USD/JPY

The USD/JPY pair fell during the day on Thursday, as we continue to see quite a bit of resistance at the 110 level in order to keep the market lower. This is an area that has quite a bit of resistance all the way to the 111 level, and with that being the case it’s only a matter of time before sellers get involved in my opinion. If we can break down below the bottom of the range for the Thursday session, and feel that this market will probably grind down towards the 108 level. On the other hand, if we can break above the 111 level, at that point in time I feel that the market will go much higher. At this point though, I don’t see any reason to think why we would breakout to the upside.

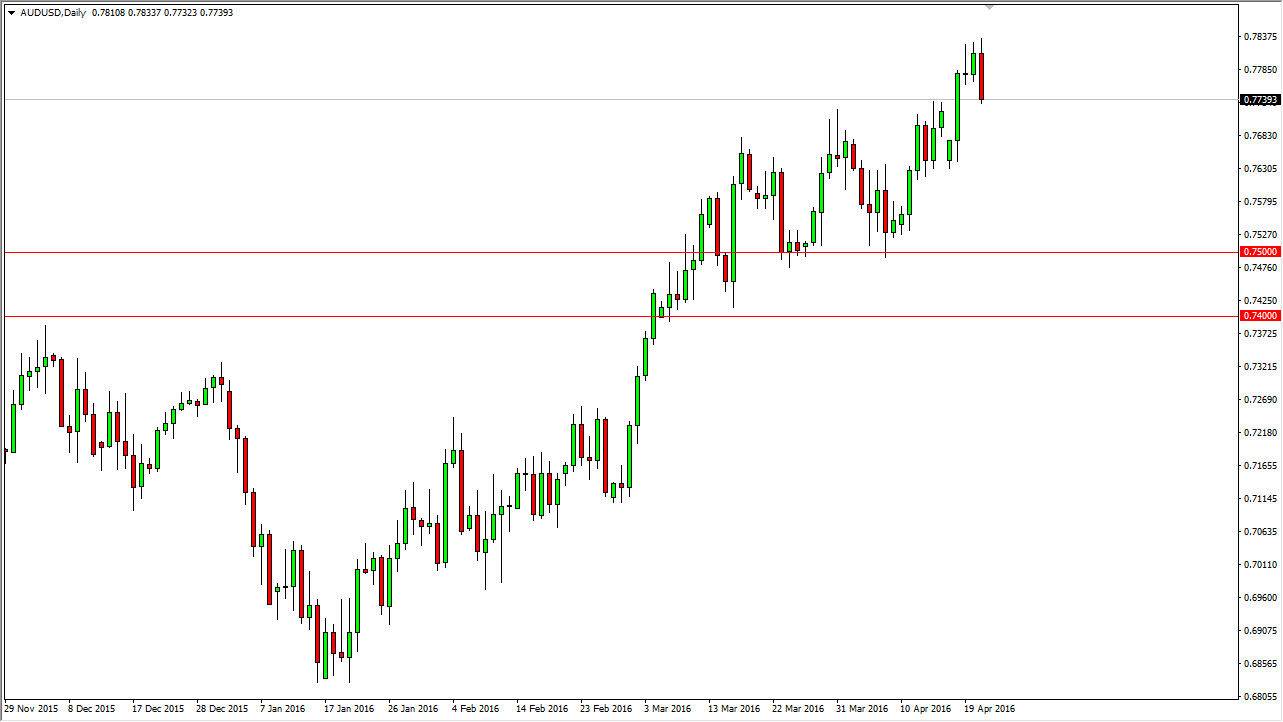

AUD/USD

The AUD/USD market initially tried to rally during the course of the day on Thursday, but turned back around to fall significantly. We are testing the 0.77 level, an area that was previously resistance. Because of this, I feel it’s only a matter of time before there is some type of bounce or supportive candle that we can start taking as a signal to start going long. I think there is a significant amount of support all the way down to the 0.75 level, so I feel that the market will eventually continue the longer-term uptrend.

It is only a matter of time before the market reaches towards the 0.80 level in my opinion, and with that being the case, I feel it’s only a matter of time before the market find plenty of buyers going forward. I think that the 0.80 level is a major tipping point in this market from a longer-term perspective. Pay attention to the gold markets, they will have an influence here.