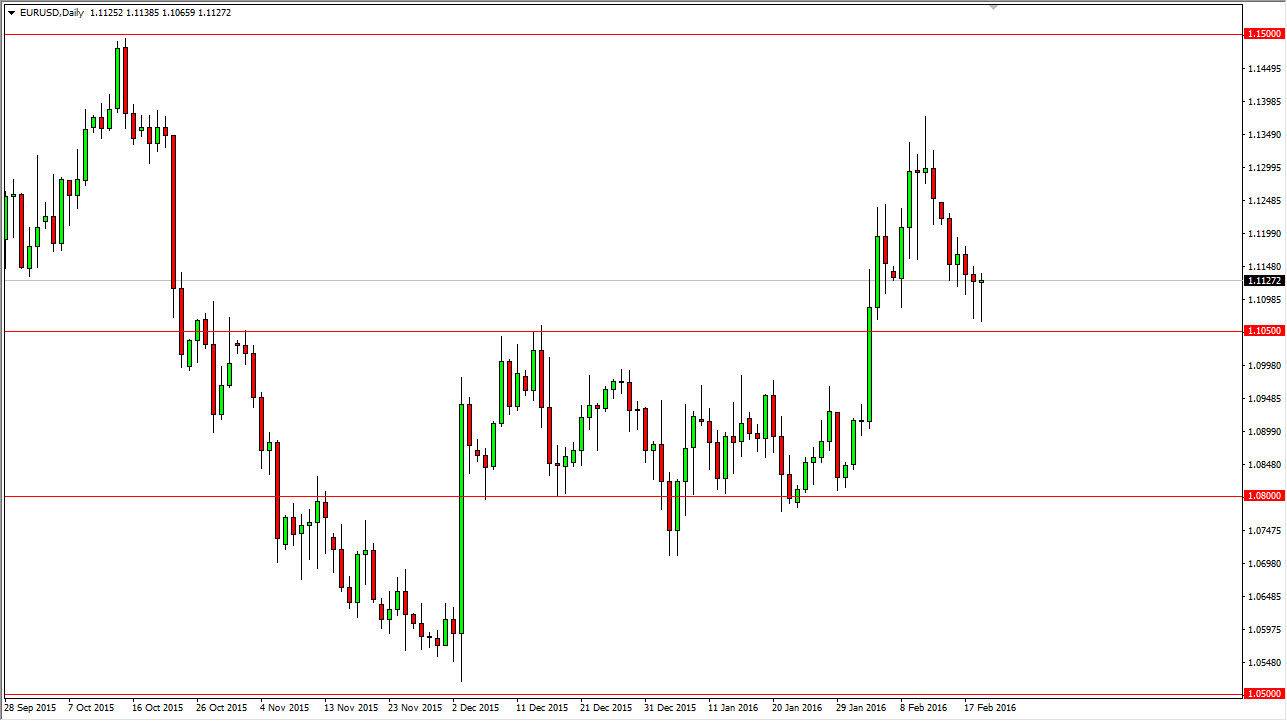

EUR/USD

The EUR/USD pair initially fell on Friday, but found support just above the 1.1050 level again. By doing so, we ended up forming a hammer which is exactly that we did on Thursday, a very bullish sign. With 2 hammers in a row, I feel that this market will more than likely try to bounce from here, and of course it makes sense considering that this area was so resistive previously. With that being the case, I’m waiting to see whether or not we can get a break above the top of the hammers to start buying but once we do I have no concerns. At that point, I would expect this market to reach towards the 1.13 level, and then possibly even the 1.15 level given enough time.

I’m not interested in selling this pair until we get below the 1.10 level, an area that would show a capitulation of buying pressure. At that point, I would expect the Euro to drop down to the 1.08 level.

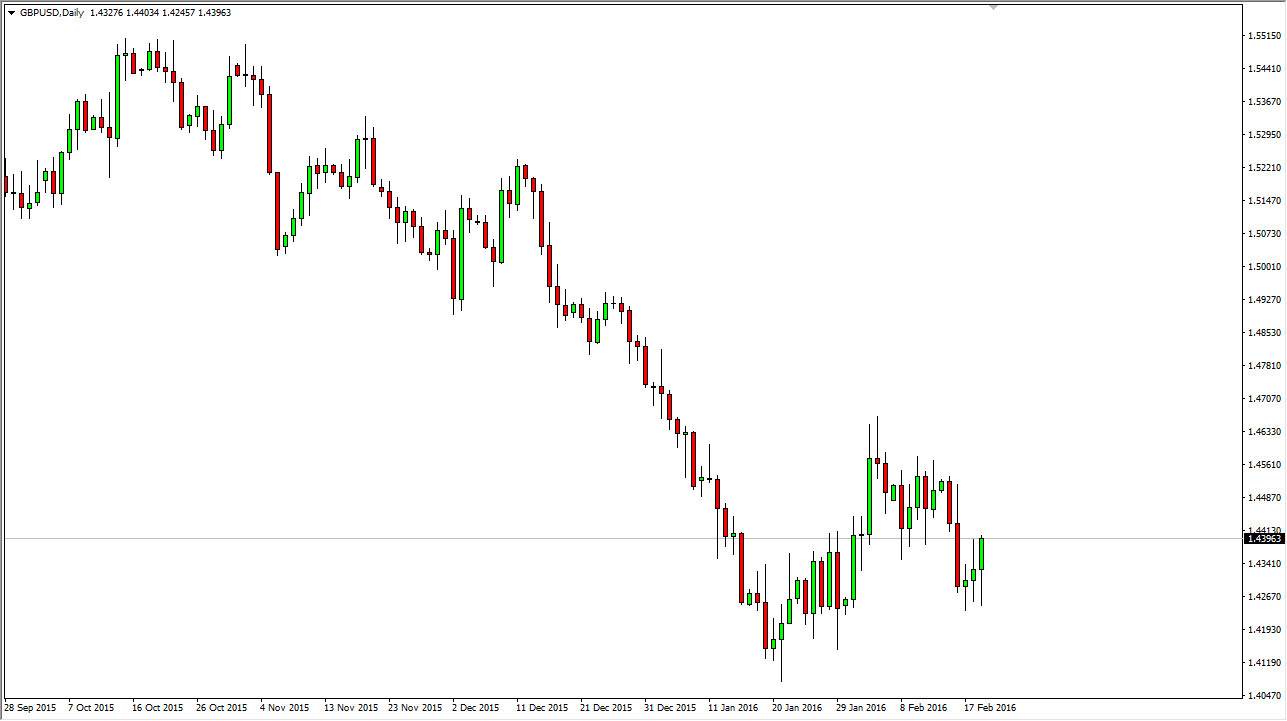

GBP/USD

The GBP/USD pair initially tried to fall during the course of the day on Friday, but turned back around and form a relatively supportive looking candle. With that being the case, it’s very likely that the market will rally from here, perhaps reaching towards the 1.46 handle. I would anticipate quite a bit of resistance in that area though, so I think this is a short-term rally only. In fact, a very comfortable selling near that area on an exhaustive candle.

The overall downtrend should continue, but it may take a while to turn things back around towards it. With we do though, I think we will not only go a little bit lower than the previous couple of sessions, but I think we will test the 1.41 level yet again. That of course was the recent lows, and therefore the market will probably have to test that area for support.