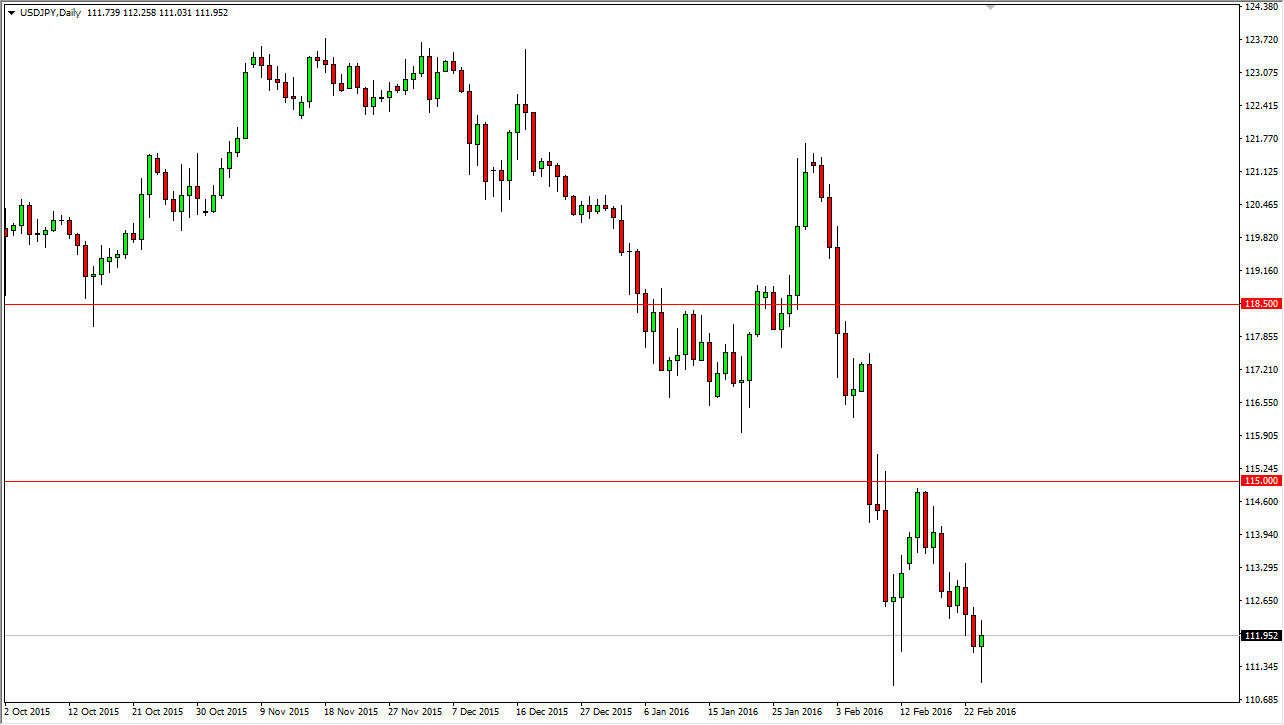

USD/JPY

The USD/JPY pair initially fell during the day on Wednesday, but found enough support at the lows again to turn things back around. By doing so, it looks as if the market is trying to bounce from here and quite frankly that would not be a surprise considering how far the market had fallen in such a short amount of time. Because of this, it’s very likely that the bounce will be met with selling pressure, so I am simply waiting to see exhaustive candles to start shorting again. On the other hand, if we break down below the low of Wednesday, we will more than likely reach towards the 110 level. I don’t really have a scenario in which I'm willing to buy this pair at the moment as there seems to be quite a bit of risk aversion out there.

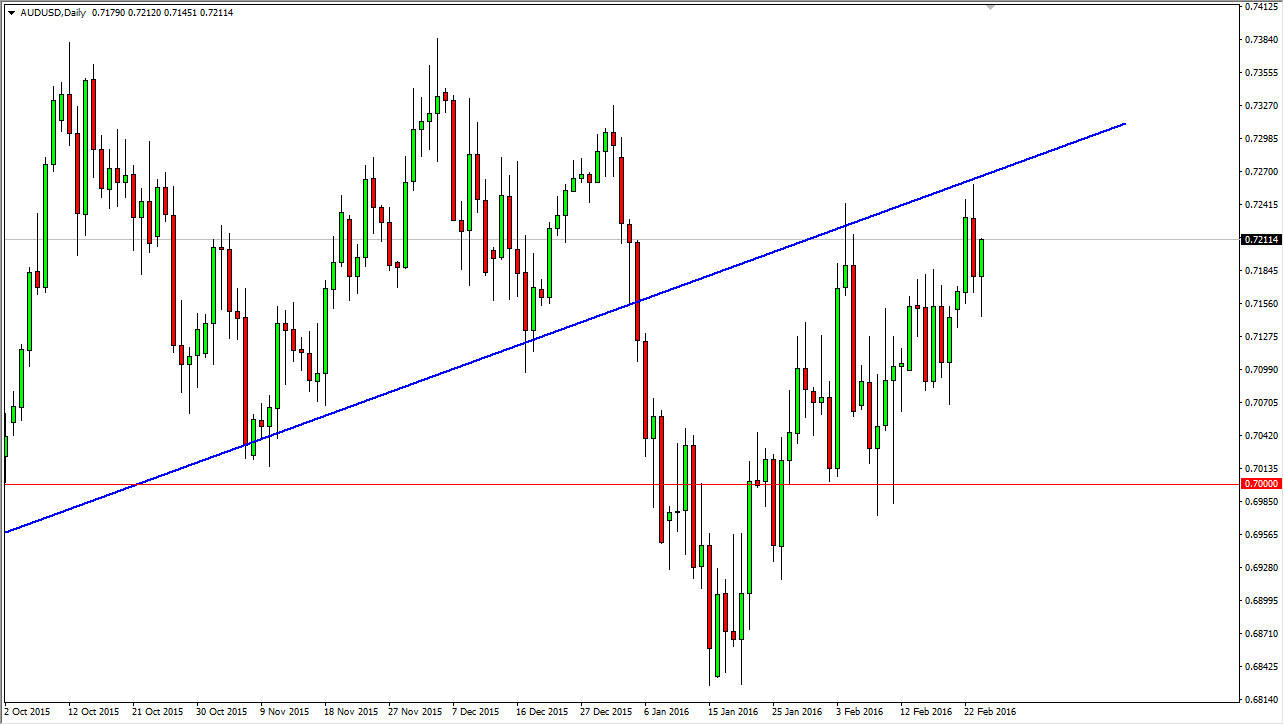

AUD/USD

The AUD/USD pair initially fell during the course of the session on Wednesday, but turned back around to form a rather supportive looking candle. The shape of the candle can be best described as a hammer, and as a result it looks like we could try to go higher from here. If we do, it’s very likely that there will be a bit of resistance at the previous uptrend line, which has been fairly reliable so far. It’s probably at best a short-term move to the upside that we will see in this market.

An exhaustive candle above should also be a nice selling opportunity; so therefore it looks as if the market could offer that fairly soon. I don’t really have any interest in buying this pair until we clear the uptrend line on a daily close, which would signify that perhaps we broke out to the upside enough to warrant thinking that the trend has changed.