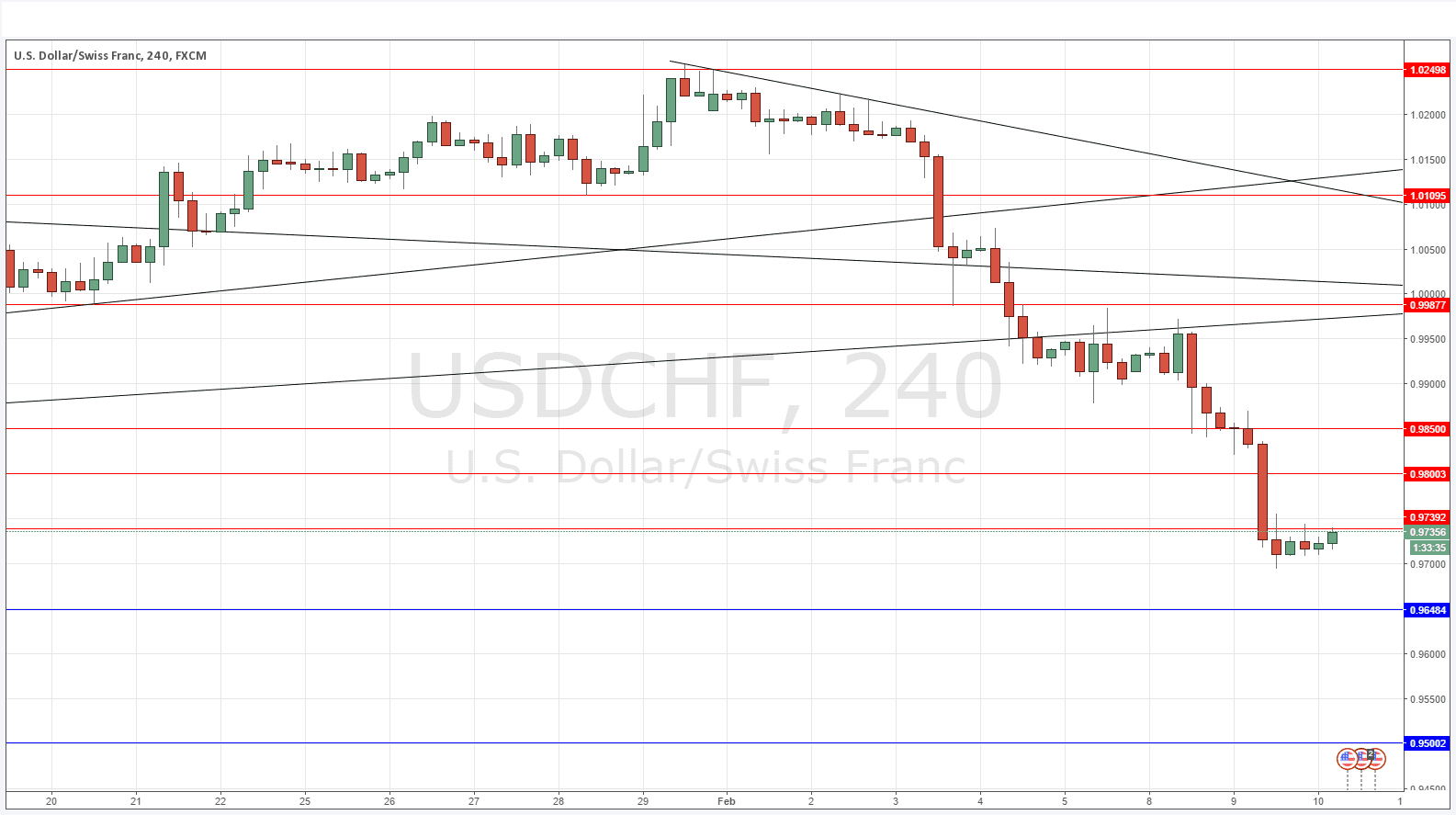

USD/CHF Signal Update

Yesterday’s signals expired without being triggered.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be taken from 8am to 5pm London time today.

Long Trade 1

* Go long after bullish price action on the H1 time frame following the next touch of 0.9648.

* Place the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

* Go long after bullish price action on the H1 time frame following the next touch of 0.9500.

* Place the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Go short after bearish price action on the H1 time frame following a touch of 0.9739.

* Place the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

* Go short after bearish price action on the H1 time frame following a touch of 0.9800.

* Place the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 3

* Go short after bearish price action on the H1 time frame following a touch of 0.9850.

* Place the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

I wrote yesterday that this pair was at a very crucial, pivotal price of 0.9850 and the fact that we broke down strongly below this level is significant. The upwards trend is well and truly over but the CHF is not really very strong and so overall we have a pair here that looks likely to chop around in a kind of no-man’s land for some time, albeit with a bearish bias. You can probably get much better results looking to get long EUR/USD than you can looking to get short USD/CHF.

There is nothing due today concerning the CHF. Regarding the USD, the Chair of the Federal Reserve will be testifying before Congress at 3pm London time, followed later by Crude Oil Inventories at 3:30pm.