GBP/USD Signals Update

Yesterday’s signals were not triggered and expired.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today only.

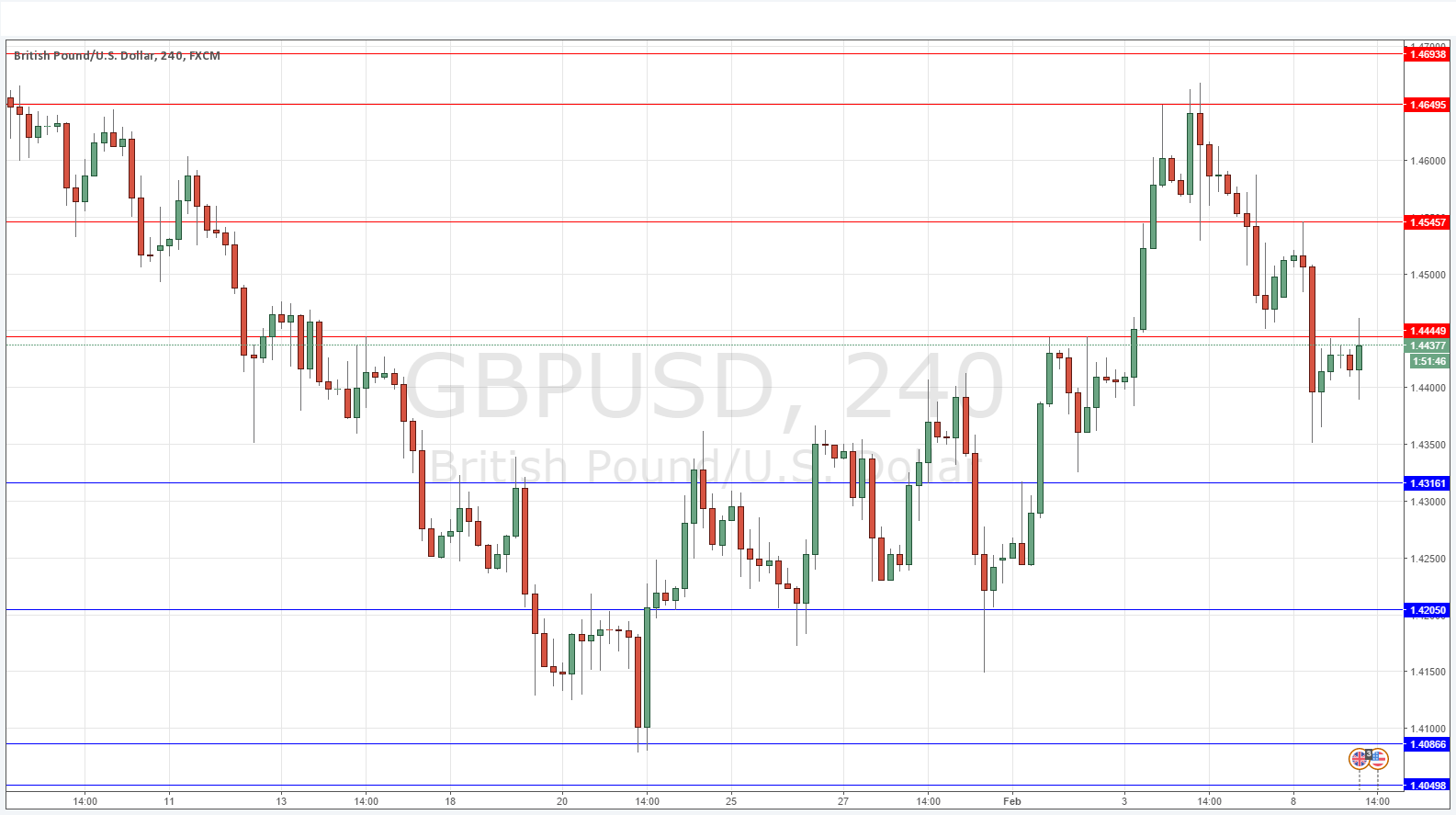

Long Trade 1

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.4316.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 25 pips in profit.

* Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.4445.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 25 pips in profit.

* Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Short Trade 2

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.4546.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 25 pips in profit.

* Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

GBP/USD Analysis

This pair fell sharply yesterday although since the USD weakened a lot it has come back. Still the GBP is definitely one of the weaker currencies so it still seems possible to profitably short it against an even weaker USD.

The key levels are quite clearly defined and at the time of writing we may be able to get a short trade off a bearish rejection of a test of 1.4445. If the price manages to break up above that level, then we may go back to test 1.4546 again.

The pair is in a long-term downwards trend which has been very strong but if the USD continues to be weak it is going to be hard to get much lower, if at all.

There is nothing due today concerning either the GBP or the USD.