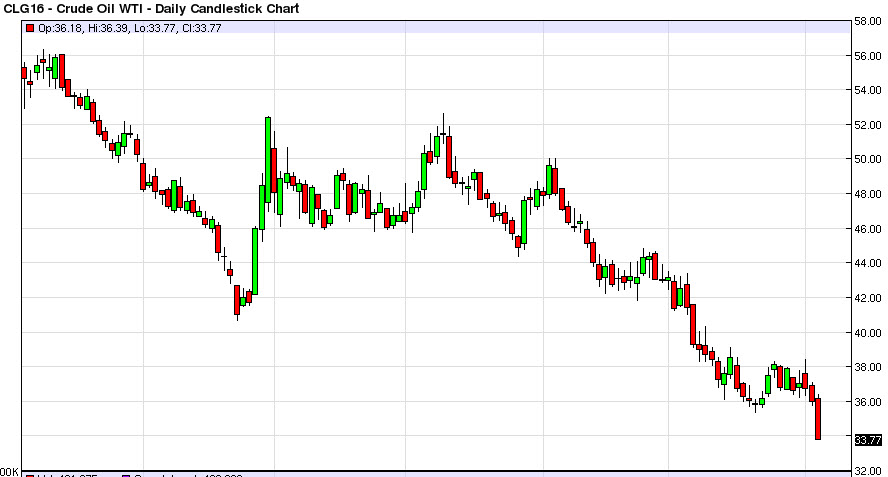

WTI Crude Oil

The WTI Crude Oil market broke down significantly during the course of the day on Wednesday, slicing through the $35 level like it wasn’t even there. That’s a very bearish sign obviously, and it looks like we are starting to accelerate to the downside now. I believe that short-term rallies should offer selling opportunities going forward, and as a result I think that day trading is probably the best way to go at the moment. It’s very rare that you hear me say that, but this is a very volatile yet very clearly negative market.

I believe this point in time we will head down to the $30 level, and quite frankly there’s nothing on this chart that suggests that we can’t get there rather quickly. With that being said, I believe that now the $36 level will be looked at as a potential “ceiling” in this market.

Natural Gas

Natural gas on the other hand continues to meander around the $2.30 level. Looking at the broader scope of things, it appears that we are essentially consolidating between the $2.20 level on the bottom, and the $2.40 level on the top. I think that you can continue to trade back and forth on short-term charts until we break out of that range, but I also recognize that the $2.40 level signifies something much more important.

The reason I think that is that it is the bottom of a cluster during the month of November that is starting to come into play now. If we break above there, we still have to deal with that area, and as a result I think that we are eventually going to see the sellers win. If we managed to break above the next cluster, which is extended all the way to the $2.60 level, we would have to start thinking trend change at that point. A break down below the $2.20 level has this market falling towards the lows yet again. In the meantime, nimble and quick traders can continue to play back and forth.