WTI Crude Oil

The WTI Crude Oil market rose during the day on Tuesday, testing the $32 level. However, this area seemed quite a bit resistive, so it’s not a big surprise that we pulled back. I also recognize that the Crude Oil Inventories number coming out today could have an effect on this market, not to mention the fact that the FOMC Statement comes out. Ultimately, I believe that this market does continue to go much lower but you will probably have to look towards the short-term charts in order to find the trading opportunity to do so. I have no interest in buying this market, and even if we get some type of strong move higher, I believe that it’s only a matter of time for the sellers come back. After all, we have a significantly bearish market based upon long-term fundamental issues. I still have a target of $25 at this point.

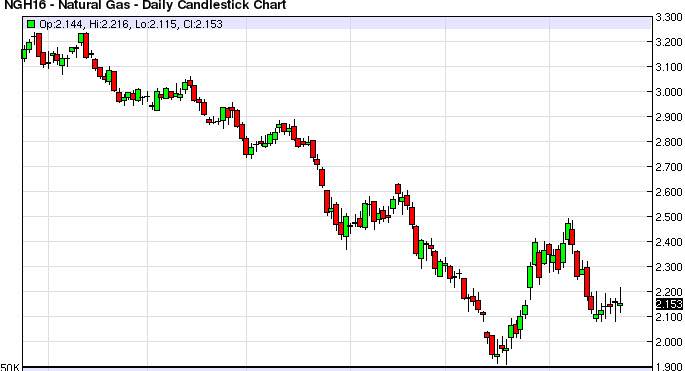

Natural Gas

The natural gas markets initially tried to rally at the open on Tuesday, but found enough resistance near the 2.20 level to turn things back around and form a bit of a shooting star. We had previously formed a hammer during the Monday session, so at this point in time I think we are simply consolidating. However, if we break down below the $2.09 level, I feel the market continues to go much lower, probably reaching towards the lows that had been set back during the month of December.

I have no interest whatsoever in buying this market, and at this point in time I have to look at any rally as a potential gift to short sellers as the market has been so bearish over the longer term. In fact, I don’t really have a scenario in which I'm willing to buy natural gas and I think that a rally will simply attract more sellers. At this point though, I fully anticipate that the market will break down below the support over the last couple of days to continue the move.