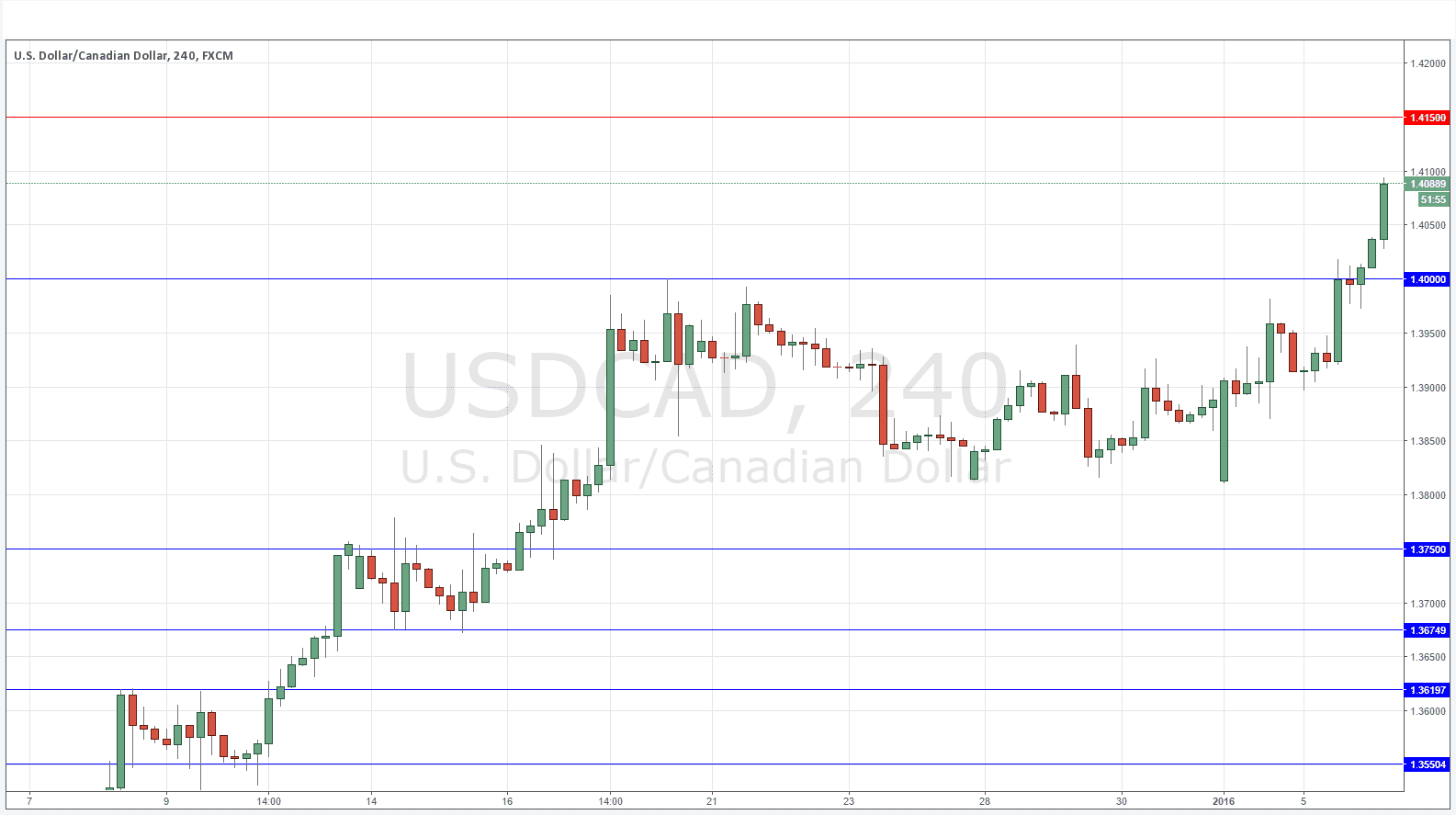

USD/CAD Signal Update

Yesterday’s signals were not triggered as the bearish price action at 1.4000 did not take place until after London closed.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades must be taken between 8am London time and 5pm New York time today only.

Protect any open trades before 6:30pm.

Long Trade 1

* Go long following a bullish price reversal upon the next touch of 1.4000.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Go short following a bearish price reversal upon the next touch of 1.4150.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CAD Analysis

We finally broke the 11 year high of 1.4000, which I was not expecting to happen just yet. We are in blue sky, reaching prices that have not been seen for over a decade, as the price of crude oil also reached historic new lows.

There may be resistance above at 1.4150 which was a key monthly low as well as very close to significant highs over 11 years ago. Any reversal here should look very strong before it would be worth going short.

The level at 1.4000 was strong resistance so can now be expected to decisively flip to support, unless the mood of the market changes quite radically. That is unlikely to happen before the FOMC Meeting Minutes release due later after London closes.

Concerning the CAD, there will be a release of Trade Balance data at 1:30pm London time. Regarding the USD, there will be a release of the ADP Non-Farm Employment change at 1:15pm, followed by Trade Balance data at 1:30pm and ISM Non-Manufacturing PMI data at 3pm. Finally