USD/CAD Signal Update

Last Thursday’s signals were not triggered.

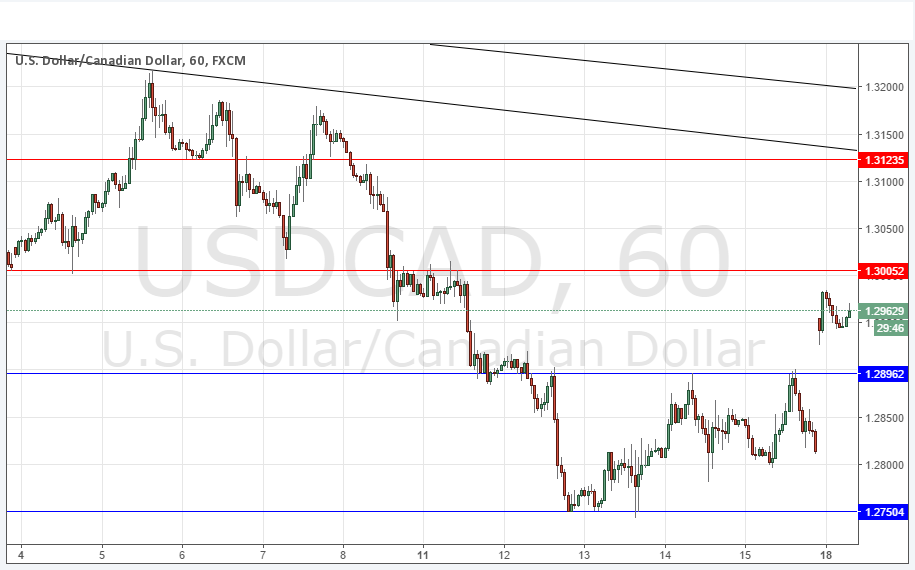

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades must be entered before 5pm New York time today only.

Long Trade 1

Go long after bullish price action on the H1 time frame immediately following the next touch of 1.2896.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short after bearish price action on the H1 time frame following the next touch of 1.3005.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CAD Analysis

OPEC failed to reach a deal yesterday that would have capped oil production and therefore limited supply. The failure of the talks produced an immediate and sharp drop in the price of crude oil of about 5%. This was reflected in this pair gapping up at the weekly open quite strongly, well above the anticipated resistance level of 1.2896, which should now be seen as potentially supportive. In fact the price reached a level not very far from the further anticipated resistance at 1.3005 which has looked very strong.

Gaps do tend to get filled and so a further move now up to 1.3000 followed by a bearish reversal could be a really great short trade if it sets up. We could also then expect a bounce at 1.2896 especially if the price reached there in a fast movement.

There is nothing due today regarding either the CAD or the USD.