GBP/USD Signals Update

Last Thursday’s signals were not triggered as there was no bearish price action at either 1.4245 or 1.4275.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today.

Short Trade 1

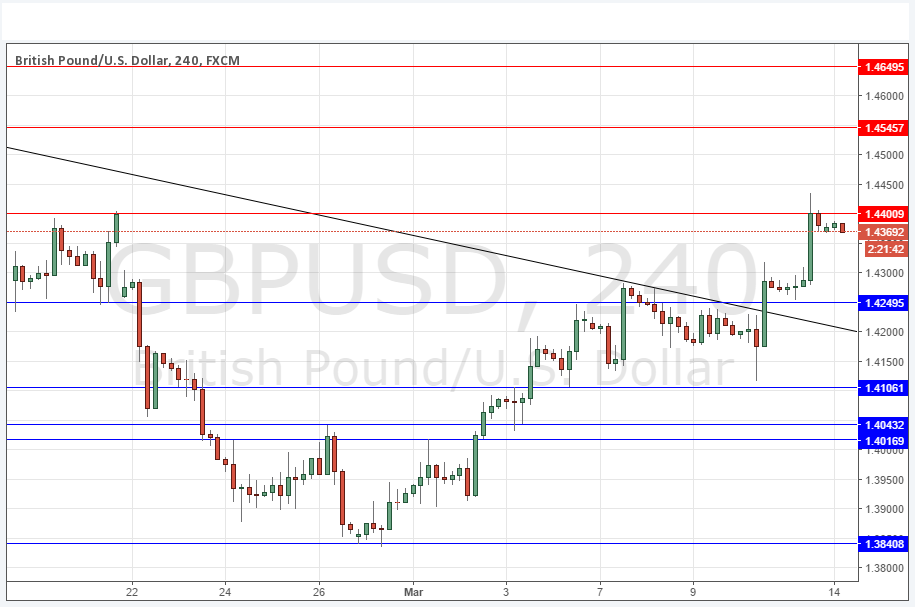

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.4400.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Short Trade 2

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.4546.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Long Trade 1

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.4250.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Long Trade 2

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of the broken bearish trend line currently sitting at around 1.4210.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

The USD has been in decline recently and there has been an increased appetite for riskier assets such as the GBP. So therefore even though there is a long-term downwards trend, this pair has been rising quite strongly, breaking up above resistance and printing new support. Most importantly of all, the price has clearly broken above the fairly long-term bearish trend line which may now be expected to provide support.

The price has recently reached 1.4400 which was a weekly opening price when news broke that there was political support for a British exit from the European Union. However even though polls still show the referendum campaigns as running neck and neck, it does not seem to be weighing on the GBP right now.

It makes sense to have a bullish bias, but to be careful at the resistance levels as we are coming back into a more congested area, where the price might begin to consolidate.

There is nothing due today concerning either the GBP or the USD.