Canadian dollar as a proxy for crude oil itself. With those market falling apart, currency traders have been selling the Canadian dollar hand over fist for quite some time.

Buying Dips

I continue to buy dips time and time again and eventually will place more of a “buy-and-hold” type of trade once we finally get above the 1.40 handle. At that point in time, the market should continue to go much higher given enough time, and continue the massive uptrend that we have started over the last several months. On top of that, I believe that every time we pullback people will continue to buy this pair as the Canadian dollar is suffering due to the commodity markets and of course the fact that the US dollar is one of the most favored currencies around the world right now. I also think that the fact that the Federal Reserve is starting to raise interest rates should continue to favor the US dollar over most other currencies as well.

I think that the 1.38 level is a bit of a floor in this market, but the absolute bottom I believe at this point in time as the 1.35 level. I would be surprised if we get down there though, so at this point in time I fully expect the buyers to return and grind this market higher.