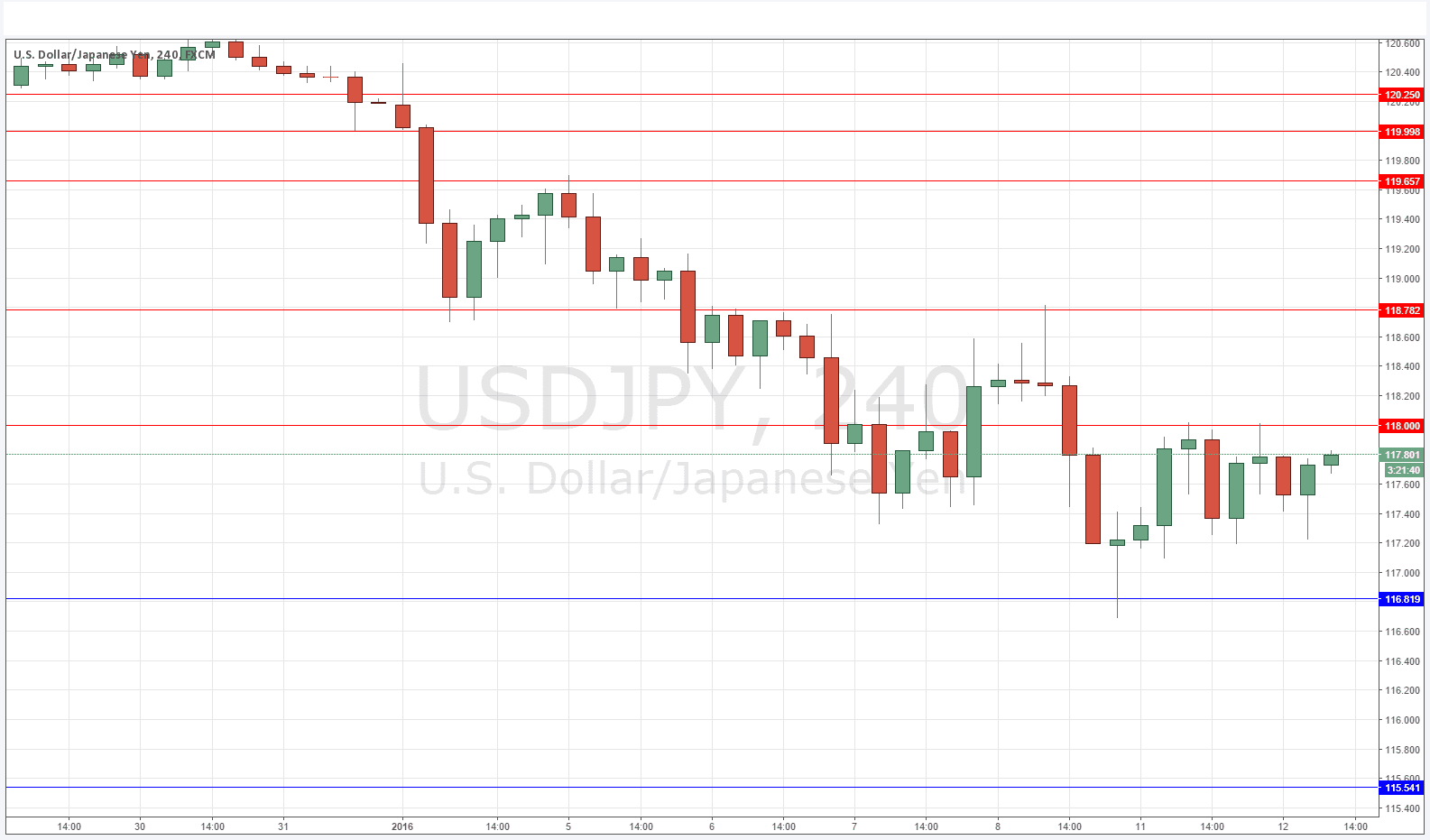

USD/JPY Signal Update

Yesterday’s signals gave a profitable short trade off the bearish doji on the hourly chart that rejected the resistance level at 118.00, although it only ran for slightly more than the recommended 20 pips of profit.

Today’s USD/JPY Signals

Risk 0.50%

Trades may be taken only from 8am New York time until 5pm Tokyo time.

Long Trade 1

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 116.82.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 118.00.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 118.72.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

We have again bounced off the resistance at 118.00 and it seems at present that this pair is stuck between 117.00 and 118.00. Whichever way the price breaks next – either above 118.00 or below 116.82 – is going to be crucial for the medium-term outlook as the bulls and bears fight over these crucial levels. The price action suggests that it is more likely that the bulls will win this fight.

There is nothing due today concerning the USD. Regarding the JPY, the Governor of the Bank of Japan will be speaking at 10:30am at a symposium.