USD/CHF Signal Update

Yesterday’s signals were not triggered.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today.

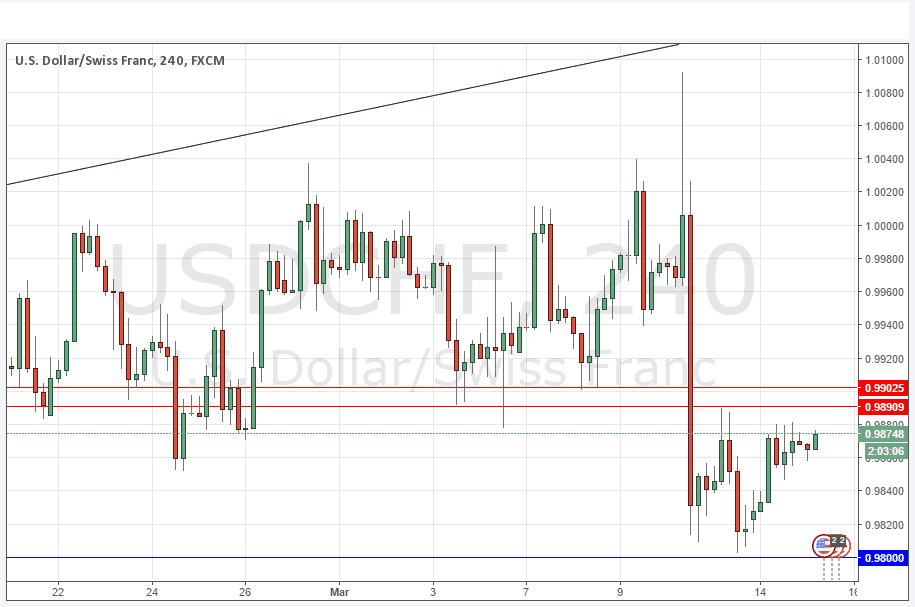

Long Trade 1

* Long entry after bullish price action on the H1 time frame following the next touch of 0.9800.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Short entry after bearish price action on the H1 time frame following the next entry into the zone between 0.9891 and 0.9903.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

Resistance has already begun to be felt a little way below 0.9891, at around 0.9880. The price action does suggest there will be a move at least a little higher, and that therefore the price should reach 0.9891 shortly.

It is interesting to note that the USD is close to hitting key resistance against the EUR, GBP, and CHF, which strengthens the case for a short USD trade if and when this reversal happens simultaneously in all three currency pairs.

Looking at the long-term picture, the support below at 0.9650 is a very key level. If the price becomes established below there, it will probably signal a major long-term trend change, from no trend to bearish trend.

There is nothing due today concerning the CHF. Regarding the USD, there will be a release of Retail Sales and PPI data at 12:30pm London time.