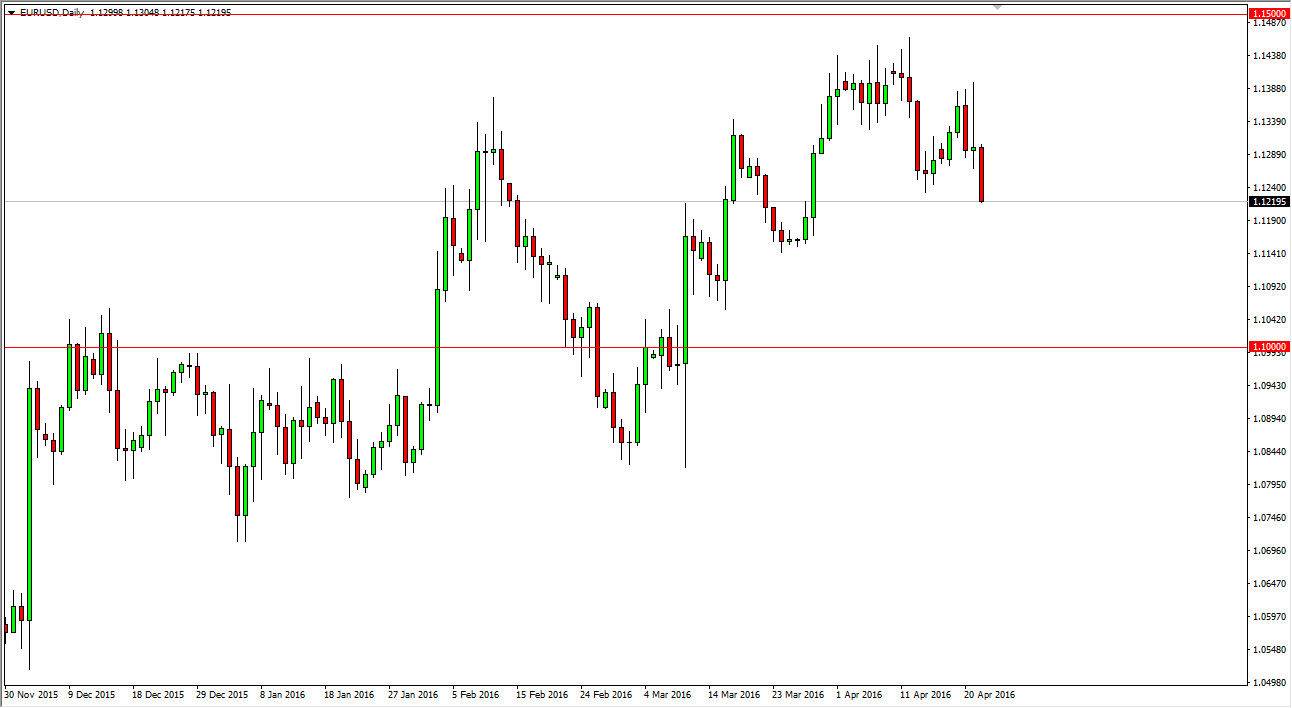

EUR/USD

The EUR/USD pair broke down during the day on Friday, clearing the bottom of the shooting star from the Thursday session which of course is a very negative sign. Because of that, the market will more than likely continue to try to go lower, as the market has formed a massively negative candle. I don’t necessarily think that we are going to meltdown at this point, and I do think that there are going to be times where buyers get involved in the market and little hints of support. With that being the case, the market will continue to be volatile, but it most certainly has a negative bias to it at this point in time. I believe that sellers will continue to enter the market every time we rally on short-term charts and show signs of exhaustion.

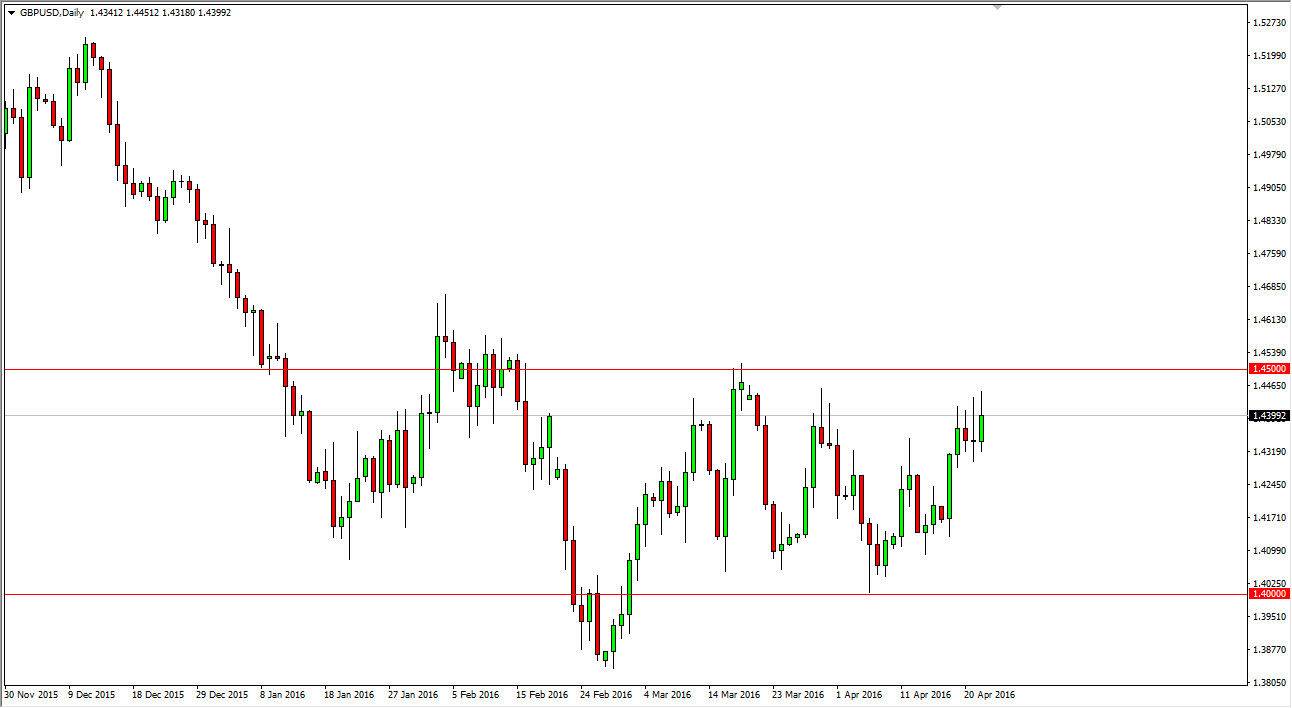

GBP/USD

The GBP/USD pair had a positive session on Friday, testing the highs yet again that we haven’t seen recently. However, there is a massive amount of resistance between 1.44 level and the 1.45 level, so having said that it doesn’t surprise me at all that we couldn’t continue to go higher. On top of that, I am essentially looking for an exhaustive candle in order to start selling again. After all, we are at the top of the recent consolidation area, so it makes sense that the sellers would be very interested in shorting this market as we returned to the bottom of the consolidation range. That of course would be the 1.40 level but supports start somewhere near the 1.41 level, so I think that is about as far as is market will go with any type of ease. In order to short this market though, you will probably have to look at short-term charts.

An alternate way to enter the market of course is a break below the bottom of the shooting star from the Thursday session. On the other hand, if we break above the 1.4550 level, I feel that the market will search go much higher, although I do not anticipate that happening.