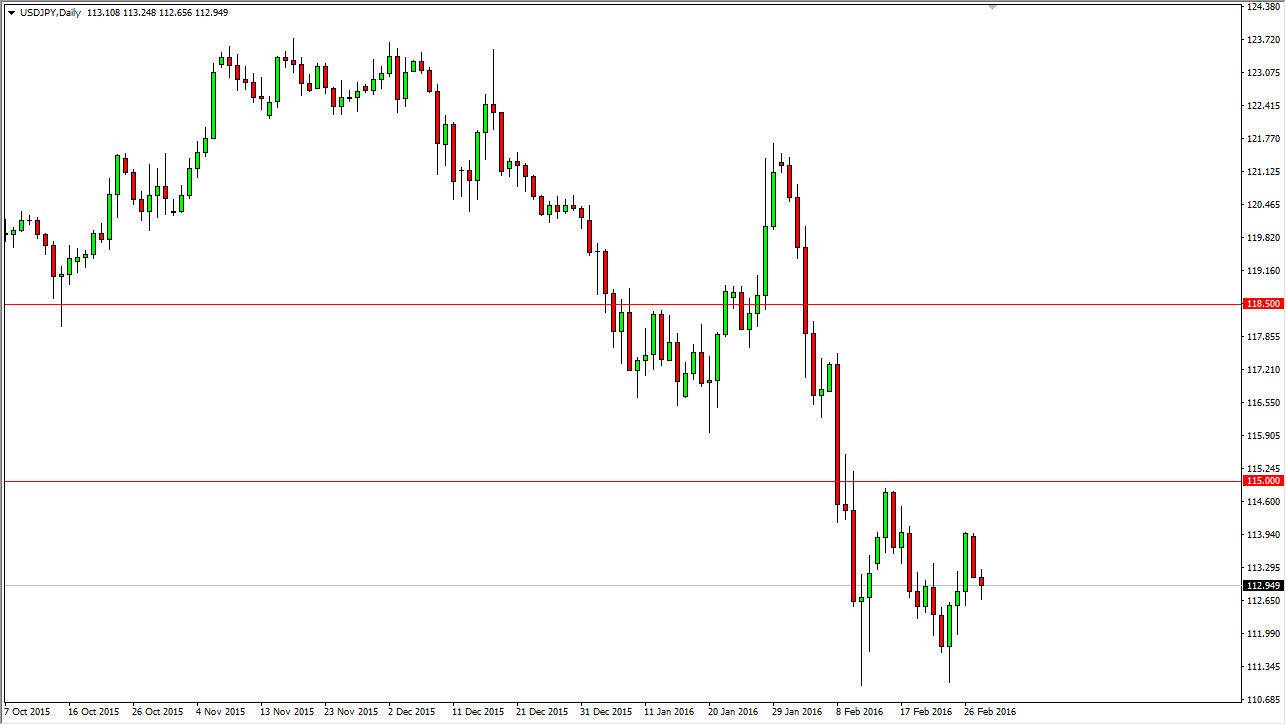

USD/JPY

The USD/JPY pair fell initially during the day on Monday, but found enough support below to turn things around and form a bit of a hammer. This hammer of course is a bullish candle but quite frankly I feel that we are in the middle of the larger consolidation area so I'm not exactly excited about trading at this point. I suppose if I had to put money in this market, I would anticipate that the US dollar will continue to rise against the Japanese yen, but only for a while as the 115 level above should be massively resistive. We believe that at this point in time we may have found ourselves a new consolidation area between 110 on the bottom, and 115 on the top. With that being the case, we have to wait until we get to one of the extreme levels to start placing money into this market.

AUD/USD

AUD/USD pair went back and forth during the course of the day on Monday as well, and ended up forming a relatively bearish looking candle low as the exhaustive looking candle looks as if it is ready to continue the downward move that we saw start on Friday. With this, I feel that the market is reaching towards the 0.70 level, and it’s only a matter of time before we get down there. That’s not to say that is going to be easy, I believe it can be very choppy down to that level but there’s probably only one way to trade this market, and that’s to buy the US dollar.

Even though gold has been doing fairly well lately, the reality is it hasn’t been enough to lift the value the Australian dollar for any significant amount of time. Ultimately, I feel that this is more or less a reflection as to what going on in Asia than anything else.