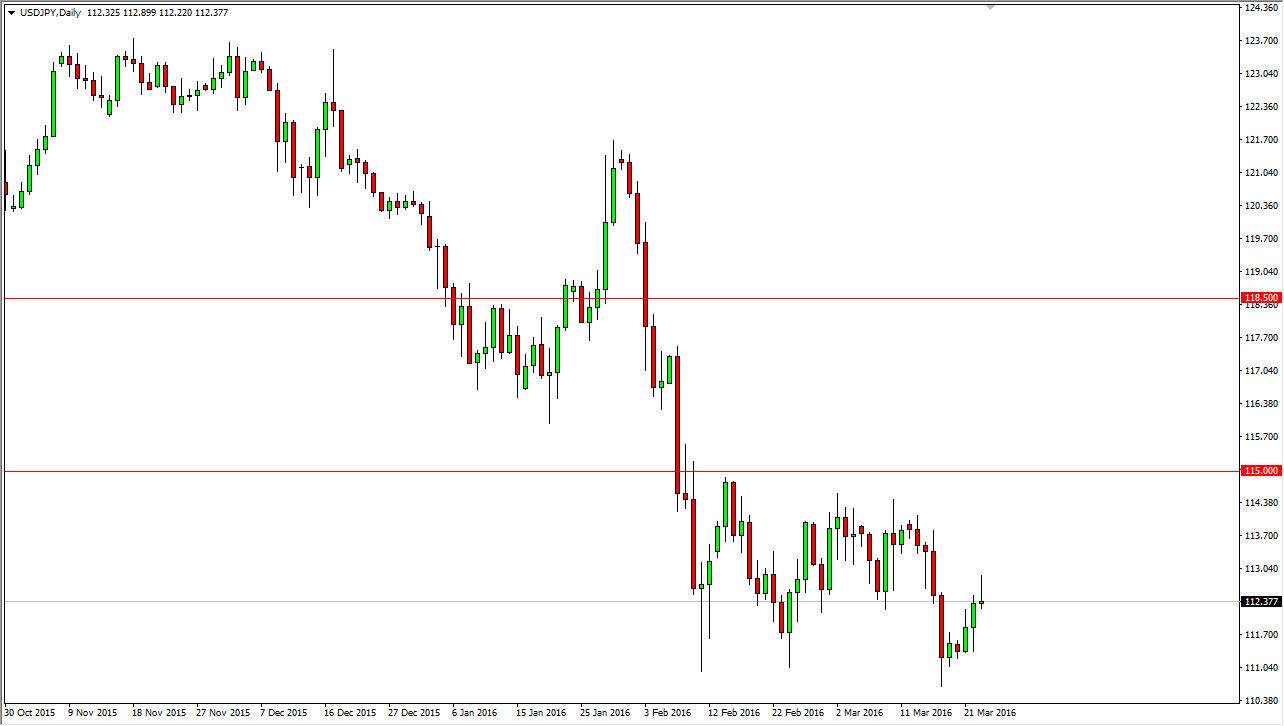

USD/JPY

The USD/JPY pair initially tried to rally during the course of the session on Wednesday, but turned right back around to form a nice-looking shooting star. The shooting star as you can see is right at an area that was previously supportive, in the form of the 112.50 level. Because of this, if we break down below the bottom of the candle for the session, I believe that we will drive back down towards the 111 level. That was where the recent bounce turned from, and as a result it makes sense that we try to test that area yet again. If we can break down below there, the market will then reach to the 110 level. On the other hand, if we break above the top of the shooting star from the session on Wednesday, that’s a very bullish sign and we should then go to the 114.50 level.

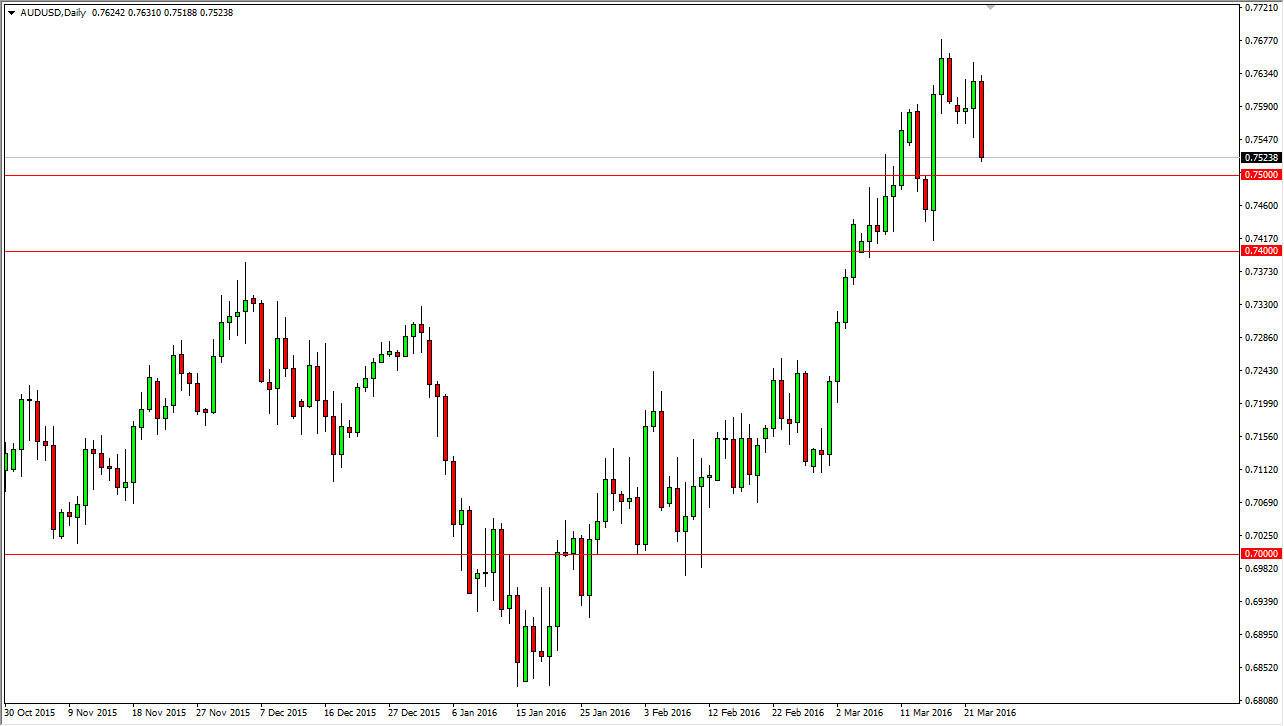

AUD/USD

The AUD/USD pair fell hard during the course of the session on Wednesday, reaching towards the 0.75 level. That’s the beginning of a massive support that extends all the way down to the 0.74 level, so I am actually waiting to see a supportive candle to start going long again. You have to keep in mind that the gold markets fell as well, and with that it makes sense that we pulled back. If we can see positivity in the gold market, and of course a positive candle in this market, we would be more than likely heading towards the 0.76 level, and then beyond that to the 0.80 level which is a major level on longer-term charts.

If we did somehow break down below the 0.74 level, the market would then grind quite a bit lower. Nonetheless, at this point in time I do not think that this market is going to break down, and simply being patient could give you an opportunity to make quite a bit of money to the upside.