USD/JPY

The USD/JPY pair broke down during the course of the day on Monday, reaching all the way towards the 115 handle. That of course is a major round number, and is an area that could have a significant effect on the marketplace. If we can break down below the 150 level, I feel that this pair will start to drop significantly from there and perhaps reach as low as 112. However, this is a market that is a bit oversold at this point, so I don’t know that we will have the momentum to do that. If we get a daily candle that ends up forming a fairly supportive looking shape near the 115 level, I would consider buying, but that of course would be based upon the daily charts so I would not be quick to pull the trigger.

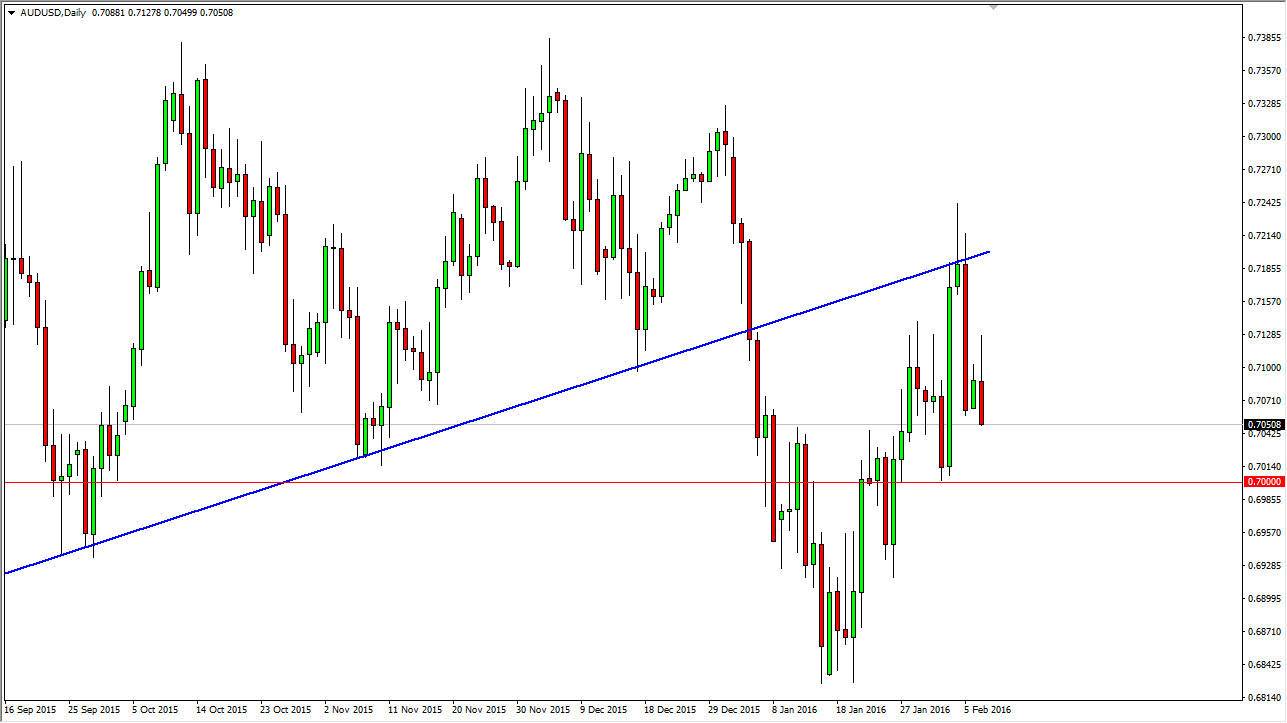

AUD/USD

The AUD/USD pair initially tried to rally during the day on Monday but found the area above the 0.71 level be far too resistive to continue. We ended up forming a bit of a shooting star which suggests that we could very well drop to the 0.70 handle. I think that area could be some what of a barrier, but eventually we will more than likely continue below there as we have been in a downtrend for a minute.

Ultimately, I don’t have any interest in buying this pair at the moment, even though gold markets have been rallying. Gold markets typically will lift the Australian dollar, and if they don’t it shows that there is serious trouble with the currency. Ultimately, I feel that the market will continue to struggle every time it tries to rally, and as a result it’s probably only a matter of time before the sellers return again and again.