WTI Crude Oil

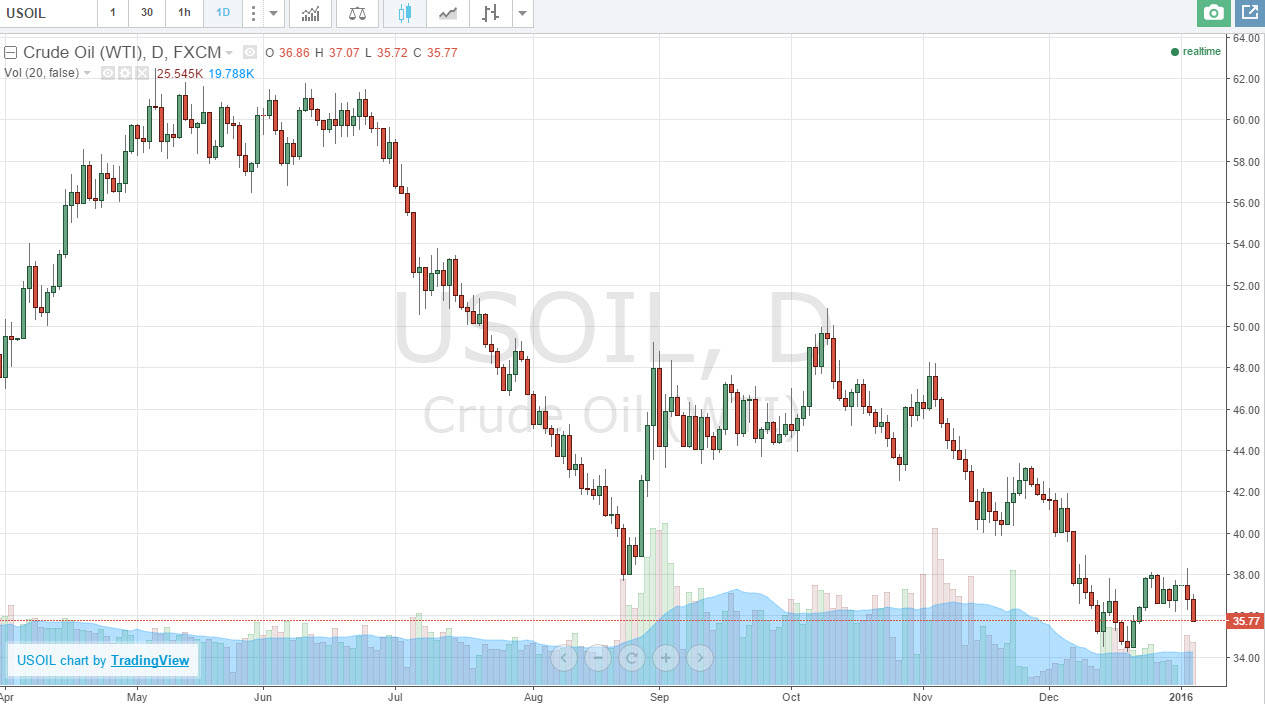

The WTI Crude Oil markets fell during the session on Tuesday, breaking below the $36 level. That being the case, I believe that the only thing you can do in this market is sell as we have broken down below support. However, today is the Crude Oil Inventories announcement, so having said that we could get a bit of volatility, but I believe that any rally at this point in time is going to be a perfect selling opportunity. Quite frankly, I actually prefer that we get it so that we can build up more momentum to the downside.

I believe that the $34 level below will be targeted, and the fact that the US dollar continues to strengthen will work against the value of this market as well. Ultimately, I believe that the $34 level below will get broken given enough time as well. I have no interest whatsoever in buying.

Natural Gas

The natural gas markets went back and forth during the day, ultimately settling on a positive candle for Tuesday. Quite frankly though, I believe that we are simply consolidating between the $2.20 level on the bottom, and the $2.40 level on the top. Given enough time, we will break out, but until then I think that the only thing that you can do is essentially “range trade” this particular market.

At the prefer to see this market break down below the $2.20 level, so we could really pick up some downward momentum. Because of the longer-term trend, which of course is very negative in general. I think if we can break down below there, it would not be that big of a surprise to see this market reach down to the $2.00 level given enough time.

If we do rally from here, it is going to be a bit of a fairly difficult long-term position, but it could signal that the natural gas markets are trying to make a serious move higher.