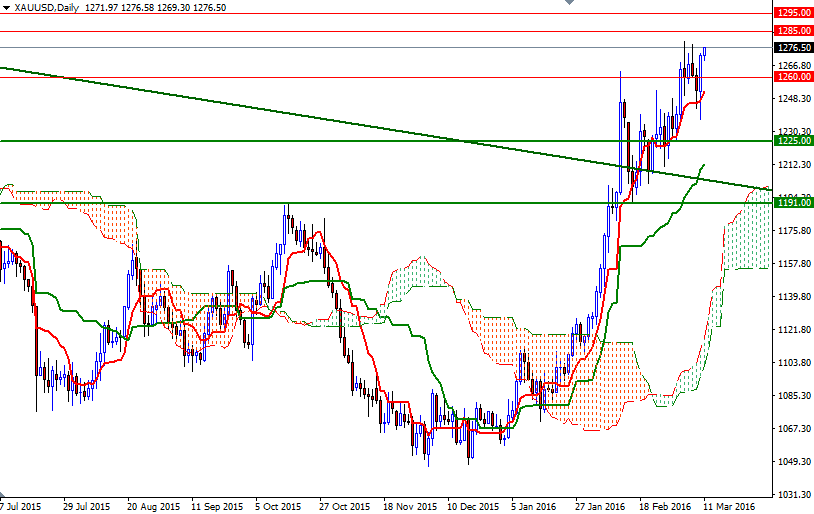

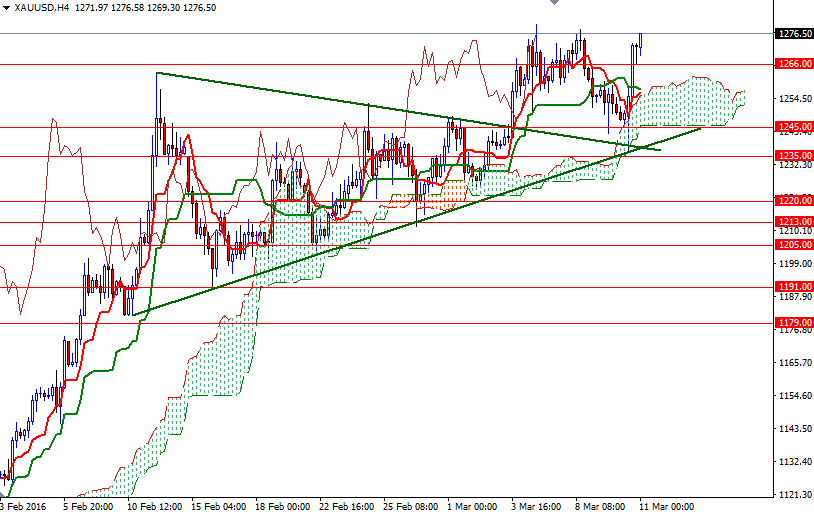

Gold rallied nearly 1.16% on Thursday, marking the first gain in three sessions, as a weaker dollar and losses in equity markets spurred demand for safe havens. The XAU/USD pair initially fell but bounce up quite nicely from the anticipated support in the 1238/5 area where a bullish trend line and the bottom of the 4-hourly Ichimoku cloud converged. It appears that a fresh batch of stimulus measures from the European Central Bank increased bets that inflation and growth may accelerate in the bloc.

The XAU/USD is currently trading at $1276.50 an ounce, slightly higher than the opening price of $1271.97. It looks as if the XAU/USD pair is going to try to break to the upside, and march towards the 1285 level. However, as I mentioned yesterday, the market has to climb and hold beyond the 1280/79 area (at least on the 4-hour time frame) in order to support this theory. The bulls have to capture this strategic fort (1285), if they intend to challenge the bears at the 1295 battle field.

On the other hand, if the market can't penetrate 1280/79 and prices start to retreat, support can be found in the 1267.50-1266 region. A break down below 1266 could see an extension toward the Ichimoku cloud on the 4-hour chart. In that case, keep an eye on the 1260-1258.60 region.