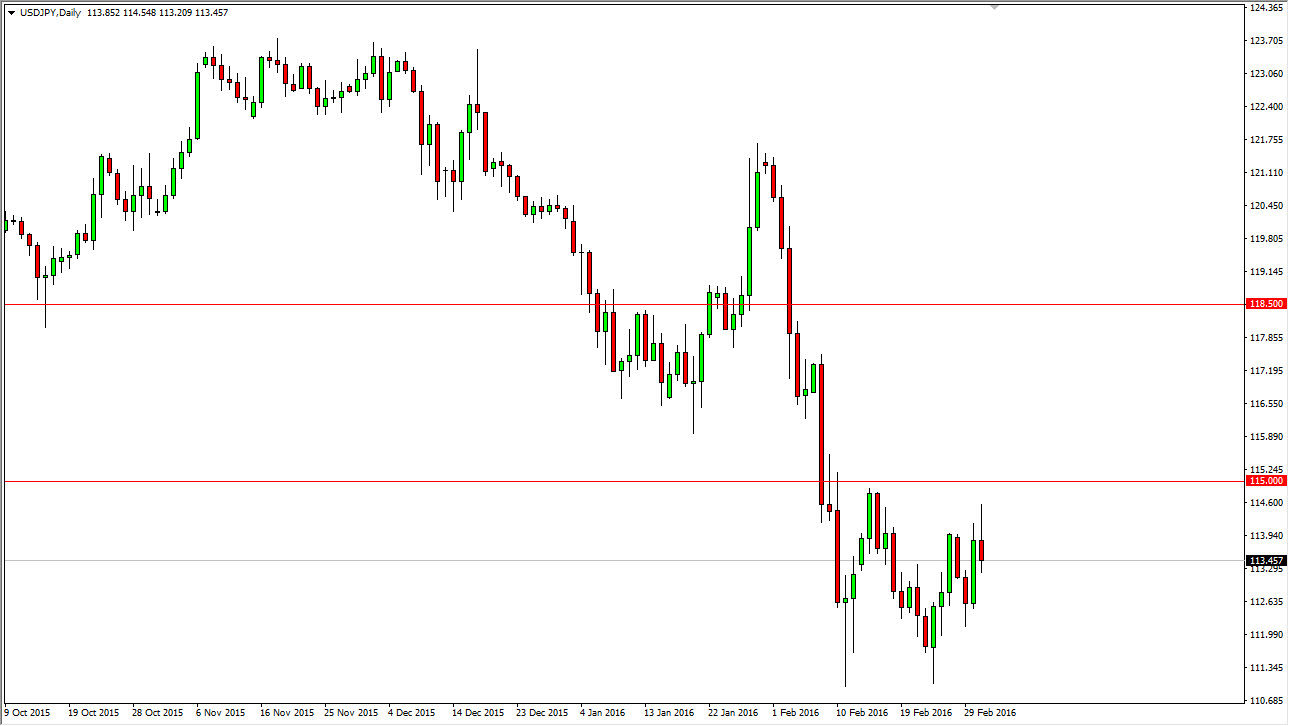

USD/JPY

The USD/JPY pair initially tried to rally during the day on Wednesday but found enough resistance above the 114 level to turn things around and form a bit of a shooting star. The shooting star is a very negative sign, and as a result it’s very likely that this market pulls back at this point in time. Ultimately, the market should then reach down to the 112 level, where it should start to see buyers in that region. The pair should continue to be volatile, and as a result it will be the domain of short-term traders at this point. The market breaking above the 115.50 level would be very bullish, and then have me holding onto a longer-term trade for a bullish outlook. If we break below the 112 level, we should then reach down to the 110 level next.

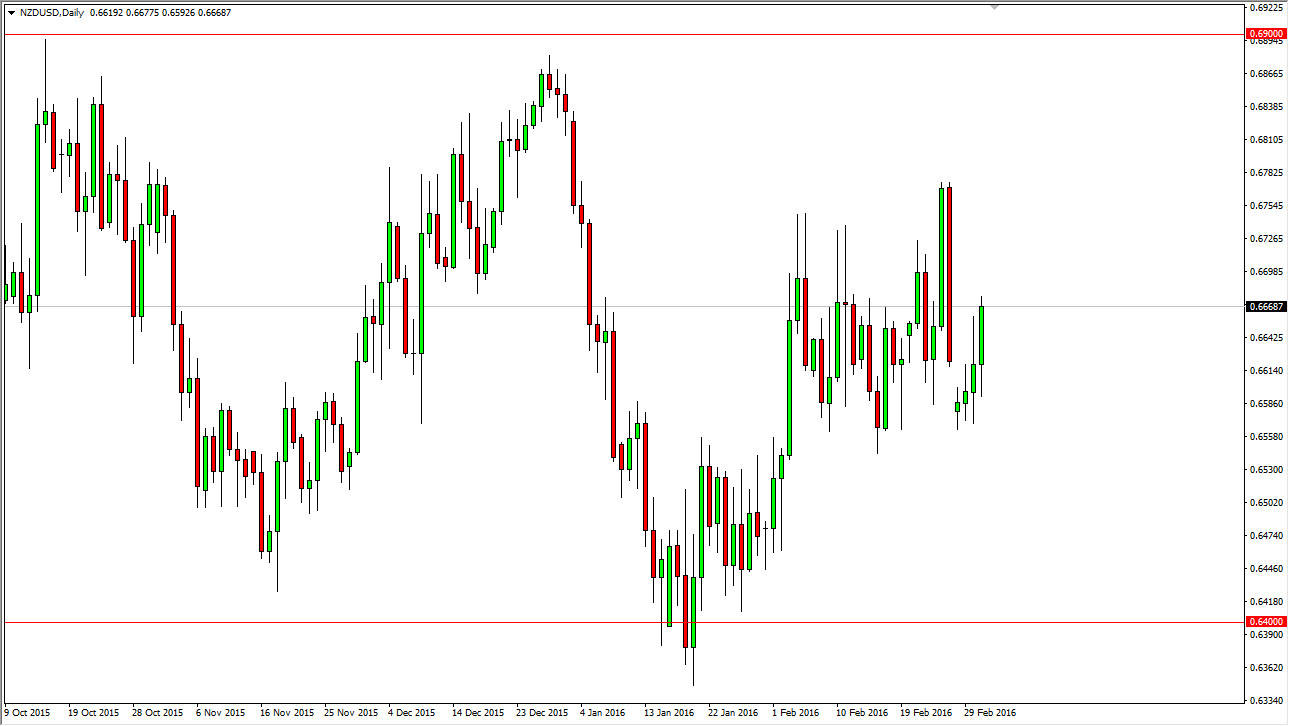

NZD/USD

The New Zealand dollar initially fell during the day on Wednesday, but then found quite a bit of bullish pressure to send the market higher. The pair looks as if it is consolidating overall, and as a result we could reach to the top of the area, the 0.6750 level. This is a market that of course is highly influenced by commodities, which are starting to get a bit of a reprieve lately. Ultimately though, I don’t think that either one of those markets, be it the New Zealand dollar or any of the major commodities, can do anything for an extended period of time.

With this, it’s very likely that the market will continue to bounce back and forth and I believe that short-term traders will be rewarded by being patient and simply buying at the bottom and selling at the top. The jobs number of course comes out on Friday and that of course can change everything so be aware of that.