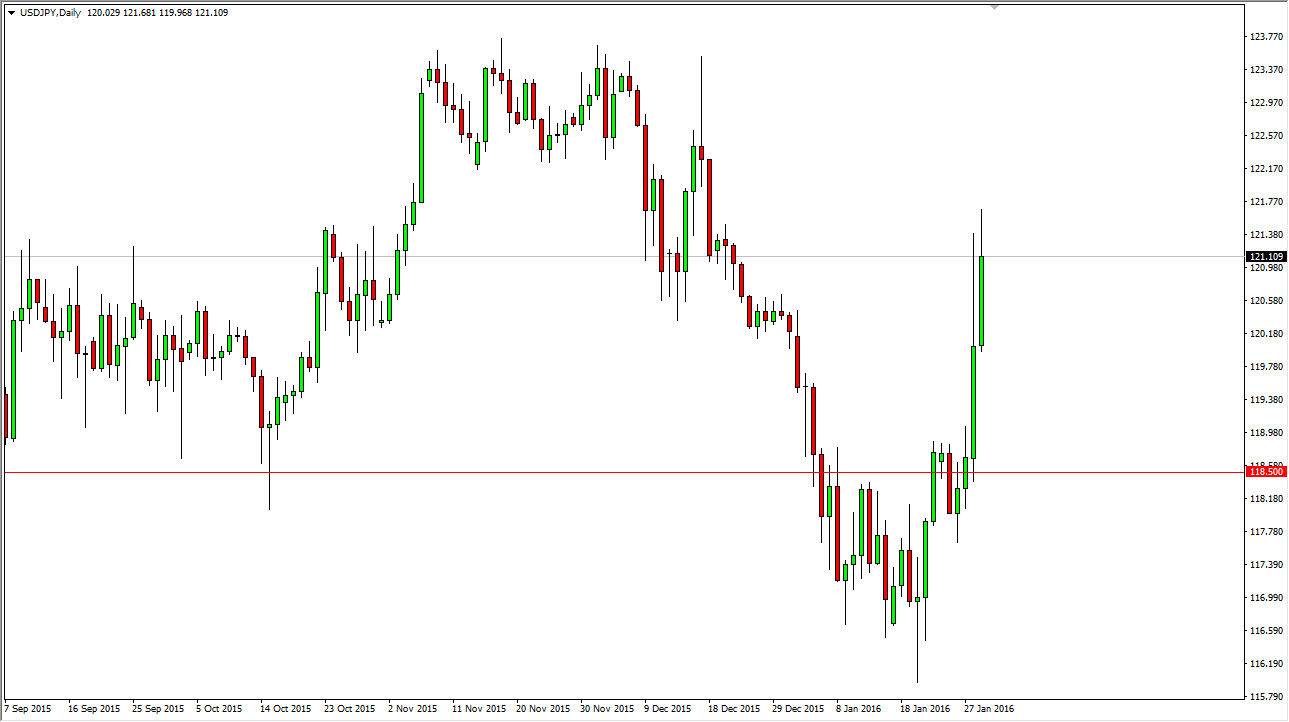

USD/JPY

The USD/JPY pair rallied during the session on Friday as the Bank of Japan has indicated that negative interest rates are coming. That of course is very negative for the Japanese yen, and therefore I feel that this market continues to go higher. Eventually, the market should then reach towards the 123.50 level, and then possibly higher. We may have to pullback between now and then, but I think that is just going to end up being a nice buying opportunity. That being the case, I am simply waiting for pullbacks that represent value that I can take advantage of in a world that is most certainly going to continue to punish the Japanese yen going forward. Ultimately, I think that we do break all the way to at least the 125 handle.

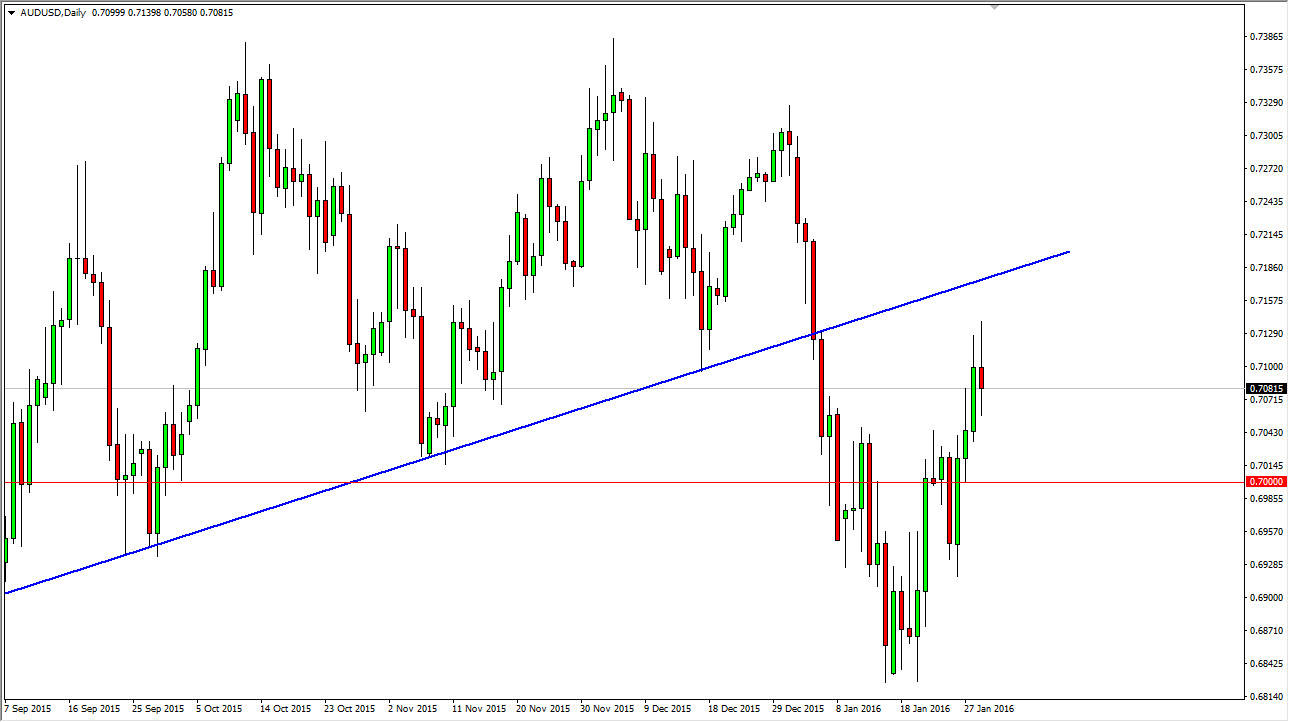

AUD/USD

The AUD/USD pair initially tried to rally during the session on Friday, but turned back around to form a nice-looking shooting star. The shooting star of course signifies that the selling pressure is coming back into the marketplace, and as a result I feel that the market is probably going to head back to the 0.70 level at the very least, and then possibly even lower such as the 0.68 handle. I’m very bearish of the Australian dollar, mainly because the situation in Asia is dire at best.

On top of that, the US dollar continues to be favored, and with that it makes sense that the market continues to show the same thing as the rest of the Forex world. I have no interest in buying this pair, at least not until we break well above the uptrend line that is above, which should now be quite a bit of resistance in the meantime. Given enough time, I do think that we make fresh new lows, but it might be a bit difficult to get there in the meantime, expect quite a bit of volatility.