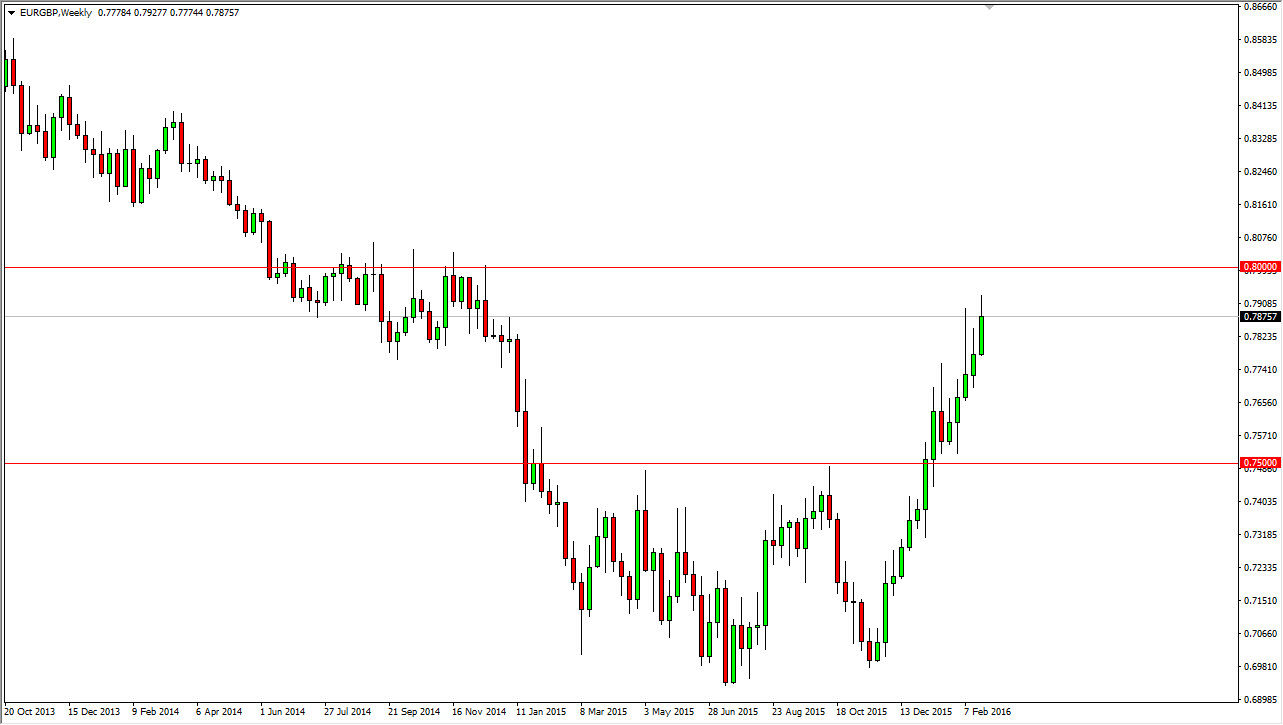

The EUR/GBP pair broke higher during the course of the last several weeks, but now we are struggling at a relatively strong resistance barrier. I think that the area between 0.78 and the 0.80 is going to continue to be a bit difficult to deal with, but eventually we could very well break above there. Once we get above the 0.80 level, I feel that this market will take off to the upside for quite a while.

However, I think at this point in time we might be a little bit exhausted, so a pullback could be seen. That to me is just an opportunity to try to pick up momentum going forward, and with that being the case it’s likely that we can find some type of value down there. I believe this market might be a bit bearish for this market, but quite frankly the market is one that I still want to be long of, maybe not during the beginning of the month though.

British Pound Weakness

The British pound has shown quite a bit of weakness as there are concerns as to whether or not the British are going to leave the European Union. I believe that the 0.75 level below will continue to be supportive, and as a result I would love to buy some type of supportive candle closer to that area. Of course having said that, if we break above the 0.80 level, I believe at that point in time it becomes more of a “buy-and-hold” type situation.

On the other hand though, one of the things that could be a chance for the market pullback could be that vote. Perhaps if the British choose not to leave the European Union, it will cause a bit of weakness in this market in the short-term. However, I believe that the economic situation was still demand that this pair continue to go higher.