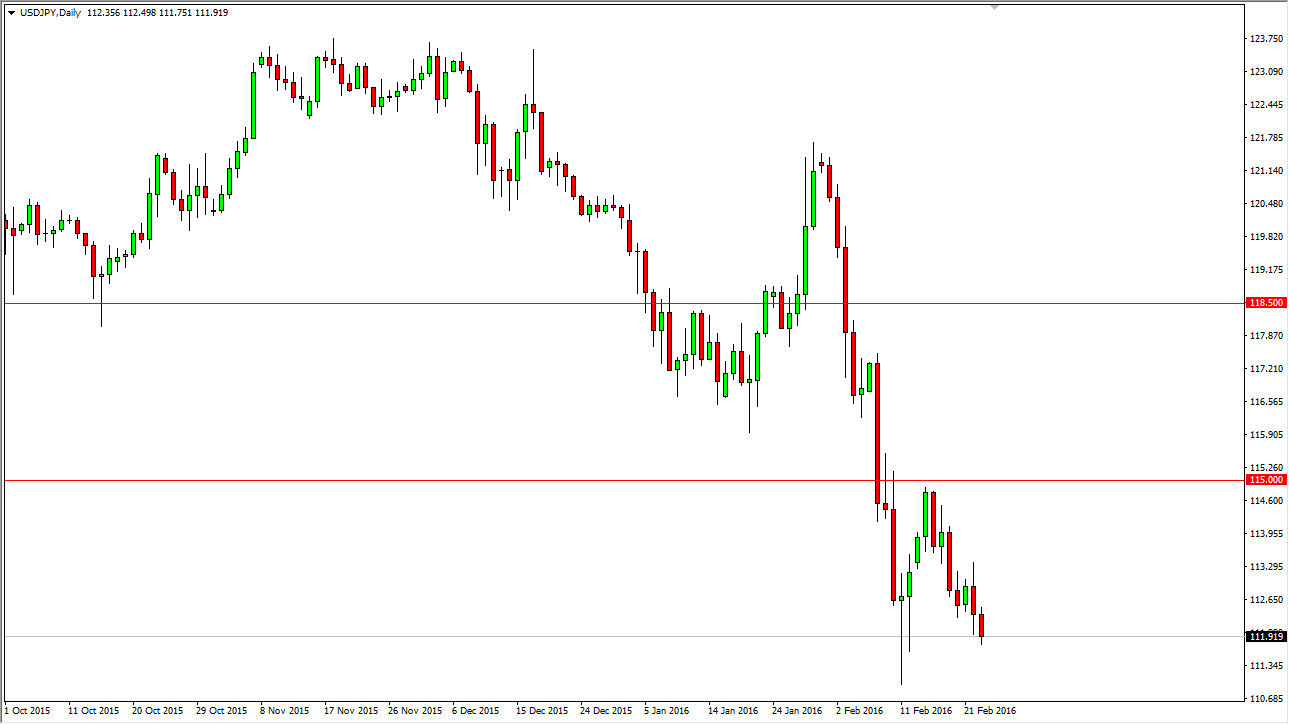

USD/JPY

The USD/JPY pair fell during the course of the session on Tuesday, testing the 112 level. It looks as if we are ready to continue going lower, perhaps reaching down to the 110 level given enough time. Rallies at this point in time should be selling opportunities, as this is a market that looks very soft. In fact, I believe that there is a significant amount of resistance all the way to the 115 level, so it’s not until we get above there that I would consider buying this market. In the meantime, I am looking to sell short-term rallies every time we show signs of exhaustion after a rally. In fact, I believe that will be the theme going forward. I don’t know if we are going to break down below the 110 level, but in the meantime it looks as if we are most certainly going to try to get there.

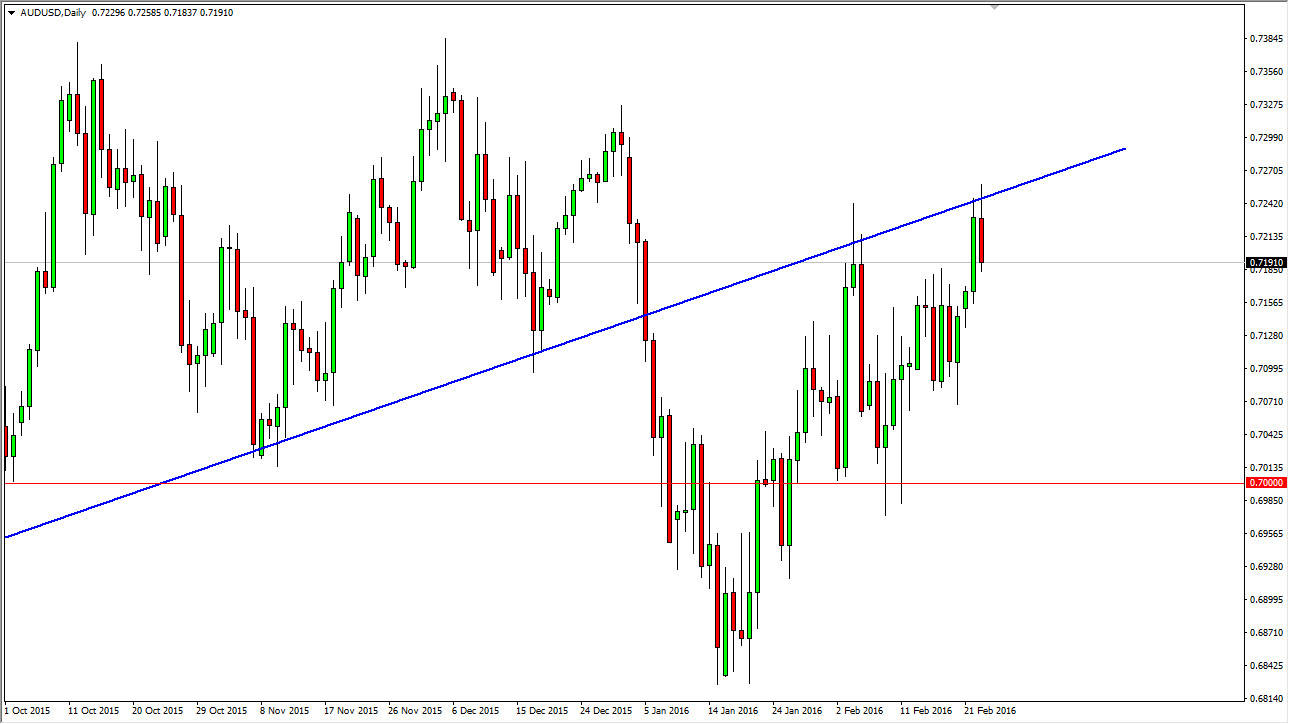

AUD/USD

The AUD/USD pair initially tried to rally during the course of the day on Tuesday, but the area just above the previous uptrend line offered enough resistance to turn the market back around and show signs of exhaustion. By doing so, the market looks as if it is ready to pull back and I think that the Australian dollar will definitely be a bit soft today, offering a selling opportunity. However, I do not expect this market to break down significantly, I think we are just simply going to consolidate in this general vicinity and perhaps reach down to the 0.71 area.

I also believe that the market probably has an even more stringent support level in the neighborhood of the 0.70, as it is a large, round, psychologically significant number and of course we have had support previously in that general vicinity. Ultimately, this is a market that should continue to be very choppy as there are a lot of concerns in the Asian region of the world.