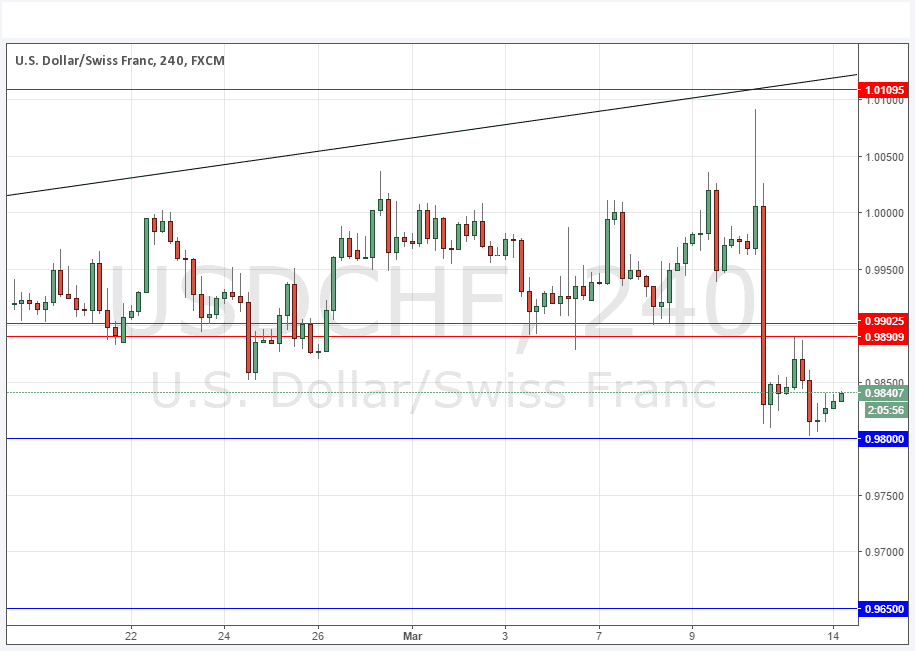

USD/CHF Signal Update

Last Thursday’s signals did give a bullish bounce from 0.9820 but unfortunately this occurred after the market hours’ time limit given within the signals.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be taken between 8am and 5pm London time today.

Long Trade 1

* Go long after bullish price action on the H1 time frame following the next touch of 0.9800.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Go short after bearish price action on the H1 time frame following the next entry into the zone between 0.9891 and 0.9903.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

This pair was dragged along by EUR/USD during last Thursday’s very large move in the price of that currency pair. We are now in an interesting position here where although there is no clear long-term trend, we are close to key support at 0.9800, but we also have the 0.9900 area above which is likely to be good resistance, at least upon the first test. This means that day traders today could focus on fading those areas and have a good chance of making some pips in either direction.

For the long-term, the support further below at 0.9650 is a very key level. If the price becomes established below there, it will probably signal a major long-term trend change, from no trend to bearish trend.

There is nothing due today concerning either the CHF or the USD.