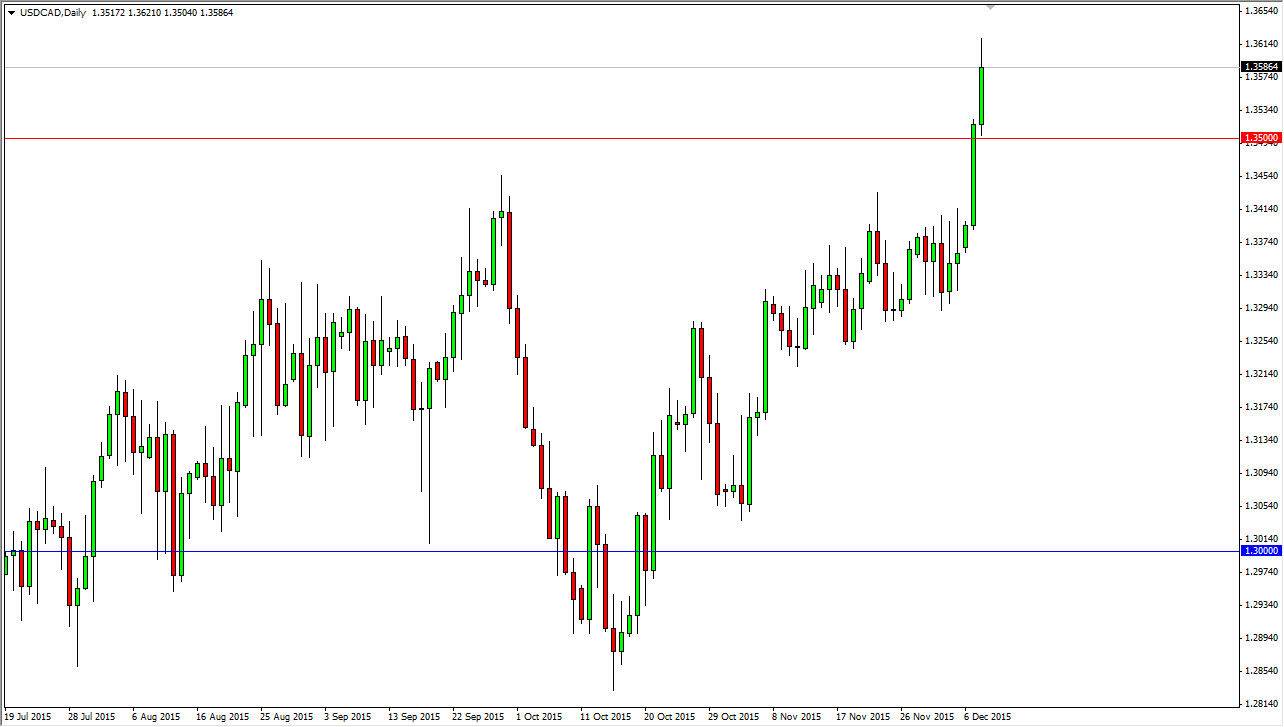

The USD/CAD pair finally cleared the 1.35 resistance barrier during the day on Tuesday, an event I have been waiting for over the last several weeks. When you look back at the last several weeks, you can see that we continue to grind our way higher along that time, but simply could not sustain gains above the 1.34 level. However, oil markets fell apart and as a result it appears that the Canadian dollar is going to suffer.

The US dollar continues to be one of the favored currencies around the world right now, and as a result of oil falling it makes sense that this market continues to grind its way higher. The Canadian dollar is used as a proxy as Canada exports so much in the way of petroleum, so at this point in time I believe that Forex traders in general will continue to punish this currency. I also believe that the length of the candles suggests that the market is trying to break out longer term.

Pullbacks

I believe that pullbacks will be buying opportunities every time we see them, as the American has picked up. Keep in mind that this market tends to be fairly choppy though as the 2 economies are so intertwined. Ultimately though, I believe that the buyers will return again and again as oil continues to feel quite a bit of pressure. Oil is being pressured by several different things at once, not the least of which is the strengthening US dollar. However, the problem with oil goes much deeper than that, as demand simply isn’t there worldwide. With the Americans are producing more and more of their own crude oil, it’s very likely that crude oil prices will continue to fall in the meantime. It is not until we get more economic strength worldwide that I feel that the oil markets will find serious buyers. With the Federal Reserve likely to raise rates soon, the US dollar should continue to climb.