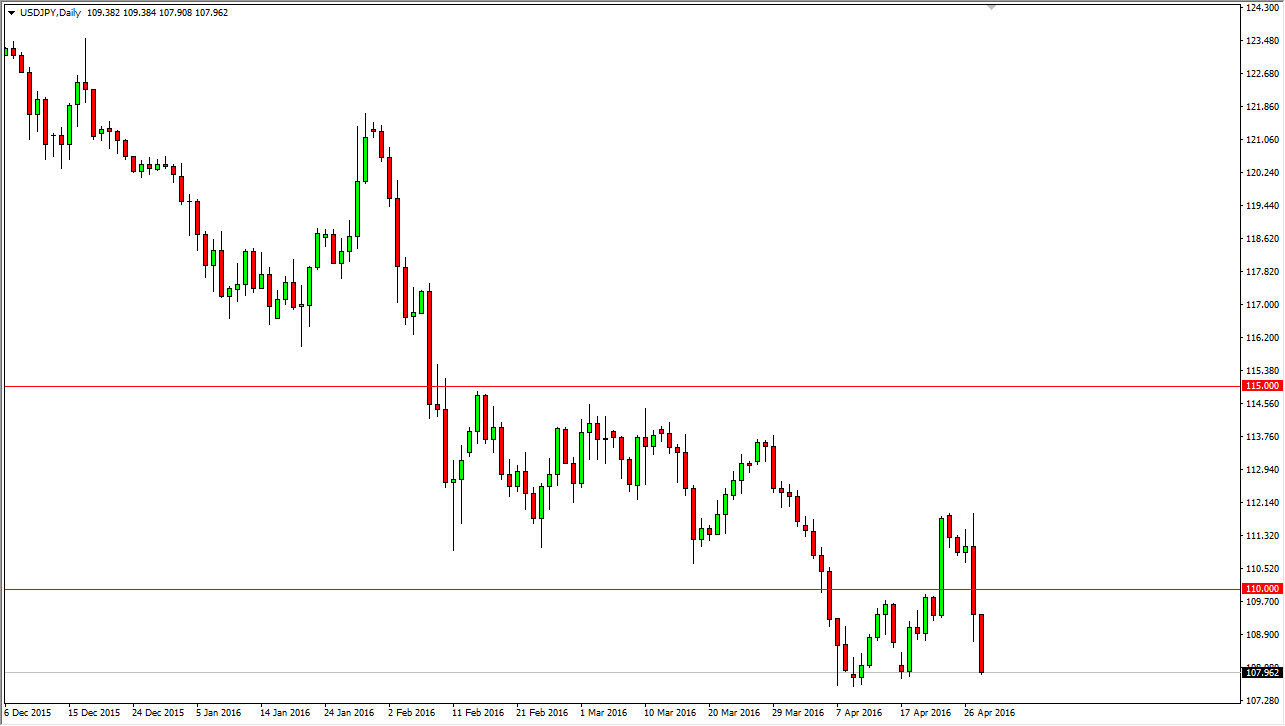

USD/JPY

The USD/JPY pair fell rather significantly during the course of the day on Thursday, dropping below the 108 level. This is a significant move, as we are testing the lows yet again and it appears that the market is ready to continue buying the Japanese yen in reaction to the fact that the Bank of Japan cannot be bothered to add to the quantitative easing that had been previously implemented. Quite frankly, it appears that the market was caught off guard as the central bank chose not to do so, although it’s very likely that they will sometime in the month of June. Ultimately, this market looks as if it is ready to break down and perhaps reach the 105 level. Any rally at this point in time will look suspicious, and I would be a seller of exhaustive candles.

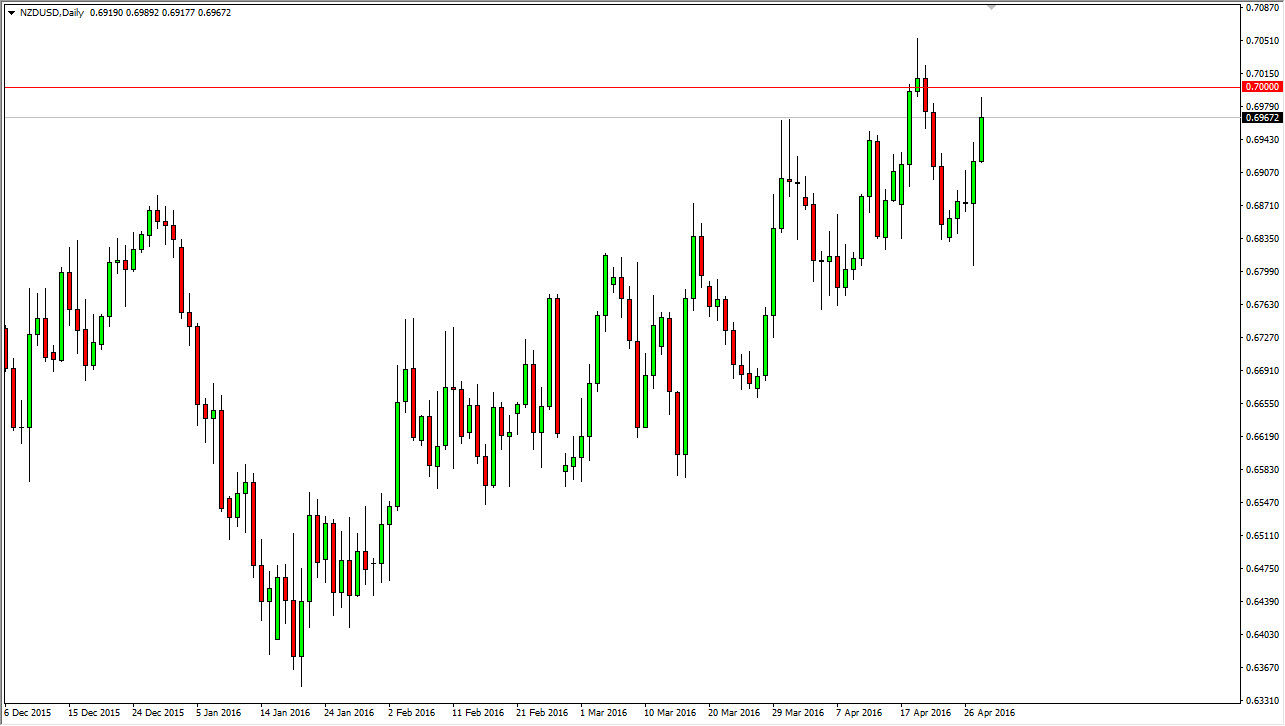

NZD/USD

The New Zealand dollar rose during the course of the day on Thursday, as the market tested the 0.70 level yet again. However, there is a shooting star from last week that will have to be overcome, so having said that I believe that it will be hard to break out to the upside, and a pullback will more than likely offer value that traders will continue to take advantage of. The New Zealand dollar is of course very sensitive to the overall attitude of commodity markets, and of course she will have to watch those in order to find a potential catalyst for the breakout. At this point in time, I believe as long as we can stay above the 0.68 handle, the New Zealand dollar should continue to be very positive.

A break above the top of the shooting star from last week should send this market looking for the 0.75 handle given enough time, and as a result would make it more or less a “buy-and-hold” type of situation in the New Zealand dollar.